China escalated the trade war by using language in a warning that’s only been used twice previously. The latest threat involves withholding the sale of components known as “rare earth elements”. These metals are used in many applications and China is the largest producer in the world.

“Don’t say that we didn’t warn you” was the phrase that is getting attention worldwide.

Will China act on this latest threat? Will the Chinese use other means to hurt the U.S.?

On Wednesday May 29, 2019 the People’s China Daily, presumably speaking with the consent of China’s top leaders, said:

“We advise the U.S. side not to underestimate the Chinese side’s ability to safeguard its development rights and interests. Don’t say we didn’t warn you!”

That phrase, “Don’t say we didn’t warn you” has special significance in Chinese history and has only been used twice before. Both times China was about to embark on military action, once in India in 1962 and once with Vietnam in 1979.

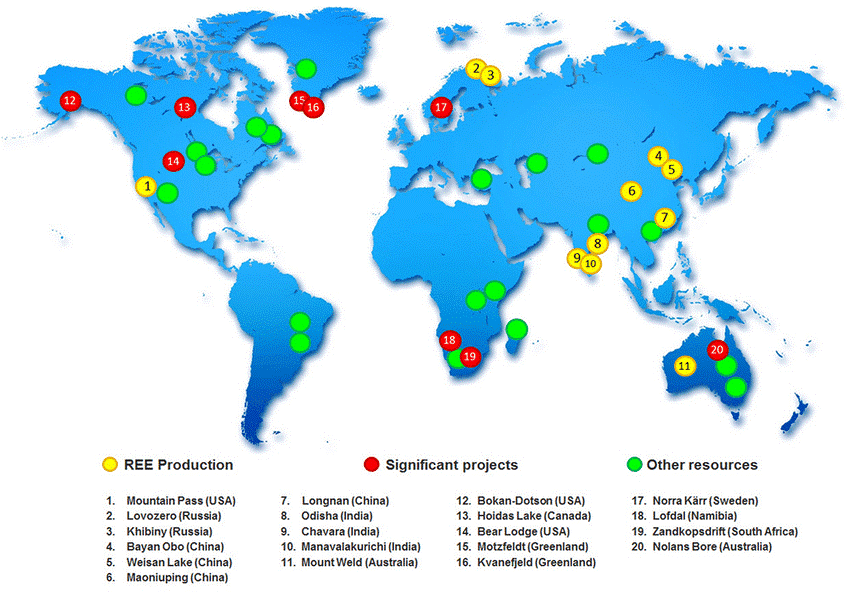

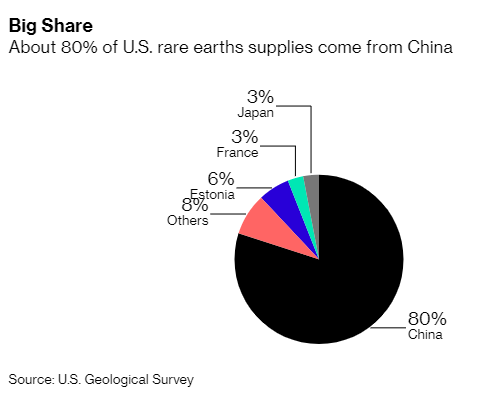

The specific threat this time refers to “rare earth elements”, a group of 17 elements that have many uses in manufacturing and electronics. China accounts for 70 percent of the world’s production of these elements, which despite the name are not particularly rare. Canada for example has significant deposits but most countries, including the U.S., rely on China to supply them. An article at Bloomberg.com “China gears up to weaponize rare earths in trade war” has more information.

Source: Australasian Institute of Mining and Metallurgy

Source: Bloomberg

But curtailment of these rare earth elements is not the only “weapon” that China has available in a trade war with the U.S., and it’s not the most dangerous threat that China could make. Here are some that would cause more worry:

- Target U.S. firms that manufacture in China, such as Apple and the IPhone. China has refrained from using these tactics as it would be very harmful to China, as production would just move to other countries like Vietnam.

- Devalue the China currency, the renminbi. This is a likely option for China, if things get ugly. This would make China’s exports cheaper. But China wants to get its currency accepted more widely in trade transactions and a devaluation would be a setback in reaching that goal.

- Sell US treasuries. This is a tactic that gets mentioned often. The fear is that by selling US government bonds the Chinese would drive interest rates higher, possibly causing a recession. But the logic for China doesn’t work. The buildup of trillions in US treasuries comes from China’s success as an exporter of goods to America and the US dollars received in payment for those goods. China leaves most of that money in US dollars. Selling those holdings would mean converting to another currency. If that money were brought home, the renminbi would surge, hurting China’s exports.

- Stop buying US oil. This move has some attractions for China as costly imports of oil were running at annual growth rates above 20 percent late in 2018. The U.S. has become the world’s largest producer of oil and has started to export significant volumes through deep-water ports in the Gulf of Mexico. If China reduces its purchases of crude oil, the U.S. oil industry would be hit hard.

We don’t know what will happen in the US-China conflict, but Chinese President Xi has been preparing the Chinese people for a long and difficult struggle. Both the U.S. and China have been escalating the conflict in the last few months. In the U.S. there is bi-partisan support for a tough stance against China.

The next event is the G20 meeting in Japan at the end of June, where the leaders could meet and hold talks. The potential for good news is limited but there’s always a chance of a positive surprise.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.