Rapid inflation reared its ugly head this month, as the Consumer Price Index hit 2.6 percent gain for the last year.

The price increase for energy was closer to 15 percent, while food was almost 4 percent.

If the CPI keeps rising at this pace, as some predict, interest rates will rise.

What will central banks do if inflation goes well above 3 percent?

The Consumer Price Index for All Urban Consumers, headline CPI, jumped 2.6 percent year-over-year. Of course, last year in April the price of oil on the commodity futures market hit a record low of minus 37.63 dollars. OPEC, maybe a little terrified, agreed to cut 10 million barrels per day of production.

Because energy carries a big weighting in the CPI that low price caused a low reading for CPI a year ago, at minus 0.7 percent. So it was expected that inflation would show a big gain twelve months later, from what is known as the base effect, that is a very low starting number making this latest observation artificially high. Next month the number will have an even bigger base effect as the CPI with the minus number will be reported in May.

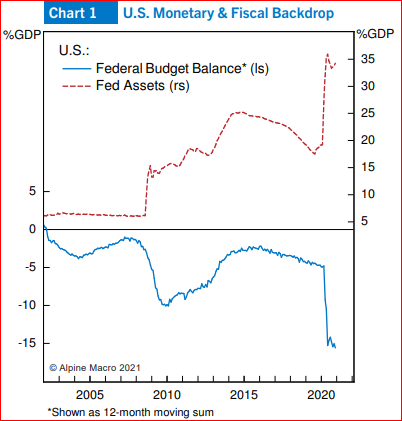

In November I wrote that inflation is the most likely outcome of the conundrum that central banks face with the amount of monetary expansion and fiscal largesse that has been injected into the economy, with more to come if President Biden can get his $1.9 trillion infrastructure bill passed.

Will the Fed have to unwind this during an inflation spike?

Source: Alpine Macro

Some economists expect inflation to peak at 4 percent but call it temporary.

Supply chains are more fragile with some items in short supply. Lumber prices have tripled from last year, from $300 to more than $900 today.

Used car prices are soaring because new cars are scarce due to a shortage of computer chips. Containers are hard to find, so shippers are paying premiums to ship their goods from Asia to buyers in North America.

Housing prices are jumping in Canada and moving higher in the U.S. as central banks have flooded the market with cheap money and banks have been instructed to lend aggressively.

All of this adds up to a test for the Bank of Canada and the Federal Reserve. Both are on record saying they would be happy to see inflation move higher and they would let it rise, temporarily, in order to give the economy a boost.

So will these central banks keep interest rates below 1 percent if inflation hits 4 percent?

Or will the market demand much higher rates on bonds in view of the higher inflation rate? My guess is that initially the central banks will do as they promised, but when bond rates soar to match inflation rates central bankers will back down and follow market rates higher.

That will be a severe test for these markets, which are now full of complacency.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.