The stock market has started to react negatively to COVID-19 spreading outside of China.

Markets are down about 10 percent from the peak valuations of mid-February 2020.

During a steep correction, it has been profitable to buy stocks. This is called “buying the dip”.

Is now a good time to add exposure to the market?

A generation of investors has learned to buy during the periodic setbacks that come in the stock market. The setbacks have been milder and milder in recent years, which means that people need to jump in quickly to benefit from the “buy the dip” strategy. Since the bear market bottom which was reached in March 2009 the largest setback in the stock market has been less than 20 percent. Since this market has dropped by more than 10 percent, if the pattern persists, stock market buyers must jump in soon to avoid missing out.

One of the emotions that has become very prevalent in times of rising prices is called “Fear Of Missing Out” or FOMO. FOMO is another name for greed. It’s been said that one of the most difficult times for any human being is watching a friend or neighbour get rich while not participating.

The character trait that can be valuable in investing, and is the opposite of FOMO, is patience. Today patience is in short supply. For most people instant gratification is highly desirable, and for some people even instantaneous reward isn’t fast enough. Since the patient investors that have waited for bargain prices have repeatedly missed out, impatient people have gained confidence in buying the dips.

But, with patience in such short supply, patient investors could be rewarded very generously if the correction turns into something more substantial.

How can an investor use patience in the current stock market setback?

According to some pundits the correction that started a couple of weeks ago will turn into a bear market. The modern definition of a bear market is a correction of more than 20 percent. The last time that happened was more than eleven years ago, in 2008-09.

But it’s a gamble to wait to see if the current downturn in markets does extend losses to 25 or 30 percent or more. In the past, bear markets have been a normal occurrence every five to ten years. A bear market is long overdue.

How can a patient investor tell if the correction has run its course and it’s time to buy?

There are several measures of valuation that can be applied to determine when the market is cheap.

Here are two that can be calculated easily.

First, there’s the Shiller Cyclically Adjusted Price Earnings Ratio, or CAPE.

This ratio is available on Shiller's website. The CAPE graph shows that this market is expensive.

Source: Robert Shiller

The current correction hasn’t changed the extremely high valuation yet, according to the CAPE method.

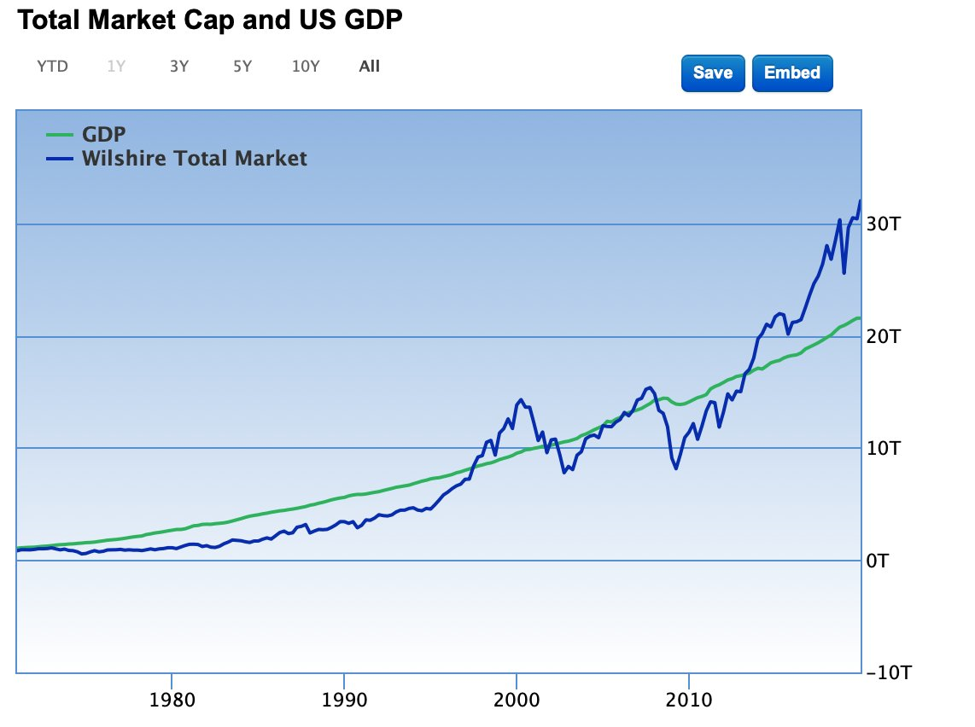

Another way to look at valuation compares stock market valuations to the growth of the economy, measured by GDP.

Sources: GuruFocus and FRED - St. Louis Fed

The value of all stocks trading on the U.S. market, called the Wiltshire Total Market, is about 50 percent higher than GDP. In the past, it’s been a great time to buy when market value is below GDP, as happened in 2002 and 2009.

Both valuation methods show clearly that the market isn’t cheap yet, even after the recent correction.

So, it’s too soon to buy the dip. If periodic bear markets reappear, the market will reach bargain pricing at some point soon.

All that the patient investor needs to take advantage of those bargains is the ability to wait.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.