Market valuations in the U.S. have seldom been higher, rivalled only by 1929 and the 2000 peak.

These are unusual times as this combination of great market returns since April and a terrible economy has never happened before.

How worried should investors be about the U.S. market?

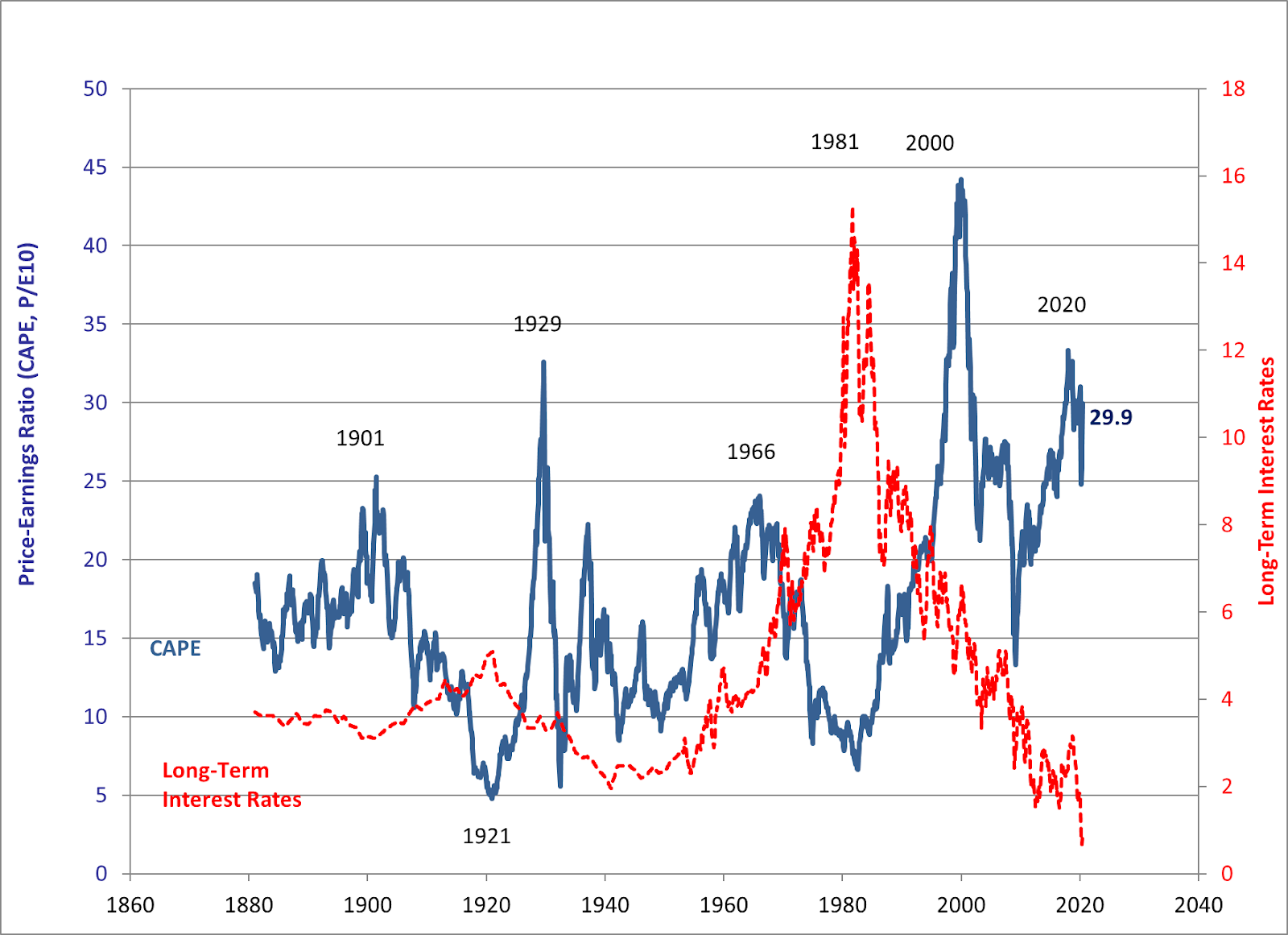

One of our favourite charts is the Shiller CAPE ratio that is available online here.

Here is the latest:

Source: Robert Shiller

At 29.9 the ratio is close to the highest reading, only surpassed by the 2000 bubble when it reached 45. But in 2000 the S&P 500 committee was including companies that had no earnings, depressing the denominator of the ratio. Since that time, the committee has reformed its approach. For example, the committee has still not admitted Tesla Inc. into their flagship index although that decision is probably imminent. But Tesla is a company that has a market capitalization of greater than $250 billion and four consecutive quarters of profit.

Now, the 500-company index is made up of companies that generate profits and therefore the quality of the earnings number is much better. As well, since the Shiller PE uses a ten-year average of earnings, adjusted for inflation, the effect of the Global Financial Crisis (GFC) is starting to disappear as the earnings result for 2009 is gone.

But to reach a reasonable valuation the Shiller CAPE must get way down to about 15, or ideally below 10. With the earnings number in the denominator around 100 now the numerator – stock prices -- would need to go to 1,500, about 50 percent lower. And earnings growth will not be enough.

Because of the COVID-19 recession, earnings will drop in the third and fourth quarter of 2020 from the prior year. Estimates show earnings of about $150 this year, down from the prevailing estimate of $180 before March.

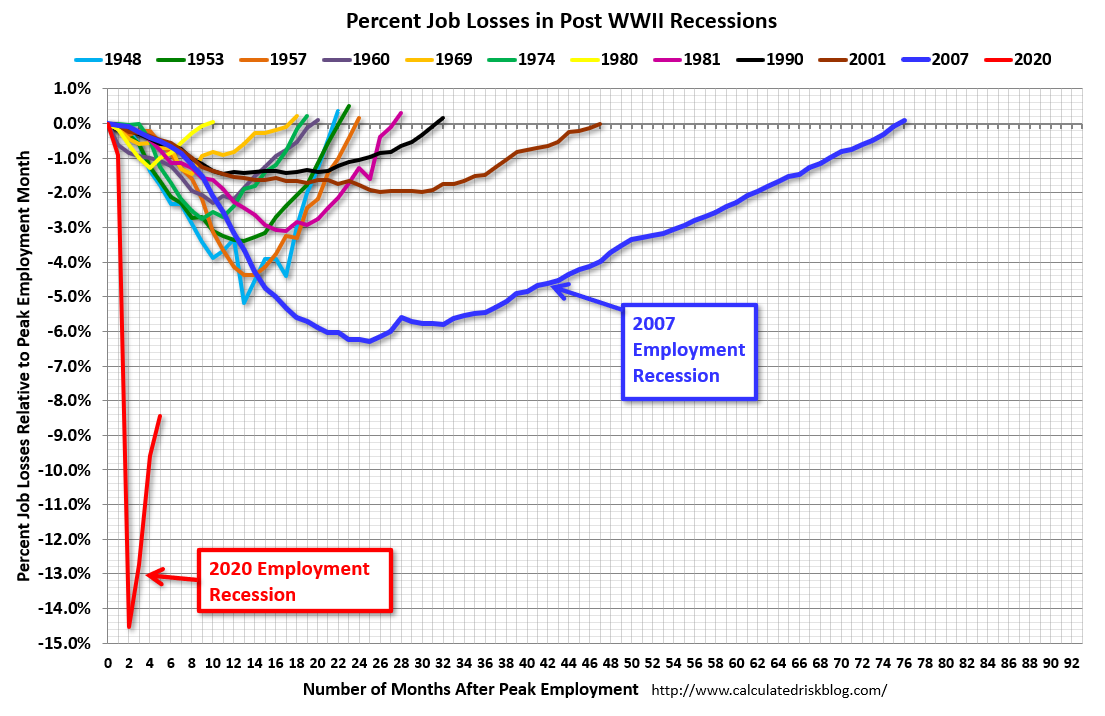

However, it is very likely that $150 is still too optimistic since that estimate includes a forecasted robust rebound in profits starting in the second half of 2020, something that is increasingly unlikely as many companies and industries are hit by the current recession. The drop in employment is unprecedented:

Here is the current drop in employment compared to all previous recession since WWII courtesy of Calculated Risk blog which is updated daily.

Source: Calculated Risk Blog

During the GFC earnings on the S&P 500 dropped from a high of about $90 in 2006 to a low of $45 in 2009. The 2020 recession is destined to be at least twice as severe.

So, in the current environment, we can expect at least a similar percentage drop of about 50 percent.

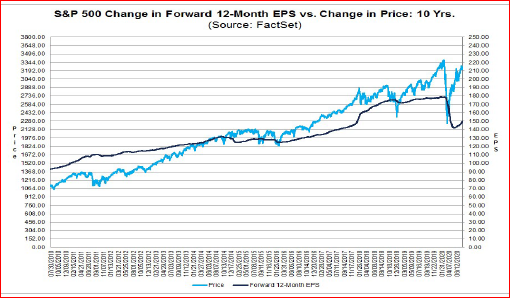

Source: Factset

See how the market has rebounded to within a whisker of all-time highs – blue line -- while earnings – black line -- are sagging.

Investors should be worried about this because extreme investor complacency and record highs are a mismatch with the dire situation that businesses face in the COVID-19 emergency.

This is an era when department stores are disappearing, shopping malls are closing, airlines are operating way below capacity, hotels are not making enough to survive, universities are not inviting students back to campus, professional sports are cancelling games and even seasons, office towers are empty, transit cars have few passengers and the list could go on and on. Nothing like this has ever happened before, in recent memory.

So now is the time for investors to worry about the future and to act with extreme caution. This probably means settling for safety and giving up the prospect of chasing double-digit gains in the portfolio.

At least temporarily, greed is no longer good.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.