Canadian population growth gets too much credit for rising house prices. In fact, in Calgary and Edmonton, house prices declined or stayed flat while population grew much faster than the Canadian average.

But now Canadian population growth is slowing.

Can population growth explain house price increases?

Recent data from Statistics Canada show a significant decline in the rate of increase of population during 2020. A sudden and steep drop in non-permanent residents, such as students and people on temporary work visas, has affected the growth rate. In fact, for 2020 as a whole, the population of Canada barely increased. Real estate optimists, using immigration as a talking point, will have to find a new justification. From Statcan last week:

"Canada’s population was estimated at 38,048,738 on January 1, 2021, an increase of 149,461 (+0.4%) from January 1, 2020. This was the lowest growth rate since 1916 (+0.3%)."

The drop was due to a small change in the natural rate --births minus deaths -- and a large drop in the number of new residents arriving in Canada minus departures.

“More non-permanent residents left Canada than came to the country in 2020 (-86,535), which is the largest net loss since comparable records have been available (1972)." Statcan

And yet house prices have soared during the same period.

The facts show that the real estate industry’s claim of a direct relationship between population growth and house prices is too simplistic. There are many factors that affect house prices and population growth is only one. Indeed, in some cases, there is a negative correlation between house prices and population growth.

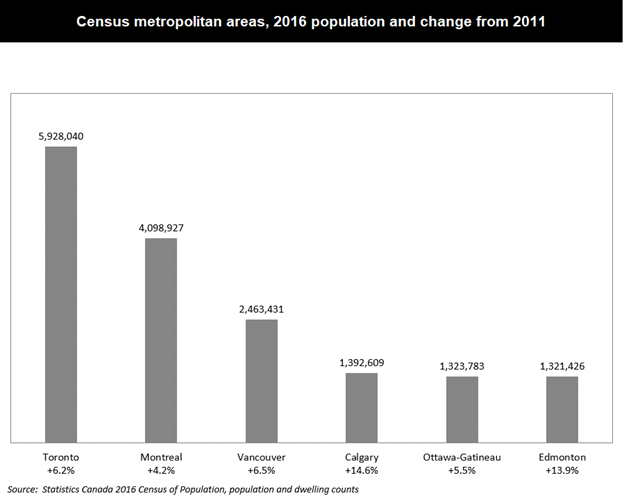

This graph is from the 2nd edition of “When the Bubble Bursts” 2018 when I wrote:

“According to the 2016 Census, the growth in Canada’s population has been steady at 1 percent annually for the 2011 to 2016 period.”

(Note there is a census every five years in Canada and the new one will be taken in May 2021)

For the five-year period ending in 2016 there were vast differences in growth among regions.

For example Toronto showed growth of 6.2 percent, just 1.1 percent annually. But in Calgary and Edmonton there was growth of 14.6 percent and 13.9 percent, respectively, more than 2.5 times the rate of Toronto.

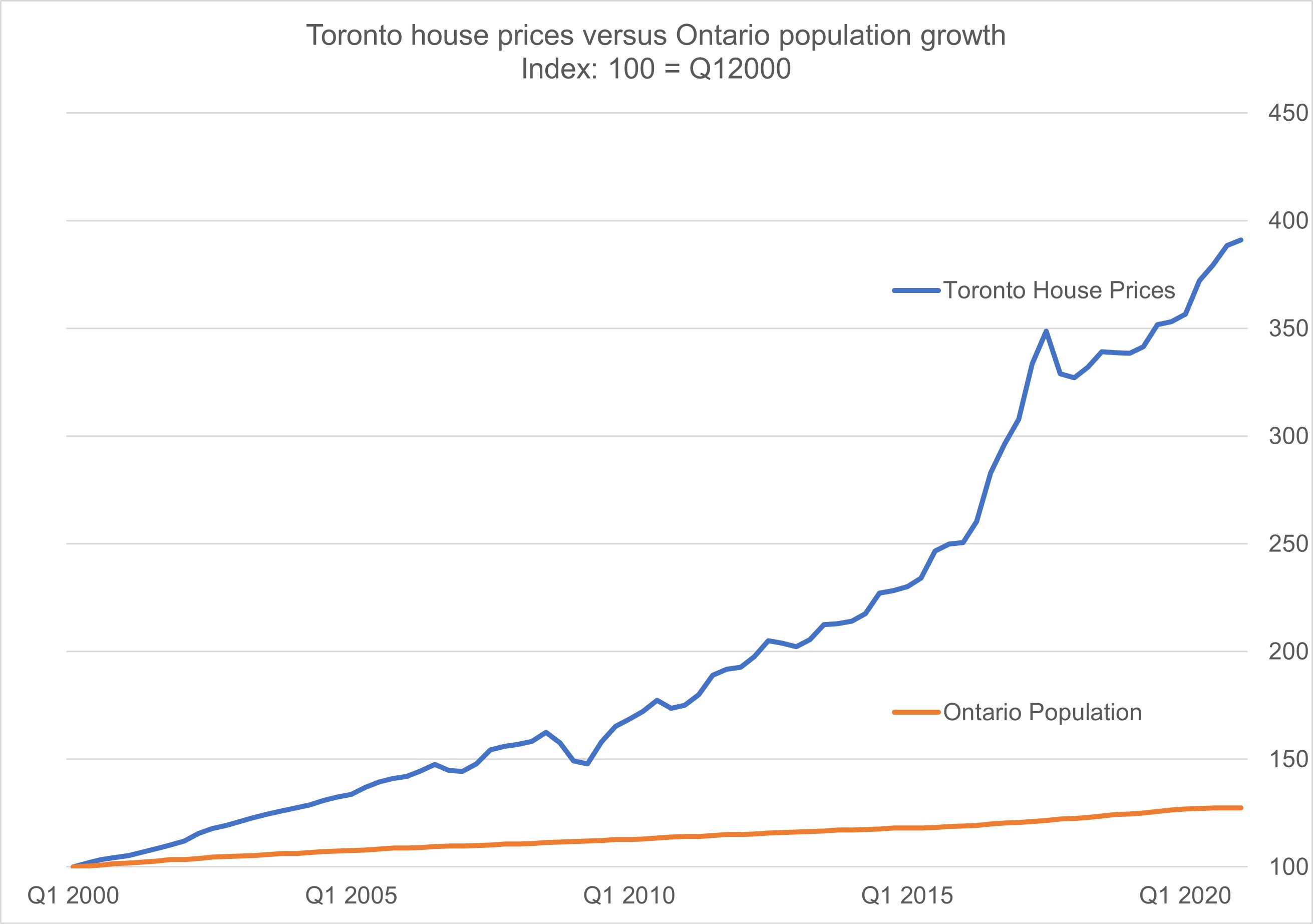

Taking a longer period for Toronto and Ontario, we can see population growth lags far behind house price growth, with both data series indexed at 100 starting in 2000.

Sources: Statistics Canada and Teranet National Bank National HPI

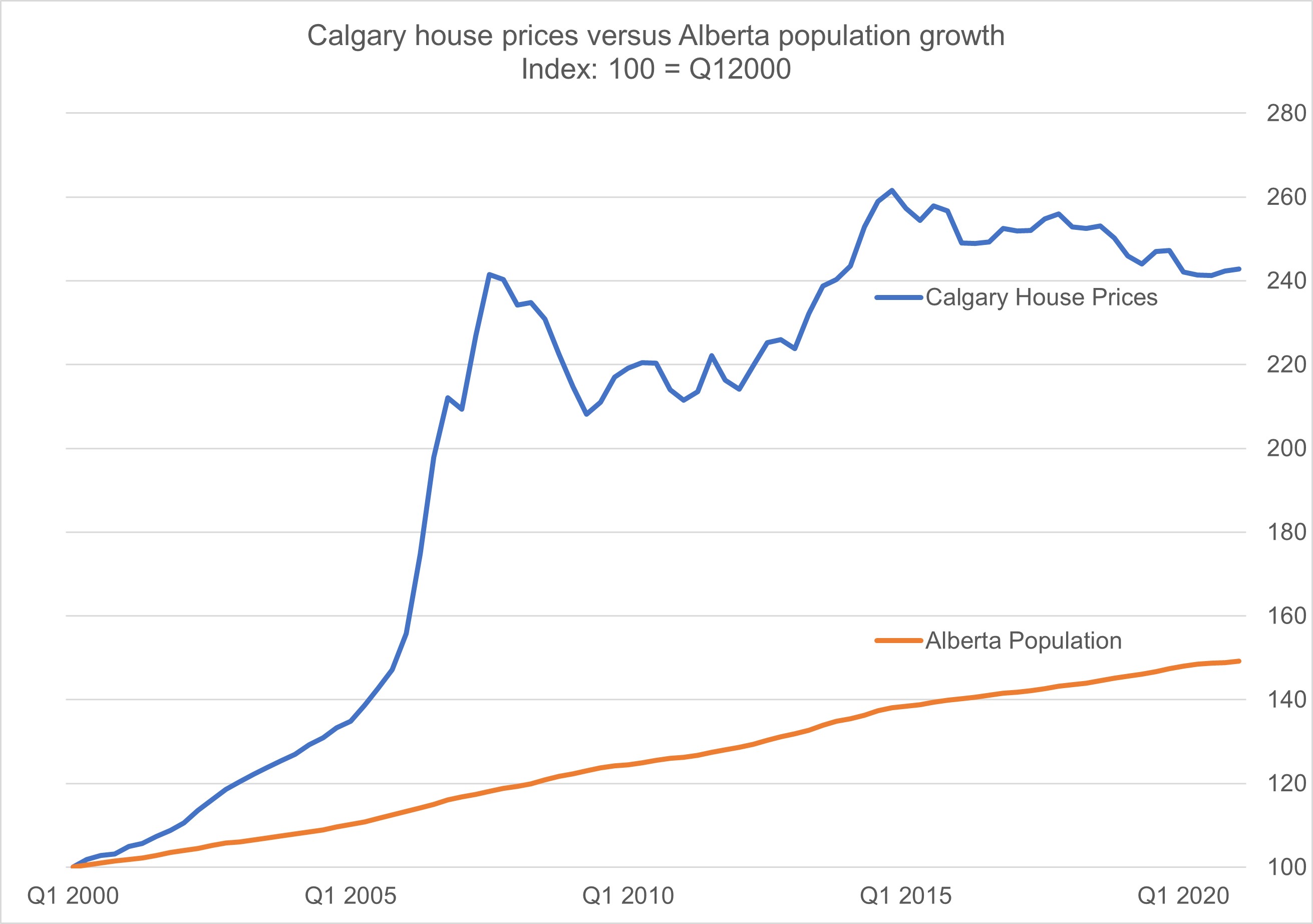

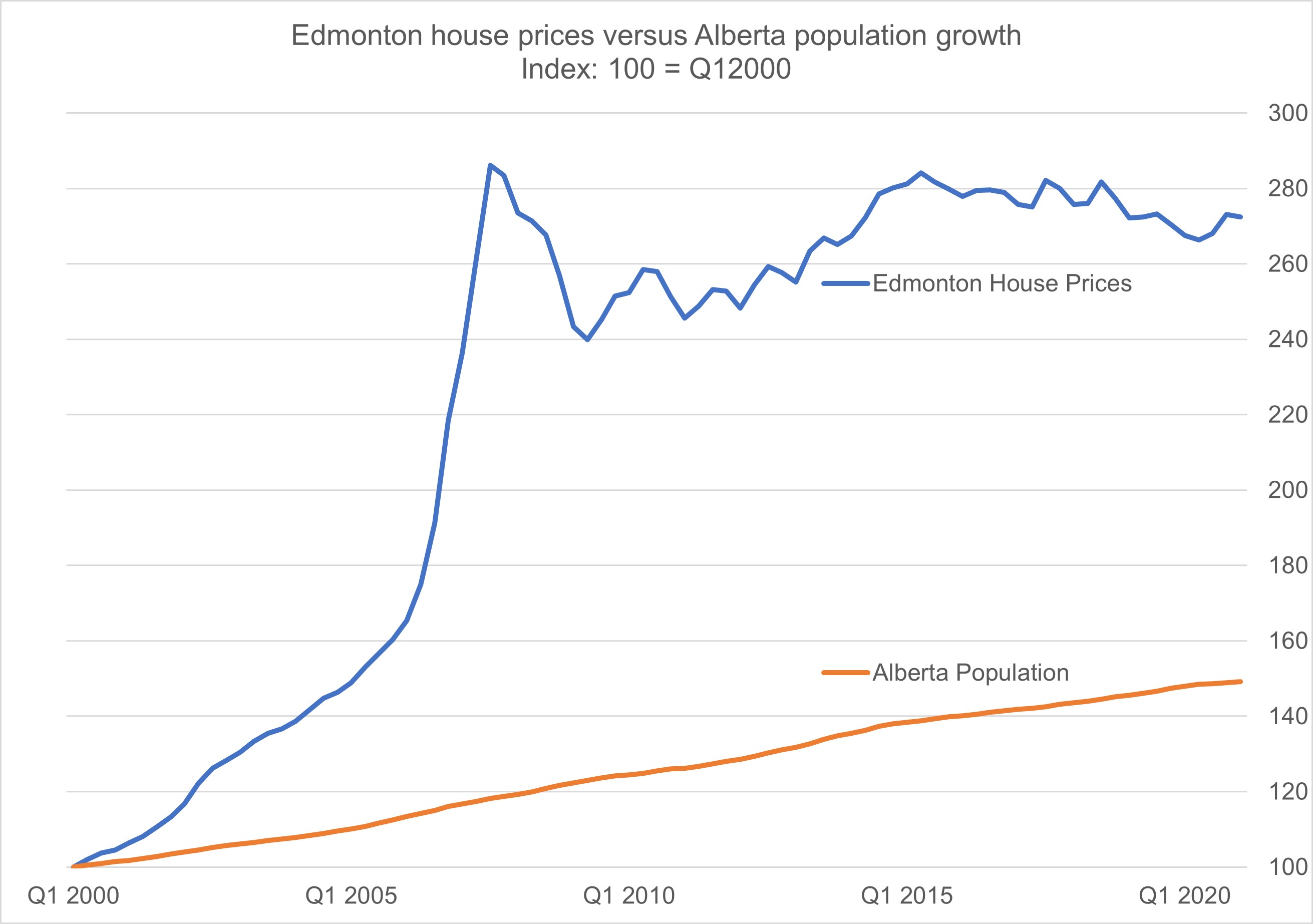

But in Calgary and Edmonton house prices peaked in 2007 in Edmonton and in 2014 in Calgary. Overall there was little or no change in house prices in those two cities for more than ten years, while the population soared with migration from other provinces especially strong.

Sources: Statistics Canada and Teranet National Bank National HPI

Sources: Statistics Canada and Teranet National Bank National HPI

These three graphs show that population growth alone does not explain house prices. In Toronto soaring house prices and slow growth and vice-versa in Alberta.

So it must be something else that drives home prices. Could it be limitations of geography?

Edmonton and Calgary are surrounded by open land which can be used to develop new housing subdivisions while Toronto is limited geographically, at least for single family homes, because of Lake Ontario.

But when examining countries that have much higher population density than Canada, like Germany and Japan, that argument appears to fail too. Germany’s 83 million people would fit into a space smaller than Alberta, with room to spare.

Germany (blue) superimposed over Alberta. Source: thetruesize.com

So if it is not population growth nor lack of land, what causes extremely high house prices?

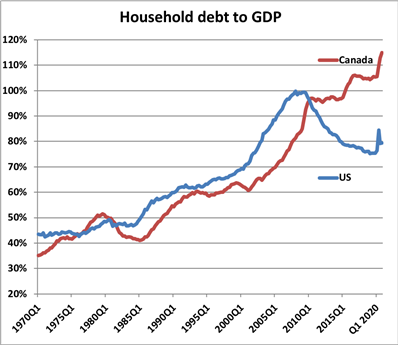

Could it be household credit?

Source: Ben Rabidoux, North Cove Advisors

The availability of cheap finance has a very large influence on house prices.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.