Change is constant, in life and in investing. Most of us would prefer that things continue as they are, especially when it’s to our benefit.

But change is often unavoidable and sometimes disruptive. While many people and firms fail to adapt to change, others can prosper by predicting what will come.

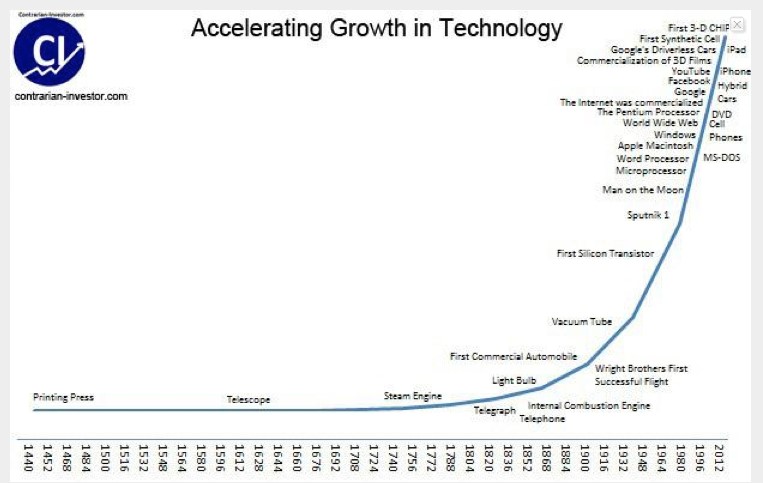

What are some of the bigger disruptions coming?

Sources: Econlife and Contrarian-Investor.com

A book called “The Innovator’s Dilemma: When Technologies Cause Great Firms to Fail.” by Clayton Christensen uses several case studies to illustrate how the best-managed firms fail to deal with change, even when they are fully aware of the disruptive trend.

The common flaw is that firms are unwilling to enter new, smaller markets with products that are lower cost and less profitable. It wouldn’t make sense for them to abandon their best customers who give them most of their revenues and profits to chase a new market that barely exists. So, new and much smaller firms invariably win that contest.

Credit Suisse (CS) wrote several reports on disruption, with a focus on the likely impact on investors.

CS identifies four forces that could generate a large amount of disruption:

Regulation, Globalisation, A Multi-Polar World and Technological Innovation.

Regulation has the potential to create uncertainty, as the “laissez-faire” attitude toward business that started with Margaret Thatcher has proven lacking in some areas. For example, the de-regulation of banking and investment firms in the 1990s led directly to the global financial crisis of 2009 and the failure of dozens of large banking institutions worldwide. So, regulation could be coming back in that field.

In a new area for regulation, the threat posed by climate change may lead governments to enact rules that affect the non-renewable energy sector.

There is some risk even to large tech companies as increased pressure to regulate tech giants like Facebook and Amazon appears. Since those companies, as well as Alphabet (Google), occupy such a dominant position they are targets to be treated like a public utility or broken up.

In technology an obvious disruptive force is automation. As much as 50 percent of jobs in some categories could be at risk soon, as machines take over.

CS highlights a few areas that are “disruptable” such as retail stores and banking. In China already 20 percent of retail sales are done online compared to about 8 percent for the global average. And yet offline retail employment in the UK is down only 3 percent in the last five years.

The three sectors identified as “most at risk” are automobiles, energy and pharmaceuticals. In autos the threat of all-electric vehicles is real. Billions of dollars are being invested by incumbents such as Volkswagen, Toyota and GM to create a competitive offering in the electric vehicle space. But Christensen in the “Innovators Dilemma” gives compelling reasons why they probably won’t be successful as they will try to compete in the new arena while protecting their legacy business.

Some disruptor companies are at risk themselves of being disrupted. Netflix is one example, as that company reported a decline in new subscribers recently. New offerings by Amazon Prime could give Netflix serious competition with new content.

Other companies are viewed as relatively immune to disruption. Companies like Nestle, L’Oreal, and Heineken in Europe and Walmart, Coca-Cola and Procter & Gamble in North America would be hard to disrupt. But these stocks are expensive by stock market valuation measures such as price-to-earnings ratios.

Investors need to protect themselves from potential losses in sectors that are getting disrupted. Investors can also look for new arenas for investment, once a trend of disruption is established.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.