Democratic Presidential nominee Joseph Biden unveiled his clean energy platform this week, which shows an increased willingness to move closer to the progressive wing of his party.

The $2 trillion spending proposal is over four years, a dramatic change from his previous campaign promise of $1.7 trillion over ten years.

If Biden wins in November, should investors shift their investment strategy to clean energy?

The website Predictit suggests that Joe Biden has a 62 percent chance of winning in November 2020. Three months ago, President Trump had a slight lead over Biden, who was rated at 45 percent. Then Covid-19 and the recession happened, and Biden surged ahead.

A well-known polling website FiveThirtyEight shows Biden with a lead at 49.9 percent versus 41.5 percent for Trump, using an average of all election polls. This gap has widened significantly since March 2020 when the two candidates were only about 4 points apart.

Donald Trump also suffers from an approval rating that has slumped to 40.4 percent. The two recent former presidents with approval ratings this low -- Jimmy Carter and George H. W. Bush -- both were defeated. No president has won a second term with approval ratings below 45 percent except Harry Truman in 1948.

So, investors should start to take a close look at the Biden platform as it is possible that he will be sworn in as the next President in January 2021.

In his clean energy plan Biden is promising that all power generation will be “emissions-free” by 2035. Coal-fired power plants have been in decline for years in the U.S., but this bold proposal would require that both coal and natural gas power generation go to zero in about 14 years. No forecasters that I could find predict such an abrupt change to power generation.

His platform calls for incentives to trade internal combustion autos for electric, the buildout of 500,000 charging stations, the upgrade of 4 million buildings and retrofitting of 2 million homes, 500 million solar panels, 8 million rooftop solar panels, and 60,000 made-in-America wind turbines. 500,000 electric school buses and 3 million zero-emission public sector vehicles would be added. Biden’s emphasis is the creation of jobs in the U.S.

Bloomberg New Energy Finance predicts that wind and solar electricity generation will surpass coal-fired power in the world by 2032, but this new proposal would accelerate that trend. Today, coal-fired plants generate 37 percent of electricity in the world.

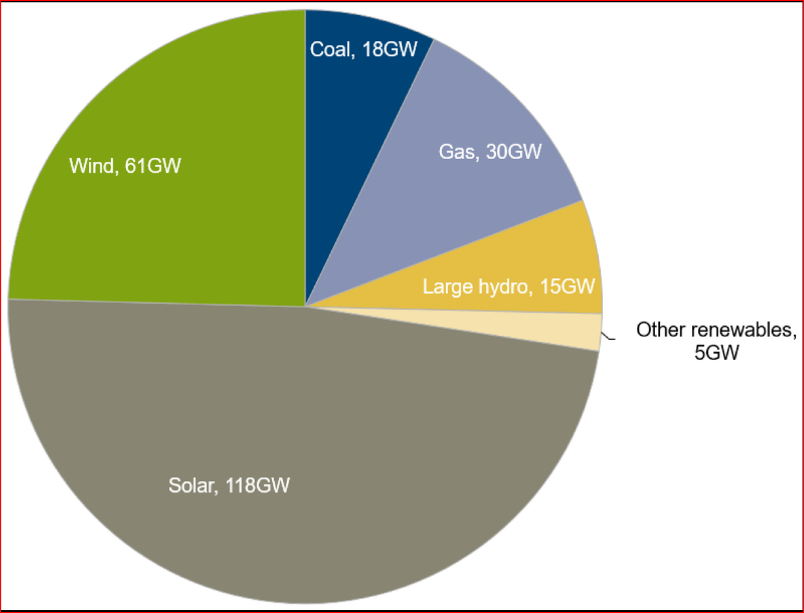

According to “Global Trends in Renewable Energy Investment” renewables were the biggest source of new power additions in 2019. But coal and natural gas were still more than 20 percent of the total added.

Source: Bloomberg

The stock market seems to have recognized this trend already, as some of the biggest winners in the last year were in renewable energy.

Some companies are Tesla, Enphase, Vestas Wind, Siemens Gamesa, BYD, Vivint Solar, Sunrun, Ballard Power, FuelCell Energy, TPI Composites, Sunpower, Canadian Solar, First Solar, NIO, SolarEdge Technologies, JinkoSolar, Iberdrola, Orsted, Ballard Power and a large number of Chinese companies.

The Invesco WilderHill Clean Energy ETF PBW gained 19.88 percent year-to-date versus 12 percent for the NASDAQ Composite Index. This gain would be exceptional in any year but given that markets have struggled with the impact of COVID-19 and a severe recession this performance is truly remarkable.

If investors shift to a positive view on renewable energy and if institutional money decides to make a serious commitment, there will be a scarcity of investable companies to absorb that buying power.

Investing in renewable energy could get very interesting in the coming years.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.