The number of people in the Millennial generation is greater than those who are labeled as Baby Boomers.

This demographic shift will have profound implications for many facets of society, such as housing, elections and employment. The younger generation is more different than most people realize, making it inevitable that there will be some unforeseen effects.

What will be the most interesting trends triggered by the rising importance of the Millennial generation?

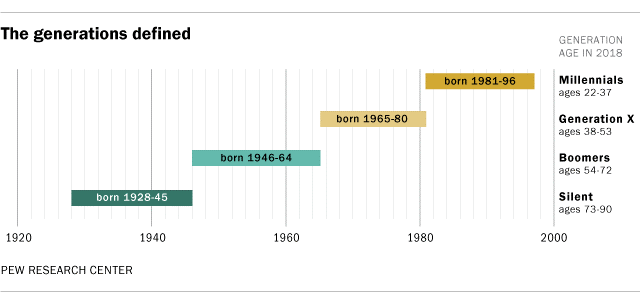

Millennials were born starting in 1981 and ending in 1996, according to Pew Research.

Source: Pew Research Centre

Millennials in the US numbered about 83 million in 2015, compared to 75 million Baby Boomers. From now on, due to more deaths in the Boomer cohort, Millennials will grow in importance while the Boomer generation fades, slowly, into the sunset.

The number of Millennials in the labour force is already well ahead of Baby Boomers, at 35% of all who are working or looking for work.

As changes like these happen society will feel the impact, although the changes might not be noticed right away. But eventually there will be surprises due to this demographic shift.

Will car sales drop as millennials avoid the odd quirk of car ownership where an expensive piece of machinery sits depreciating and unused for more than 20 hours per day? Uber and Lyft and new ride-sharing options, perhaps even driverless, will take over if Millennials adopt these new trends wholeheartedly.

Will homeownership be embraced by Millennials once affordability is restored? Right now, more than 70% of Boomers own homes and apartments they occupy while in the Millennial generation the proportion of homeowners is much lower.

According the US Census data in 2014 only 27% of Millennials were married compared to 36% of Gen-Xers, and 48% of Baby Boomers when they were at a similar stage in life.

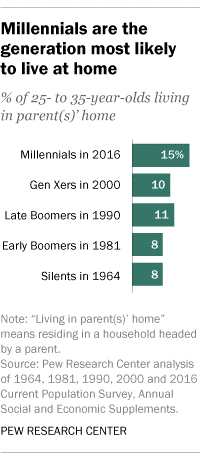

The latest numbers show that many Millennials are still living with their parents.

Source: Pew Research Centre

Real estate industry promoters in the US quote the high number still living with parents to argue there is pent-up demand for housing. On the other hand, some Canadian Millennials own real estate already, perhaps beyond what they can afford, due to help from the Bank of Mom and Dad. The next recession and the housing crash will test these Millennial homeowners as they struggle to decide what to do with expensive housing where mortgages may be larger than the value of the property. Will the parents of Millennials rescue their offspring from financial hardship due to mortgage debt? I suspect most of them will as, in many cases, the parents were involved in the initial purchase decision and helped with down payments.

The good news for those still living at home is that housing affordability is improving in Canada as prices have started to trend lower. But the price correction, so far, is in the higher-priced, single-family home segment only. Prices will have to fall much further to make housing affordable for first-time buyers who are still laden with student loans and earning, on average, less than previous generations at the same stage in life.

I’ve learned many things from talking to dozens of Millennials in the three years since the 1st edition of “When the Bubble Bursts” came out. For example, most Millennials have a strong belief that house prices can only go up, never down. And they have little or no fear of being heavily indebted.

These two attitudes will be tested as house prices start falling, and interest rates are rising. It will take time to sink in, but Millennials (and everyone else) will have to adapt to a different economic world. How Millennials react to this new reality will be fascinating to watch and will affect us all.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.