Significant technology-related disruption often seems to appear suddenly. Rapid change can impact people’s lives in ways that can’t be predicted.

Large impact events are small specks on the horizon now but could loom large in a few years. It’s interesting to look at those distant threats and opportunities and guess which will become permanent.

What are the biggest disruptions that are likely to persist?

The announced restructuring of General Motors’ North American manufacturing facilities is a harbinger of change in an industry on the front lines of disruption.

The most immediate change comes from electrification. Conventional automobile manufacturing is complicated due to the complexity of the internal combustion engine. General Motors, Ford Motor Company, Bavarian Motor Works (BMW) and Toyota Motor Corporation all have the word “motor” in their name and the motor is their biggest challenge.

Conversion to electric drive and battery power, which GM’s CEO referenced in her announcement, is disruptive for incumbents. A September 2018 Forbes article states that there are 20 moving parts in the drivetrain of an electric car versus 2,000 parts in an ICE vehicle.

The impact on car dealers could be existential. The new Tesla has two maintenance requirements — every two years it’s suggested to replace the brake fluid and every four years the battery coolant system needs attention. And that’s all, other than rotating the tires and topping up the windshield washer fluid. This is a nightmare for car dealers as more than 80% of their profit comes from maintenance tasks related to the engine. One report claims that dealers could be out of business in a decade!

“The average cost of maintenance and repair on a gas-powered car is just over $1,000 per year, or seven cents per kilometre.”

In the U.S. more than 300 million vehicles need to be maintained so that’s $300 billion annual revenue at risk.

Autonomous, driver-less cars have potential to disrupt, when they arrive. For most North Americans their personal automobiles are parked (stored) at considerable expense for more than 20 hours per day. With advanced technology the auto utilization rate could change dramatically. Two-car families could own one car. Ride-sharing could reduce the need for personal cars. Parking lot space could be released for better uses.

Here’s downtown Houston showing generous land allocation for storing cars:

Source: The Guardian and Alamy

More electric vehicles will lead to lower fuel usage. Of 18 million barrels of crude consumed daily in the U.S., about ½ is used in cars and light trucks. If only 1/3 of the fleet goes electric, fuel demand would decline by 3 million barrels per day, leading, perhaps, to an oil surplus. If highway trucks go electric, as Tesla is promoting, the impact could be even greater.

Source: Tesla, Inc.

The switch to online shopping is gaining momentum during the 2018 holiday sales season. Global online sales average about 8.8% of total sales in 2018, with China one of the highest online users at 16.6%, while the U.S. and Canada are just average. Forecasters say that global online sales will double to $4.5 trillion by 2021.

It’s interesting to imagine the full impact on the amount of land needed for shopping malls. Space will be freed up for new purposes, such as conversion to residential housing.

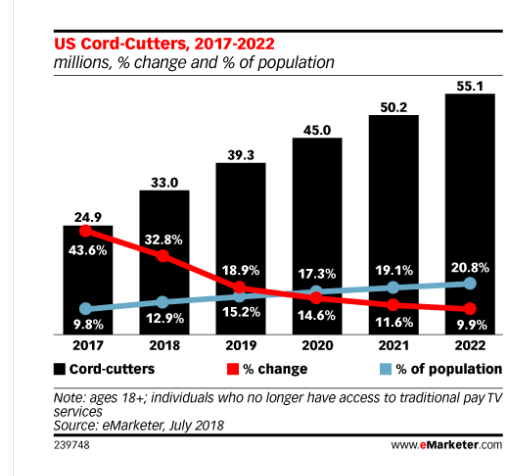

New ways to access to entertainment are disrupting the pay television industry. Cable television “cord cutting” is gaining momentum while online streaming services are exploding in popularity. According to one report there will be 33% more people dropping pay TV services this year than last.

Source: eMarketer.com

Movies are available through the internet from services like Netflix. Many millennials watch their favorite movies and shows only on their smartphones.

Investment valuations reflect these new realities. Shares of Tesla, Netflix and Amazon continue to trade at very expensive levels, reflecting investors’ belief that these trends will endure.

More cautious investors are waiting for lower share prices to establish a position in these leaders of disruption.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.