Emerging markets equities have underperformed global markets in 2018 and over the last decade. Especially compared to U.S. markets, emerging markets look relatively attractive on a valuation basis.

Emerging markets are going to outperform developed markets like the U.S. at some point.

Is it time to dip a toe into the murky waters of emerging market equities?

The U.S. stock market continues to outperform and represents more than 50% of the value of all listed stock market companies on the planet. But the U.S. population is only about 5% of the world total and U.S. GDP is about 20% of world economic activity.

Relative to emerging markets, U.S. companies are more expensive than emerging market equities. This is probably because investors feel that U.S. markets are safer than other markets and due to a desire to hold U.S. dollars.

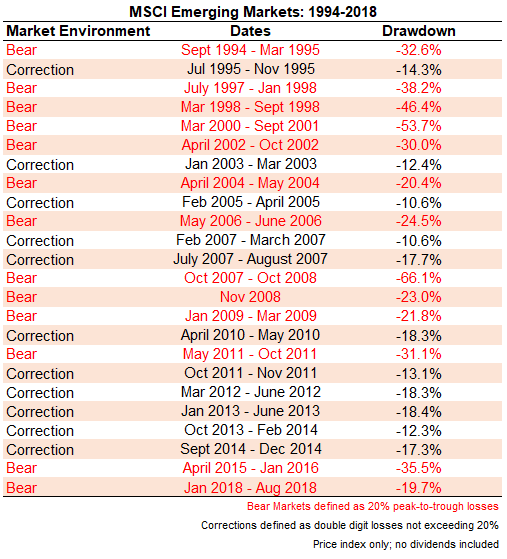

So, if it can be shown that an unusually high level of fear has depressed emerging markets to an extreme, it could be a good time to invest in emerging markets.

However, in times of crisis, most investors run for cover by returning to their home base. They also look for safety in U.S. dollar markets. A crisis can trigger a massive sell-off in emerging market equities as in the Asian crisis of 1997 when the Thailand baht collapsed overnight. Foreign debts were too large for many Asian countries when foreign investors tried to remove their investments. Emerging market countries learned a lesson from that crisis and now maintain much higher reserves to prevent such a panic.

Sources: MSCI via Ben Carlson

Fund manager Blackrock offers an ETF called iShares MSCI Emerging Markets ETF (symbol EEM) that holds a basket of many companies and countries. The price of this ETF (US dollars) is used as an indicator of emerging markets, and is trading this week at $43, less than double the low in 2009 of about $25.

The top four holdings in EEM are Tencent, Alibaba, Samsung and Taiwan Semiconductor. Of the ten largest, China-based companies hold six spots.

EEM is trading at relatively inexpensive valuations today, probably due to uncertainty over global trade.

When uncertainty over global trade increases, emerging markets are among the first to get hit. The largest emerging markets are dependent on exports. Trade represents about 10% of U.S. economic activity while China’s trade is 37% of GDP.

China, Korea and Taiwan make up more than 55% of the EEM fund. The standard deviation of returns (a measure of volatility) on EEM is 16% while the S&P 500 is 10%. The ten-year average annual return of the S&P 500 is above 5% while the EEM is a paltry 1.58%.

The price-to-earnings ratio of EEM is about 12.67 compared to 23.66 for the S&P 500.

Emerging markets are much cheaper than U.S. markets but is it a good time to buy?

Trade war anxieties are the most important factor for the short term in deciding to buy emerging markets. The trade war is driven by U.S. actions and a U.S. President who believes that winning trade wars is easy. But, if the U.S. abandons its trade war efforts at some point, we might look back on this as a wonderful time to buy.

But what about the timing of the next recession? The time since the last recession is very long and the consensus is that the U.S. economy will endure a recession in 2019 or 2020. Recessions and bear markets often go together.

How would emerging markets perform in the next bear market? It would be normal for emerging markets to do worse than U.S. markets, but the wide valuation gap in favour of emerging markets could make for an exception.

Given the superior growth outlook for emerging market countries and the much cheaper valuations it might be worth buying now. Or, for those who want to time it perfectly, waiting for the next bear market could pay off.

Since market timing is so difficult it could be sensible to dip a toe into the emerging markets now with the plan of adding exposure when the markets correct.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.