The standard safe-haven investment in a portfolio has always been fixed income or bonds. While not known for producing larger capital gains, bonds are useful as a store of value and generators of income. However, recent trends in North American bond markets have started to show evidence of overpricing.

Bonds are debt. And are issued by those needing credit from the purchaser of the bond. Whether you buy corporate or government issued debt, the general mechanics of the bond are the same. Many bonds, usually corporate, have provisions or covenants that can also affect the price of the bond but for this post, I’ll focus on the credit rating of the issuer.

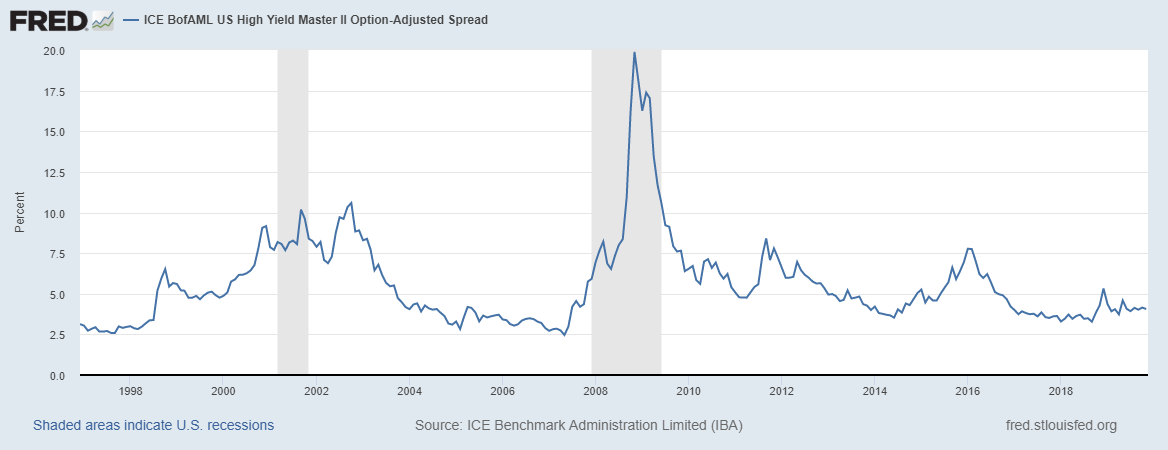

As Hilliard MacBeth discussed in his early 2018 post “Generating income with junk bonds”, the spreads of high yield bonds were closing in on the yields of higher quality credit at about a 3.29% difference. The chart he mentioned is updated below and you can see the spread has widened to 4.06%:

Source: St. Louis Fed, FRED

While this seems insignificant, if you bought and held to today a basket of high yield bonds when Hilliard wrote this post the value of your investment would have suffered a 23% capital loss. This doesn’t include the income you would have received from the bonds which would have cushioned the blow by 12%.

While this move up in high yield spreads is not as substantial as the 10% to 20% that occurs during recessions, it indicates that buyers of high yield credit are losing interest in lending money to riskier borrowers.

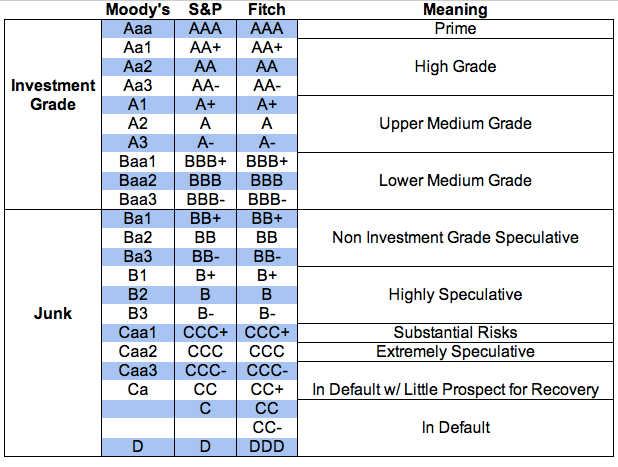

Where is this money going? Mainly to investment grade credit which in the chart below is an S&P or Fitch rating of BBB- or higher. High yield credit is classified in the ‘Junk” section of the chart.

Sources: Moody’s, Standard & Poors, Fitch Ratings

A key strategy to buying bonds is ensuring the price of the bond is trading below par or at a discount. This ensures a small capital gain when the bond matures at a price of $100. Bonds trading above $100 are said to be trading at a premium. It’s OK to buy premium bonds so long as the holder is compensated by the income. A bond trading at a premium will lose value when it matures at $100 but if the bond’s income payments cover that loss and then some, it’s a worthwhile investment. This is not uncommon as investor preference for discount bonds means that premium bonds often trade at higher yields on a relative basis.

Looking at the 288 offerings of Canadian corporate investment grade credit, only 28 are trading at a discount. The most expensive at $148.27 is a Greater Toronto Airport Authority bond maturing in 2032 paying a 6.98% coupon. If you held this bond to 2032 you would receive a 2.45% total return. Not great for 13 years.

The responsiveness of a bond’s price to interest rates is known as its duration. A bond with a longer duration responds more to changes in interest rates than a bond with a shorter duration. The GTAA bond above has a longer duration than a bond maturing in 2 or 3 years and is therefore a riskier choice.

The growing duration of bond holdings is an indicator of overpricing as investors are willing to hold riskier assets for diminishing yields. As the chart below shows, a 32% increase in duration of the US Aggregate Bond index, has brought a 40% drop in bond yields.

Source: Wall Street Journal

In this low interest rate environment, the safest ‘safe’ assets are cash and treasury bills. While one’s allocation to fixed income should always be maintained, the best way to protect these holdings is to ensure you own shorter duration bonds. While this will forego some potential yield, it will reduce the impact brought on by rising interest rates and a selloff in bonds. Always consult your investment advisor before making any changes to your personal portfolio.

Fraser Betkowski

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.