The Bank of Canada (the Bank) raised its overnight interest rate to 1.5 percent this week, as expected.

And there was a strong hint from the Bank that there are more increases on the way, with another one or two likely before the end of 2018.

Did the Bank’s policy until now promote a dangerous housing bubble? How did the Bank meet its inflation target during this bubble?

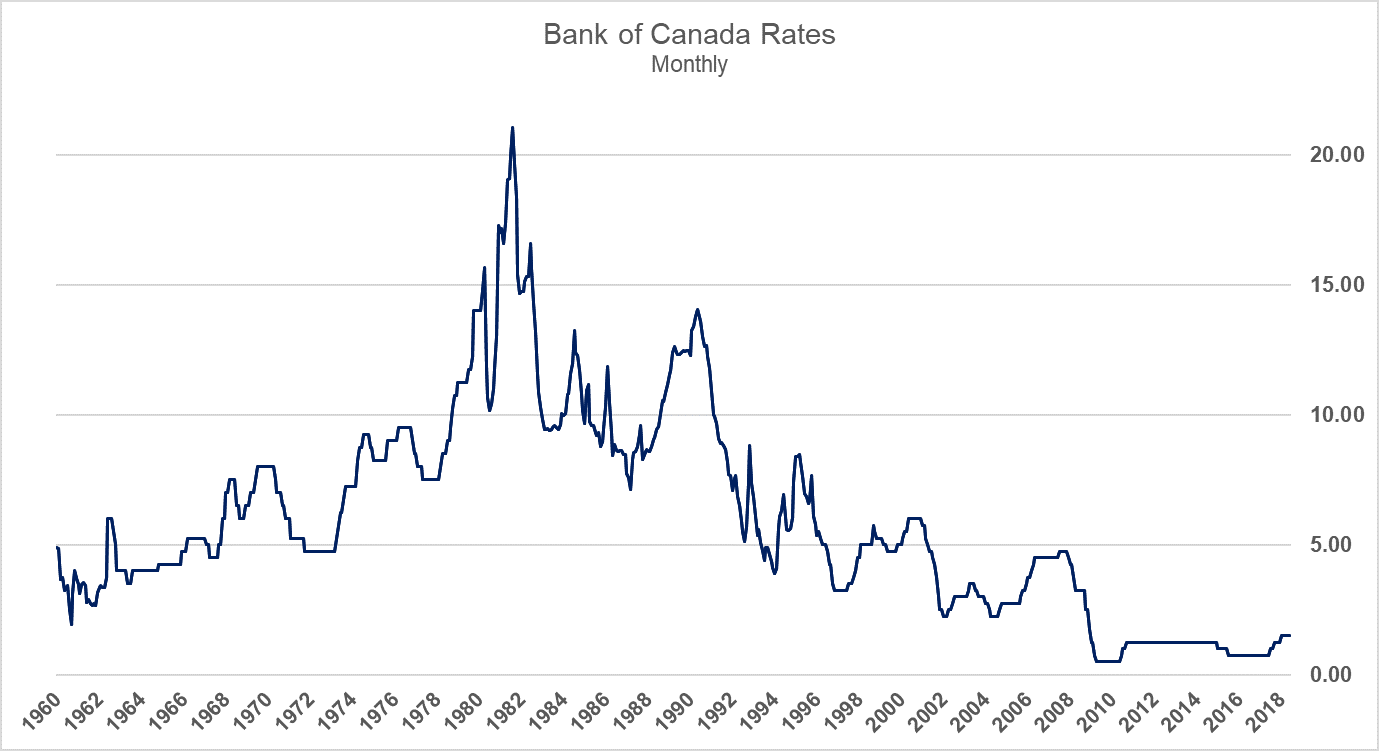

The latest increase brings the target rate to 1.5 percent, up from close to zero during the period from 2009 to 2017. Here’s the record, back to the 60s:

Source: OECD via St. Louis Fed, FRED

The Bank might have made a colossal (and costly) blunder by keeping rates low for the period when house prices were growing at 7 percent per annum, pricing most young couples completely out of the housing market, unless they borrowed enormous amounts of mortgage money and secured help with the down payment from the “Bank of Mom and Dad”.

While both debt and house prices grew exponentially, inflation only briefly went above 2 percent. How is that possible, given that the house purchase is the largest financial event in the lives of most Canadians?

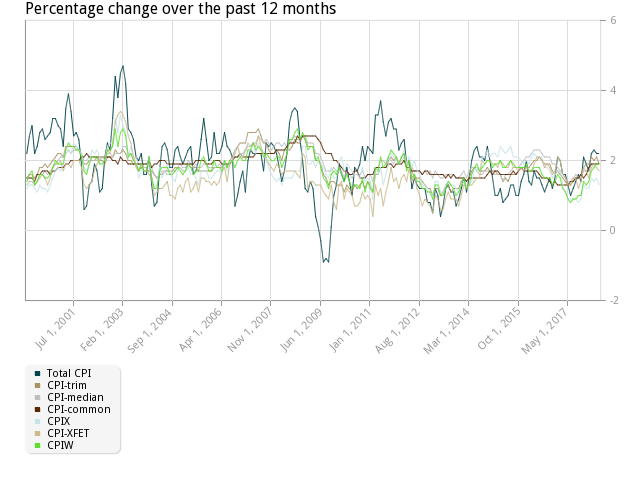

Here’s the record of inflation since 2000:

Source: Bank of Canada

The Bank has three measures of inflation — “trim”, “median” and “common”. But none of these includes a direct measure of the cost of purchasing a home. So, no indicator of inflation currently in use in Canada is useful for preventing or even measuring the extent of housing bubbles.

Statistics Canada is responsible for measuring inflation and includes the cost of shelter in the CPI, but the methodology is convoluted and flawed. Suffice to say that the cost of shelter is the largest component in the CPI at 30% weighting.

House prices grew by 7 percent annually during the 16 years since 2002, which means that a $200,000 house is now $610,000.

But the cost of shelter in the CPI rose at only about 2% annually or 37% on a cumulative basis. This gave the Bank lots of leeway to keep rates low, even when Vancouver and Toronto prices grew even faster than 7 percent.

If you want to read about a more realistic indicator of inflation, go to the C.D. Howe Institute.

From that report:

“There are many reasons why the growth in measured inflation has been relatively subdued in Canada, but one that has been mostly overlooked is the fact that the CPI is not very sensitive to housing prices.”

That’s a very drastic understatement, to be sure.

The Bank’s reliance on this inadequate measure of inflation allowed housing bubbles to grow for longer than was prudent. As the C.D. Howe authors state:

“The main concern is that the CPI’s insensitivity to housing could potentially cause the central bank – reassured by its imperfect indicators that inflation is under control – to keep rates too low for too long.”

The policy wasn’t a mistake.

As Governor Poloz said, in July 2014 speaking to the CBC:

He was talking about the Bank’s policy actions (low rates and relaxed monetary policy) and said that these actions were “a deliberate policy” to promote housing as an engine of recovery following the (2009) crisis.

And now that the Bank must raise rates, those young Canadians — and their parents — will have to live with the fallout from the higher cost of servicing their massive piles of accumulated debt. Undoubtedly some families will be devastated financially.

Perhaps Canadians, and the Bank, will learn from these mistakes, if they agree that mistakes were made. Let’s hope that future policy makers decide to endure the pain of recessions rather than promote a housing bubble and debt bubble to artificially pump up the economy.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.