Canadian house prices continue to soar higher in April, making this epic housing bubble a story for the record books.

While affordability has been stretched for several years now, with annual price gains of 20 percent fewer and fewer Canadians can buy houses based on income.

How can people afford to chase prices ever higher?

The short answer is that most Canadians cannot afford to buy homes. When we look at the largest cities the income required to qualify is much too high.

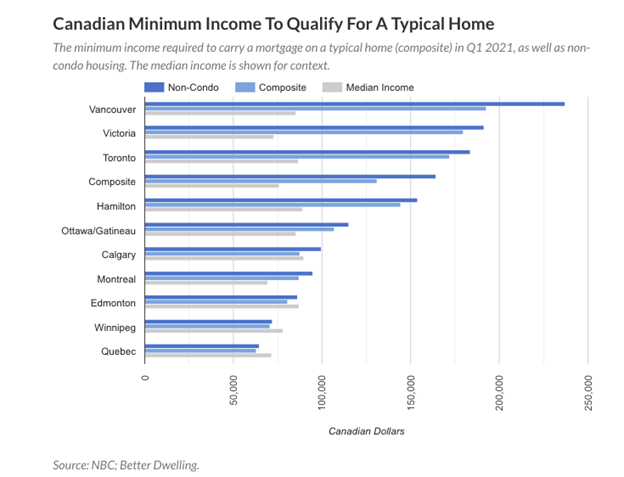

Better Dwelling calculated the minimum income required:

Vancouver stands out as the most unaffordable place requiring over $200,000, with Toronto not far behind.

Calgary and Edmonton are more affordable because house prices are lower. Demographia shows the average household income in Edmonton and Calgary is close to $100,000. Winnipeg and Quebec are quite reasonable.

However, in Vancouver and Toronto, incomes are lower at about $70,000 to $75,000, less than 1/10 of the home price.

In Vancouver and Toronto the population is older, with more retired people on lower incomes. In Victoria, most people bringing money with them from the sale of a home elsewhere. So they do not have huge mortgage payments, for the most part.

And somehow everywhere in Canada some people are still buying.

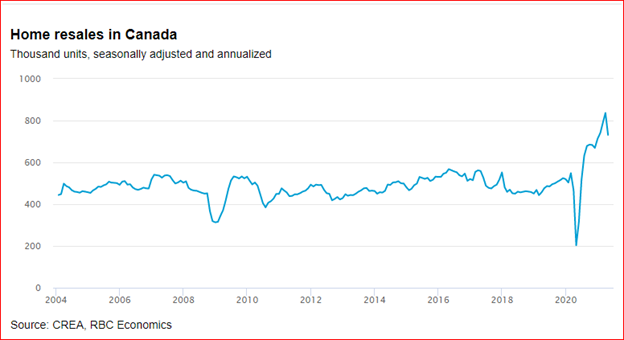

RBC on May 17 notes the record amount of home resales:

Since there are about 9 million owner-occupied homes and condos in Canada this represents annual turnover of about 9 percent, partly as a rebound from low levels in 2020. It would be unusual if it remained at this elevated level as the average turnover rate is about 5 percent.

An RBC survey showed that 41 percent of renters in BC, under 40, believe they will never own a home.

And what happens if prices keep rising at double digit rates when most Canadians can no longer afford to buy?

Of course, a healthy housing market requires a steady supply of first-time buyers to replace people who move to senior accommodation. According to US-based Pew Research, movement out of homes accelerates once people reach 65 years. The median baby boomer is 66 this year, and the youngest boomer will turn 60 in 2024. Can young people afford to buy the homes of baby boomers?

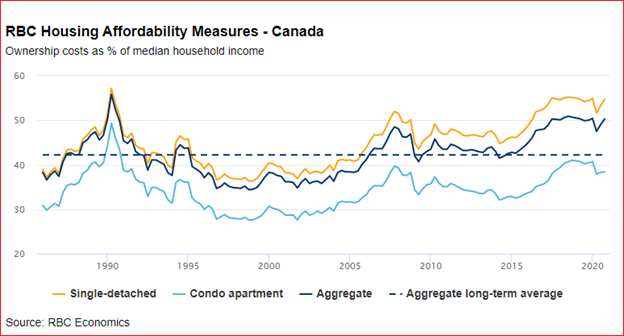

Affordability is stretched:

The only thing that keeps this housing market going is people willing to speculate on higher prices, often with Mom and Dad helping with down payments and/or co-signing mortgages.

Canadians have become accustomed to paying 60 percent of income to own housing, without realizing how unsustainable that amount of debt is compared to historical norms.

The cure for this housing mania is much lower house prices as incomes can only move higher very slowly.

And lower prices could trigger a financial crisis for highly indebted homeowners and their co-signers, not to mention the lenders.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.