Gold bullion and gold mining shares have been used at times as a hedge against the possibility of a cataclysmic event in the markets.

Since the arrival of COVID-19 and a severe economic downturn, interest in gold as a hedge is making a comeback.

Will gold and gold mining shares perform as a hedge this time?

Gold bullion and gold coins survived for centuries as currency and a store of wealth. Paper money, on the other hand, can be debased by excessive expansion of the money supply or printing of money.

Since all governments have announced massive spending plans in reaction to the crisis brought on by COVID-19, people worry about the value of government or “fiat” money. Euros, dollars, Canadian dollars, Japanese Yen and Chinese Yuan could all be worth less, perhaps much less, if this spending binge causes a deflationary collapse or years of runaway inflation. The unprecedented expansion of government and private sector debt after the GFC ago is now being reinforced by another large injection of new debt just elven years later.

Although gold isn’t perfect as a hedge in market crashes, against the U.S. dollar it has performed decently this time. Gold prices initially dropped from US$1704 to $1451, or 15 percent. Then gold rebounded to $1640 on Thursday this week. Compared to a US stock market that is still down about 18 percent year-to-date this is good performance.

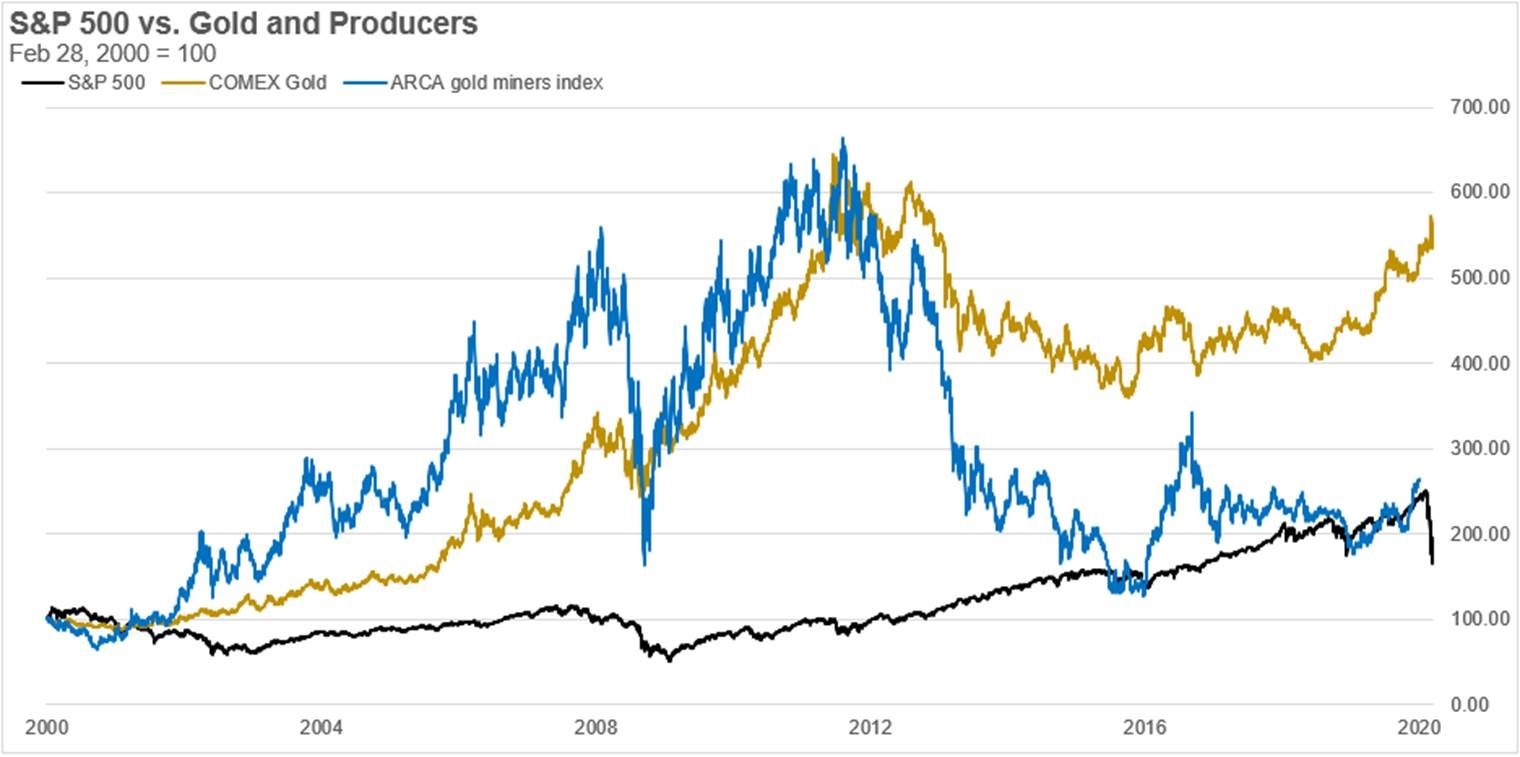

Over the last twenty years gold as a commodity has performed even better than the stock market:

Source: MacBeth MacLeod Wealth Management

COMEX gold peaked in 2011 after the GFC and is close to that level now, at six times the starting point two decades ago. The S&P 500 index has made less than half those gains. And shares of gold mining companies, the blue line, have done only a bit better than the S&P 500.

Gold miners represent an interesting alternative to bullion because they make profits and pay dividends to shareholders. The two biggest companies, Newmont and Barrick Gold, are now operating very profitably with decent dividends and strong balance sheets.

The chart shows that in the period of the Global Financial Crisis, from 2006 to 2010, gold miners as an index lost more than 70 percent of their value. As a result, investors lost some faith in the value of gold miners as a haven and turned more to gold bullion as a hedge.

But interest in gold mining companies could be restored during this bear market.

Gold miners have a few advantages over gold as a commodity.

First, gold miners are profitable at today’s prices and therefore can afford to pay dividends. Barrick Gold’s costs are under $700 for operating and under $1,000 for all-in-sustaining costs per ounce, leaving a very healthy profit margin with gold over $1,600 per ounce.

Second, gold miners usually control large reserves that have been discovered, known as proven reserves, and when the price of gold rises those reserves also rise in value. And, even better, as the gold price rises more reserves become economic and can be added to reserves.

Third, gold miners explore all the time. There hasn’t been a major discovery of a world-class gold deposit in more than a decade. While we don’t know when the next big find will happen, it’s a good bet that there will be another gold mine, like the iconic Goldstrike mine in Nevada controlled by Barrick. The shares of the company that finds that new mine will outperform.

Consider adding some gold miners as a hedge while they are trading at a discount to gold bullion.

It could be an exciting ride.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.