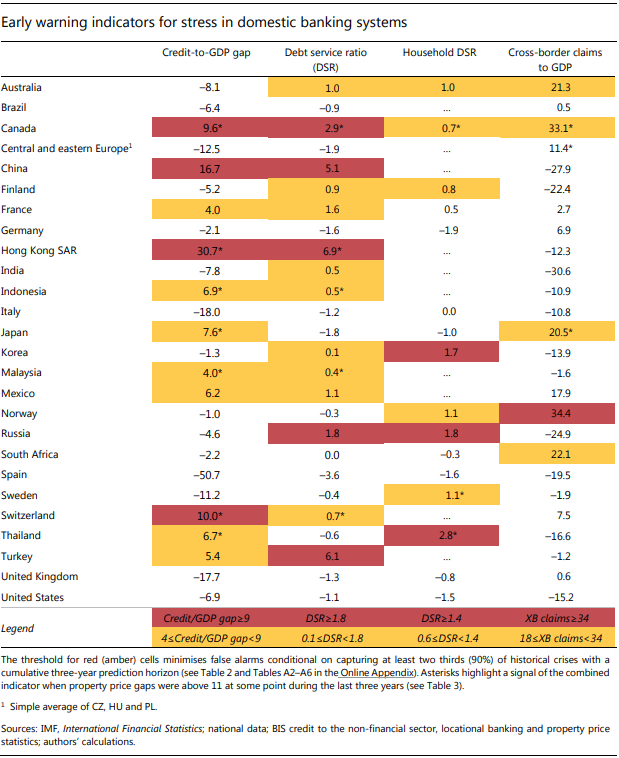

The Bank for International Settlements (BIS) singled out Canada in its latest quarterly (March 2018) report. Canada’s economic and financial data breached four categories of Early Warning Indicators for systemic banking crises, earning two red flags and two yellows.

This organization, called the central bank of central banks, does research on banking crises and has identified factors that show up prior to serious problems in the banking systems of a country.

Is it dangerous to ignore the BIS warning?

Canada was the only country covered to breach the EWI threshold in four categories.

Source: Bank for International Settlements

The BIS has done research several EWIs to determine if there are reliable signs that show up prior to a banking crisis. They have data going back to 1980 for the Credit-to-GDP gap, while in other categories such as Debt Service Ratio the data are available back to mid-1990s.

Researchers at the BIS found that combining the indicators of household debt and other factors with property prices improved the quality of the EWIs. The asterisk beside each of the four values beside Canada in the table indicate that the property price gap threshold was breached within the three years prior to the breach of any of the warning indicators.

My weekend note, “Canada gets another warning” covering the BIS March 2017 quarterly review, shows that the property price gap threshold was breached then.

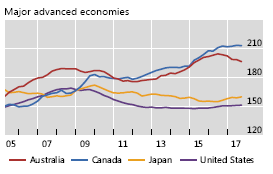

More recently Canada’s vulnerabilities have been increasing due to the rapid increase in liabilities in the private sector, that include all non-financial sector credit. This means both households and corporations have been borrowing more, going deeper into debt. It’s interesting to note that Australia has been reducing the amount of private sector debt as a percent of GDP while Canada’s continues to increase, albeit at a slower pace.

Source: Bank for International Settlements

Page A23 of the March 2018 quarterly BIS report.

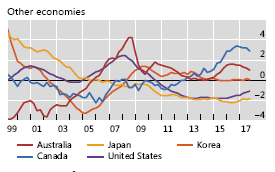

Another category in the 2018 quarterly report that flashed a warning signal is the Debt Service Ratio (DSR). DSRs measure interest payments and mortgage amortizations relative to income. As debt increases the ability to service that debt deteriorates unless income rises faster than debt.

According to BIS the total DSR has the best predictive ability closer to a crisis, while the property price gap tends to become less predictive closer to a crisis. In other words, the property price indicator is early while the DSR is triggering a warning just prior to the crisis. From page A29 of the March 2018 report:

Source: Bank for International Settlements

This indicator is the deviation from “country-specific mean” which means Canada is compared to Canada in the past. Here’s what the BIS says about this indicator:

“The DSR reflects the share of income used to service debt and has been found to provide important information about financial-real interactions. For one, the DSR is a reliable early warning indicator for systemic banking crises. Furthermore, a high DSR has a strong negative impact on consumption and investment.”

As interest rates are likely to continue to rise for the foreseeable future, the debt service ratio can only get worse. The BIS uses the average interest rate on debt to estimate the ability to service that debt.

It’s interesting to see reaction from Canadian economists to this warning from a reputable international regulatory body. Here’s one example from last week:

In a Globe and Mail article on March 19, 2018 Avery Shenfeld, a Canadian economist working for CIBC disputed the report.

Among other things he took issue with the BIS methodology, saying that interest rates are “miles below their longer-term levels”. He continued with “mortgage arrears rates in Canada continue to dive”.

Canadians who are worried about their debt are advised to value the opinion of the BIS over economists who follow the long-standing tradition of brushing off warnings with the attitude — ‘it can’t happen here, we’re special”.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.