Longevity is an interesting concept for investors. In its simplest form longevity is undoubtedly seen as a good thing because it means more time spent enjoying life or time with loved ones. With significant gains in longevity over recent decades it is time to examine whether some of the traditionally held beliefs about our relationship with aging have shifted and whether investors are properly accounting for the risk of outliving their assets.

For investors, the longevity discussion highlights an important risk that is spoken about much less often than other investing risks such as stock market risk, interest rate risk and credit risk. Longevity risk refers to the risk that an investor may outlive their assets. Because most people view living longer as a good thing the true risk is then, that they do not save enough to fund their projected lifespan.

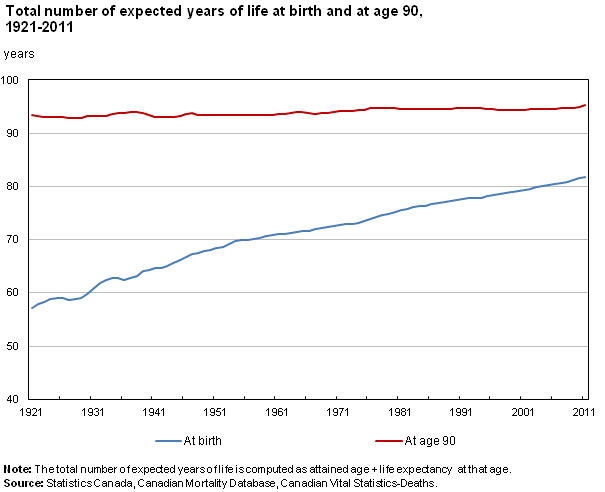

Statscan regularly publishes life expectancy numbers which show steady increases in life expectancy for both men and women. The following chart from a Statscan article published in 2014, Ninety years of change in life expectancy, shows life expectancy at birth and at age 65 for both genders combined.

Of note is the fact that as of 2011 Canadians lived an average of 81.7 years an increase of 24.6 years since 1921. Statscan points out that almost half of the gains from 1921 – 1951 come from reduced infant mortality and most of the increases since 1951 are due to reduced deaths from circulatory diseases.

The most recent numbers from Statscan (2014-2016), based on total life expectancy, are:

Life expectancy At Males Females Both

Birth 79.9 84 82

65 84.3 87.1 85.8

Canadians in general are living longer. This has important investment implications for savers and for the entire Canadian pension system. Ontario Teachers’ Pension Plan (OTPP), one of Canada’s largest public pension plans, has been pointing out for years the challenges that face the pension system today. Plan members are starting careers later, contributing for less years, and living longer. Combining these trends with historically low interest rates and it looks like a perfect storm for pension providers. OTPP publishes the following table of “Funding variables – Past and Present”:

Source: OTPP 2017 Annual report

They report the number of pensioners aged 100 or more as well as the ratio of active teachers to pensioners, both of which indicate the challenges of the current environment. Although Individual savers have more direct control over some of these variables, they can take some knowledge away from the challenges that OTPP faces. When planning, allowing for longer life spans and potentially shorter working lives may yield some combination of higher saving goals or lower projected retirement income.

Other research by the C.D. Howe Institute examines whether earnings has an impact on longevity (Published August 2018, Rich Man. Poor Man: The Policy Implications of Canadians Living Longer). The paper uses CPP data to categorize Canadians into earnings buckets and then analyzes the longevity effects across various birth cohorts. The findings show clearly that high income earners have experienced greater longevity gains than low income earners but interestingly, in Canada, the gap between high earners and low earners is not getting wider over time:

“…the highest male earners outliving the lowest earners by 8 years. For women, the earnings gradient is flatter than for men. Importantly, we find that the gap in life expectancy between high and low earners has not grown over time – improvements in longevity are evident across all earnings levels. This result is in sharp contrast with evidence from the United States.”

The C.D. Howe report didn’t specify the root causes for the longevity-income gap but did point to healthcare access, government transfer income, and health behaviour (diet, smoking, exercise) as likely factors. OTPP has previously also tied education to increased longevity.

This research carries implications for the pension system, both private and public, which can incorporate income level into longetivty projections which may in turn affect the funded status of plans. Insurance companies may also incorporate this information into pricing annuities or insurance contracts (of which longevity is a primary determinant of cost). These lessons can also be useful to individual investors who face a similar challenge to pension plans in that they are saving current assets to fund future spending. The research tells us that those with higher incomes should plan on living longer.

Jonathan MacLeod

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.