On Wednesday June 19, 2019, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve Bank announced its decision to hold policy interest rates steady at 2.25% to 2.50%.

Market participants are watching the Fed closely to see if rate cuts are coming, as there are some signs of a weakening economy. The wording of the announcement hinted the Fed is leaning in the direction of cuts later this year.

Will the FOMC cut rates at its next meeting in July?

After every Fed meeting, market participants scour every word of the Fed’s announcement for clues about the future course of Fed policy. Some of the wording changed significantly this week, with the word “patient” dropped and new wording such as “closely monitoring” added. While this change doesn’t guarantee a policy change, most observers expect that there will be a rate cut at the next meeting in July.

The Fed has two mandates: First, to sustain economic expansion and full employment and second, to maintain stable prices. On the second goal the Fed, along with most other central banks in the world, uses two percent as its target for inflation.

In mid-2019 the job market and employment are strong, and unemployment is at the lowest level since 1969. The economic expansion has lasted for a decade, from its beginning in the aftermath of the Global Financial Crisis of 2008-09. Speaking of the current state of employment, the chair of the Fed, Jerome Powell, said that “community, business and labor leaders all tell us that the prospects for job seekers have seldom been better … Wages are rising, and this is particularly so for lower-paying jobs.” Until recently most analysts thought that the Fed would continue hiking rates, as it has been since 2016.

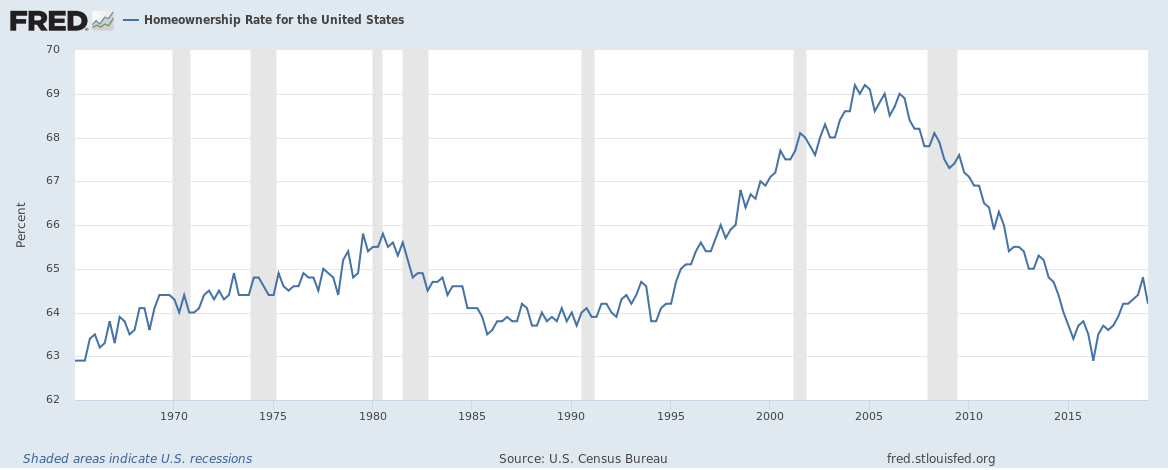

But this economic expansion has been sub-par. After the worst recession since the 1930s, it would have been normal to see a strong recovery. But the U.S. economy didn’t respond as expected. For example, the housing sector has been relatively weak. Housing is one area where the Fed believes it can stimulate directly when interest rates are lowered. But home ownership rates are still near the lowest level of the last four decades.

Source: FRED – St. Louis Federal Reserve

So, the Fed would like to extend the tepid recovery even longer to allow more people to participate.

On the second mandate, to maintain stable prices at the target level, there is a potential problem as inflation has failed to reach the two percent goal despite many vigorous attempts by the Fed to generate higher prices. Wages are not rising quickly enough to satisfy Fed policy makers. As Powell stated, “We are firmly committed to our symmetric 2 percent inflation objective, and we are well aware that inflation weakness that persists even in a healthy economy could precipitate a difficult-to-arrest downward drift in longer-run inflation expectations.”

What does it mean if the Fed cuts rates later this year?

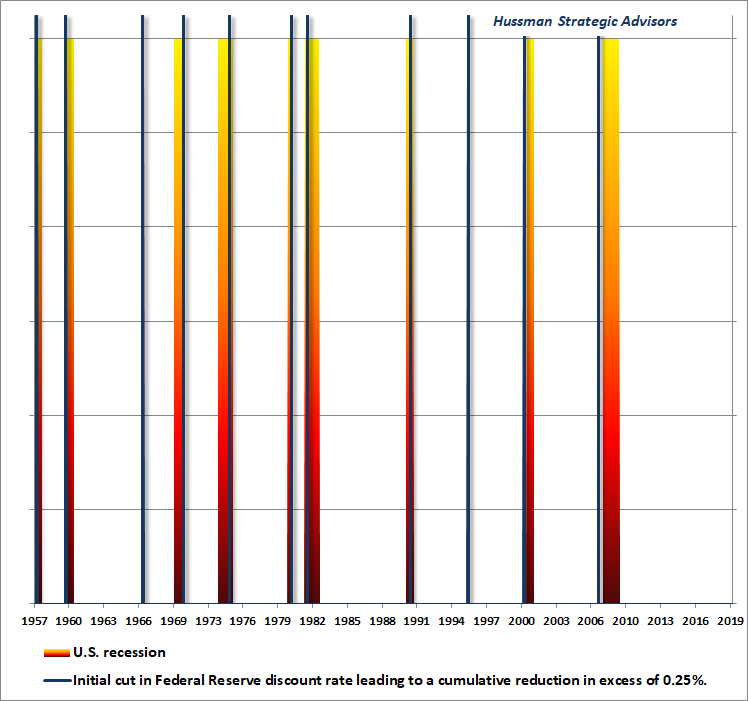

Most traders love rate reductions, as they think markets will move higher and they don’t understand that lower rates can be a sign that the economy is in recession, or soon will be. As John P. Hussman of Hussman Strategic Advisors points out, in the last sixty years, the Fed has cut rates 11 times, but only twice, in 1967 and 1996, have those cuts not signaled the start of a recession.

Source: Hussman Strategic Advisors

In other words, the FOMC is a follower of the economic trend, not a leader. Rate cuts by the Fed in July or September would likely be confirmation of an imminent recession.

As Hussman says, “be careful what you wish for.”

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.