Elon Musk, CEO of Tesla, Inc., is causing trouble for the myriad of speculators who are betting against Tesla.

By announcing that he is thinking about buying all publicly traded shares at $420 per share, he sent a chill down the spines of many short sellers.

If Tesla goes private at $420, what would it mean for traders who have sold short?

Here’s the tweet issued on Tuesday, August 7 that caused all the fuss:

Source: Twitter, @elonmusk

What Musk means by the phrase “taking Tesla private” is offering to buy all the shares that are trading publicly on the stock market and delisting the shares. This has never happened before with a company as large and valuable as Tesla, although it does happen when private equity investors buy smaller companies. Going private makes life difficult for traders who have “shorted” the stock as they need to borrow shares from the listed stock market.

“Short selling is a long-established practice for professional traders in the stock market. But short selling is still not widely understood. Even most professional money managers avoid it. When traders sell short, they borrow shares from the market (through a broker) for an indefinite period with the promise to replace them at some future time or when the brokerage firm demands them back. If the stock falls, the trader buys back the shorted stock at a lower price and makes a profit. If the share price rises, the short seller could lose money if forced to repurchase the shares at a higher price.”

From “When the Bubble Bursts: Surviving the Canadian Real Estate Crash” Page 240, Second Edition, June 2018

In the book I describe one of my most exciting and stressful experiences as a short seller. I would never sell a company like Tesla short, but I have seen many companies worth shorting in more than four decades of investing.

Short sellers are vulnerable to a sudden surge in the price of shares they are “short”. The mechanics of short selling expose the short seller to the necessity of replacing shares that have been sold, sometimes at a moment’s notice and during a time of higher share prices. Replacing the shares by a purchase on the open market is known as “covering the short”.

The risk of share prices rising is especially acute for the short sellers when there’s a takeover bid for a company. Since Tesla is the most shorted company, with an unprecedented $14 billion of value of shares sold short, this announcement by Elon Musk affected many speculators negatively.

The borrowing of shares from a broker is subject to the risk of the broker not being able to find a willing lender of the shares. If no shares can be borrowed the broker issues a “buy-in” notice, requiring the short seller to either deliver the shares that have been sold short or to purchase shares on the open market to replace the shares that are short. In a rising market after an announcement like this a “buy-in” can be very expensive. The broker makes every effort to “locate” stock to borrow, but since the potential lenders of the stock would like to see the stock price go higher they can decide to withdraw their stock from the lending market and watch the short sellers squirm. This is known as a “short squeeze”.

In this case, short sellers could be squeezed all the way to $420.

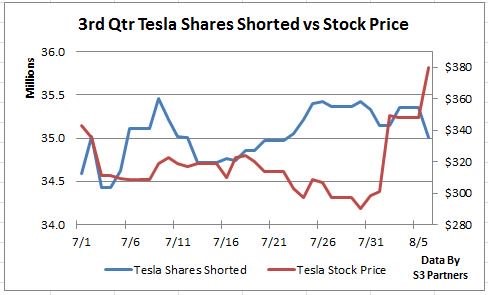

A “short-covering rally” occurs when short sellers are pushed into buying back shares by their brokers. Tesla’s stock market action in the last week looks like short covering:

Source: S3 Partners

The lesson is that we don’t want to be a short seller of shares unless we are convinced that the company is in trouble and we are prepared psychologically and financially to live with a “short squeeze”.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.