A new book, called “A Brief History of Doom: Two Hundred Years of Financial Crises” by Richard Vague, covers the causes of financial crises.

Consistent with my recent book, “When the Bubble Bursts: Surviving the Canadian Real Estate Crash”, Vague finds that most crises in history were preceded by a surge in private sector debt.

Does Vague predict that Canada will experience a financial crisis?

Vague first came to my attention in 2014 while I was writing the first edition of When the Bubble Bursts. In his 2014 book, “The Next Economic Disaster; Why It’s Coming and How to Avoid It?,” he describes how a rapid increase in private sector debt as a ratio to GDP of 15 to 20 percent over a five-year period and a total private sector debt-GDP that is above 150 percent is a reliable predictor of a financial crisis.

For example, prior to the Global Financial Crisis from 2001 to 2006 total mortgage debt in the U.S. doubled to $10.6 trillion. The crisis followed two years later in 2008.

In “A Brief History of Doom” Vague goes deeper into the reasons for the many financial crises of the last two centuries. At 196 pages the book is easy to read.

For example, dozens of books have been written about the Great Depression in the 1930s. Vague takes a different point of view by looking more closely at the period prior to the 1929 crash which shows the most important factor that all economists missed. Private sector debt growth was fueled by a lending binge for real estate construction. Houses were a priority. All quotes from “Brief History of Doom”:

“The state of the nation’s housing had become a national issue in 1921 when Secretary of State Herbert Hoover began to advocate for increased home ownership.”

“On a per-capita basis, the U.S. housing boom of the 1920s was every bit as large as the housing boom of the 2000s.”

But commercial real estate developers were also eager to cash in on the boom. “Between 1925 and 1931, office space increased by 92 percent in Manhattan…In New York alone, approximately 235 new buildings were constructed…almost all debt financed.”

“In the five years leading to 1928, {U.S.} private debt grew by $40 billion or 34 percent.”

Vague had an impressive career in the private sector. He sold a credit card company he founded, First USA., to Banc One for $7.9 billion in 1997. A majority interest in Juniper Financial, founded in 2000, was sold to the Canadian bank, CIBC, in September 2001. Juniper eventually became part of Barclays credit card division.

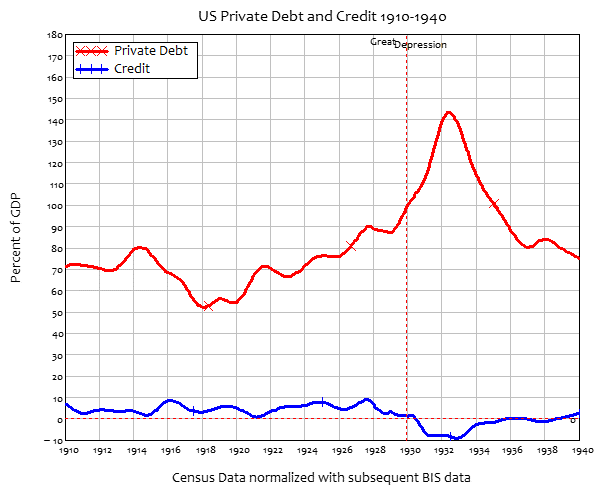

Steve Keen, economist known for predicting the Global Financial Crisis, has written extensively on the relationship of growth in private debt as the cause of crises, including his book “Can We Avoid Another Financial Crisis?”. Keen, who has collaborated with Vague, says that Vague has broken new ground in the understanding of past crises. Here’s Keen’s chart of the 1920s prior to the Great Depression:

Source: Steve Keen

Note how the U.S. private sector debt-to-GDP ratio keeps climbing until 1932, peaking at just under 150 percent, up from 50 percent in 1918. Canada’s private sector debt-GDP ratio sits at 218 percent today, well above the U.S. level in 1932 and Vague’s 150 percent threshold for predicting a crisis.

Vague does not mention Canada or any other country headed for a crisis. He singles out China, suggesting that its unique government structure could delay a crisis indefinitely.

His most important recommendation is to the regulators. He suggests that they monitor growth in private sector debt-GDP as an early warning indicator.

And he urges regulators to monitor the growth in aggregate lending. As he says, “widespread overlending leads to widespread overcapacity that leads to widespread bank (and other lender) failures. That is the essence of most financial crises.”

He could have been talking about Canada.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.