The optimism about the Canadian economy that appeared in late spring and continued into the summer was created in part by generous government income support and payment deferrals.

Now that complacency will be tested as the mortgage deferral cliff, the biggest of payment deferrals, will arrive in October. And income support programs are also expiring or modified.

Do Canadians expect indefinite protection from the full impact of this severe recession?

This recession does not feel real to many people, as some collecting government support are receiving more income than they had previously. And, in many cases, payments on mortgages, credit cards, personal and auto loans have been deferred since March, so people have had even more disposable cash to spend or save. With this extra money some are buying houses, some are doing renovations, and some are saving up the money as a bulwark against a long recession.

But now the mortgage deferral cliff is here, starting in about a week, as the maximum deferral period was six months and most deferrals were approved by the end of March.

Will this end of deferrals be a shock to some Canadians? Will they expect the government to extend their protection?

In the 1990s I was the branch manager of a brokerage firm and had to supervise financial advisors. One advisor made a huge mistake and allowed a young professional couple to put all their assets into one gold exploration company, called Bre-X, which turned out to be a scam. The shares went to zero. Because the advisor should never had allowed this to happen, the firm paid out the clients for the full value of their loss and the advisor was fired.

Those clients were assigned a new advisor who recommended a balanced portfolio with proper diversification. About a year later the 1997 Asian Crisis hit, and the value of their accounts declined by about 15 percent. Stock markets plummeted by more than 50 percent, so the couple had done quite well relatively. But they still had losses.

Shortly after, someone from head office called to say that a letter from this young couple had arrived, addressed to the president, demanding reimbursement for their new losses. I explained the history and the caller from head office said that the advisor had acted correctly and there would be no payment. A week later their accounts transferred out.

At the time I was shocked at how easily those investors were able to convince themselves that someone should cover all their losses. But it is possible to see how they got that mistaken impression.

Government actions since March could have engendered similar expectations for heavily indebted Canadians.

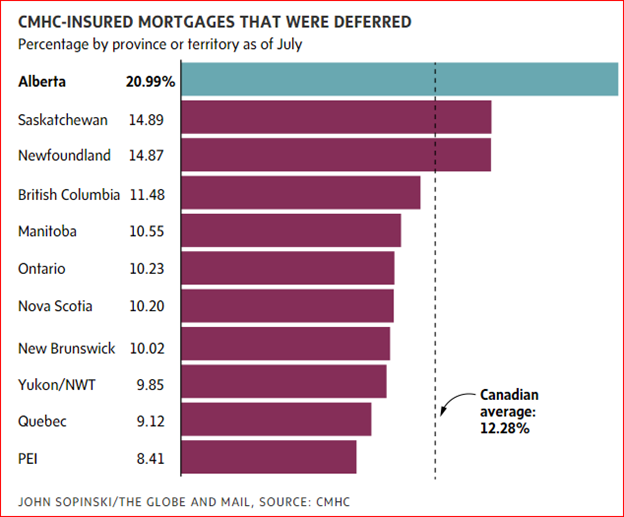

Alberta could be the epicentre of this next phase of the recession as deferrals and debts there are much larger in both volume and dollars than the Canadian average. Note that the top three provinces in deferrals are dependent on resource income.

The Canadian total of mortgages outstanding is about $1.6 trillion with CMHC-insured at about $500 billion. Household debts total more than $2 trillion, among the largest of all countries as a percent of GDP.

RBC senior economist Josh Nye said that “even before the pandemic, insolvencies jumped in both Newfoundland and Labrador and Alberta, while Saskatchewan led the country in mortgage defaults.”

Canadians might argue that they took on this debt with the encouragement of lenders who usually said, “you’re approved”.

But with such debts, people will struggle with the resumption of payments. And more than a few might write a letter to their Member of Parliament demanding an extension of the deferral.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.