Year end 2020 market update / January 2021

The unprecedented year pivots to the healing economy

Source: Yahoo Finance

As said by the Financial Times, 2020 will stand out in history as “The Year that the Coronavirus almost broke the Market.”

We entered 2020 with a high degree of uncertainty for the future of the equity markets: stock valuations were trading near all-time highs, while corporate earnings and economic growth was slowing. Interest rates had already been pushed down to historic lows by central banks. The Federal Reserve was preparing to let bonds roll off to shrink its balance sheet and slowly end its extraordinary support of financial markets. Political uncertainty was clearly a risk factor, with the US elections taking place in November. Still, markets climbed to reach multi-year highs in early February, driven mainly by mega-cap technology stocks.

A creeping concern about a mysterious pneumonia that was circulating in China in December only triggered a market reaction in February. When Chinese markets re-opened after the lunar new year in early February, at the same time the relatively then unknown city of Wuhan was locked down to contain the virus, selling in China began in earnest. It was when the illness leapt to Italy and Western Europe that North American markets took real notice. On February 24, Italy isolated and quarantined several towns. When Donald Trump banned flights from Europe on March 12, markets became truly spooked and had the single worst day since the infamous Black Monday crash of 1987. Governments broadly started taking the shocking steps of closing borders, and simultaneously locked down individual freedom of movement, association, and the ability to work for many. Oil hit its lowest price in 17 years on March 18, then futures prices actually went negative. For a brief period, speculators were paying buyers to take oil off their hands. The first injections of Fed liquidity did nothing to allay fear. Panic ensued.

In March, two very different types of paper were in short supply:

Source: Financial Times

While equity and bond markets crashed, consumers globally lined up to clear out grocery store shelves and hoarded hand sanitizer, cleaning supplies, flour, rice, and of course, toilet paper. Market selling gained momentum so quickly that even ultra-liquid US government bonds struggled to be priced. A major Depression seemed imminent, but on March 23 central banks stepped up. The Federal Reserve pledged to buy government bonds in unlimited amounts and would buy corporate debt, including junk bonds, which was not done even at the depths of the Financial Crisis. The Eurozone pledged to buy 750 billion euros in government debt with “no limits” to supporting the Eurozone. From then on, the market had the support it needed to get a rally started. With a few minor setbacks, many markets ended the year near or at all-time highs.

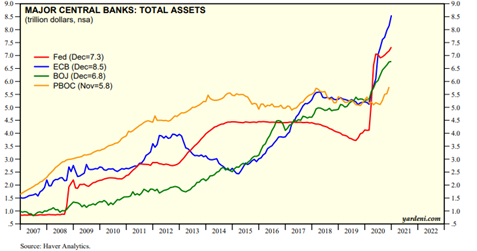

The chart below represents how much buying of assets Central Banks did in 2020, magnitudes more than was spent to limit the damage from the Financial Crisis. Interestingly, since China was able to contain the virus quickly, they were able to rely far less on monetary policy than the West, to bridge the economic gap created by lockdowns.

Source: Yardeni Research inc.

We enter 2021 with cautious optimism for the year ahead:

- We are in the early stages of economic recovery mode, which is generally bullish for equities.

- A small number of approved vaccines are beginning their deployment, and several others are expected to be approved in the months ahead. This is key to getting back to work, travel, social gathering, and the spending that goes along with those activities.

- The US election is behind us, and we can look forward to stability of governance and policy under Biden.

- We know that governments and central banks remain committed to supporting the economy by flooding main street and financial markets with cash. The $900 billion stimulus package approved in December, was characterized as just a “down payment” on support that Biden is planning for 2021. Another US $2 Trillion or more is expected in the US.

- We have excess capacity in the economy:

- Many sectors reduced capex and budgets in 2020 owing to high uncertainty around demand. Preserving balance sheets was a focus. With the introduction of a vaccine, optimism is increasing among house builders, manufacturing, mining and metals extraction, and energy producers. Leading indices such as Global Purchasing Manager Indices indicate many companies are planning for growth this year. The JP Morgan Global PMI is as 54 at year end, up from 39.6 in April. Values above 50 indicate expansion of economic activity in manufacturing. (Manulife)

- Employment labour is plentiful, and capacity can be added with little upward pressure on wages.

- A weaker US dollar benefits large US companies that operate internationally and is a boost to emerging markets.

Trends for now and years ahead:

Technology:

- Technology requires caution today as some companies may not show enough growth this year over last to justify exuberant valuations. We have our watch list for opportunistic buying on hand. However, technological disruption and improved efficiencies will continue to provide investable themes. The shifts to online purchasing, small businesses moving online, office work, the Internet of Things (connected cars, appliances, watches, etc.), internet security, will remain core parts of our daily lives. Intel, Apple, Microsoft, Google, Visa or Mastercard, are some examples that are in portfolios either directly or large shares of our core global funds. Corporations will continue to increase their rate of capex in technological innovation to remain competitive.

Healthcare Innovation:

- Testing and diagnostics; innovations in treatments for conditions that are growing with ageing demographics, such as diabetes; will continue. Becton Dickinson, Novo-Nordisk, Pfizer, Johnson and Johnson are examples.

“Green Wave”:

- There will be continued broad government support and financing of this space, as well as investor demand. Some segments are clearly in bubble territory today. However, Solar and Wind power, Electric Vehicles, battery technology and energy storage are growth sectors. Hydrogen is being explored for its potential for clean energy.

Back to Work and a growing economy in 2021:

Telecommunication

- As we go back to work, several wireless providers will benefit from the year over year uptick in business revenue and roaming services. Dividends are attractive.

- 5G technology rollout means that consumers will spend even more on data and speed; they will also be investing in new cell phones to benefit from the upgraded networks. Apple plans to make 30% more iPhones in the first half of 2021 (96 million units, Reuters). Verizon, Telus, Rogers, could benefit.

Industrials

- These are beneficiaries of the Biden Infrastructure agenda and the “Back to Work” theses. Railroads, trucking, aerospace, air transport, heavy equipment, building materials are included. This sector started to surge following announcement of vaccines in November, and parts will continue to rally with Biden infrastructure spending and stimulus expected.

Energy

- Even after a year-end rally, energy stocks are still down on average 25% from last year, and many former darlings in the Calgary oil patch down 80-90% from 2014 peaks. ARC Resources by example, traded at $32 in 2014; after the year-end rally in energy shares closed out 2020 trading at $6.10. Energy has become one of the highest dividend paying sectors, with many high-quality companies yielding 5% and higher, like Canadian Natural, Enbridge and TransCanada. There could be opportunity in this sector as the world goes back to growth and investment following the pandemic. Energy companies are more efficient, balance sheet and cash flow conscious in their operations than 5 years ago. We note that Natural Gas demand and prices quietly firmed up year over year, up 16% from 2019 to $2.50/ mcf.

Financials

- The economy is on the mend, consumer and corporate debt defaults do not appear to be as bad as initially feared. Banks have been reducing the provisions put aside for bad loans last spring. Currently, the Canadian government is preventing share buybacks and dividend increases, but that should come later in 2021. Long term interest rates have moved up, which benefits banking and life insurers. Mortgage demand is growing.

Consumer Cyclical

- Gaming, hotels, leisure travel, restaurants, autos, luxury/work apparel. More stimulus and getting back to work in person are tailwinds to come.

Basic materials:

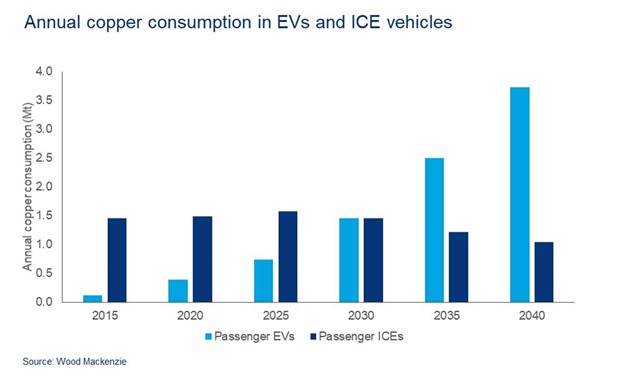

- Metals and mining are beneficiaries of growing global growth and, paradoxically, the pivot to green energy. The housing boom in the US, Emerging Markets’ growing demand; and the Green Energy movement are driving demand in metals. An electric vehicle can use up to a mile of copper wiring and uses up to 4 times more copper than a traditional internal combustion engine, 80 kilos versus 22 kilos. (Wood Mackenzie, Powering Up the Electric Vehicle, 2019).

The risks:

There are risks to the trajectory of markets from here. As in January 2020, we begin 2021 with elevated stock prices, particularly among the darling technology companies that benefitted most from working-from-home trends (Zoom and DoorDash could be examples). The market may be pricing in too much optimism on a smooth and quick return to “normal.” Bumps in the road back to normal would likely trigger profit taking with such big rally over the last 8 months.

There is a growing disconnect between Main Street and Wall Street/Bay Street. Those who could do their work from a computer at their kitchen table, or had financial assets, generally saw their fortune stabilize and grow over the last year. The injection of liquidity into markets by central banks benefitted financial assets the most, including housing, but did not reach small and medium sized business owners to the same extent. Large public companies, or those about to go public (as 2020 was one of the hottest IPO markets in near history) benefitted from access to cheap capital more than small and medium sized enterprises. For many, 2020 represented increasing inequality and economic scarring. The large part of the population that work in services: retail shops, hair salons, gym owners, neighborhood restaurants, hotels, air travel, have closed shop or are struggling. Disenfranchisement, political polarization, and populism are rising, as evidenced most recently by the riots staged on the Capitol in Washington. The same tension holds true for economic regions; there will be wide disparity in economic growth this year and beyond between China and the weakest G7 economies.

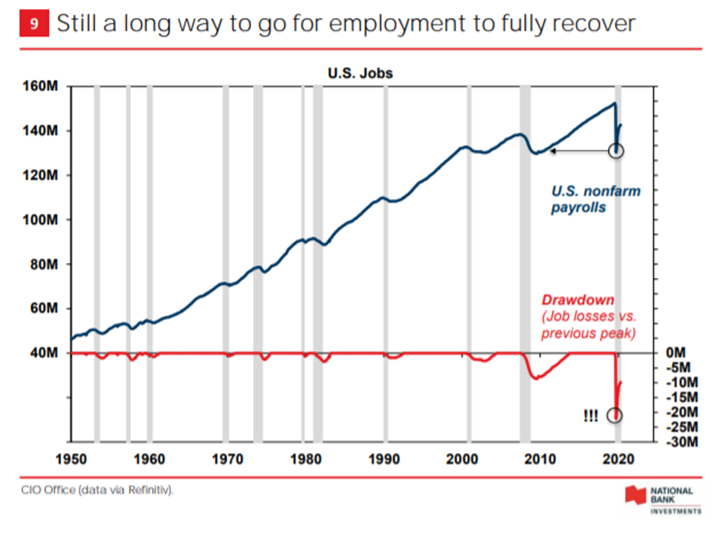

10 years of labour gains lost. This will take time to recover:

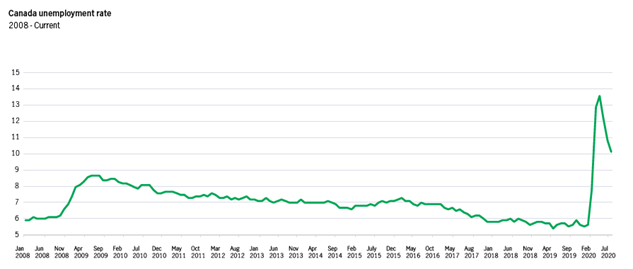

Canada’s unemployment is still much higher then at the depth of the financial crisis:

Source: Manulife Investment Management

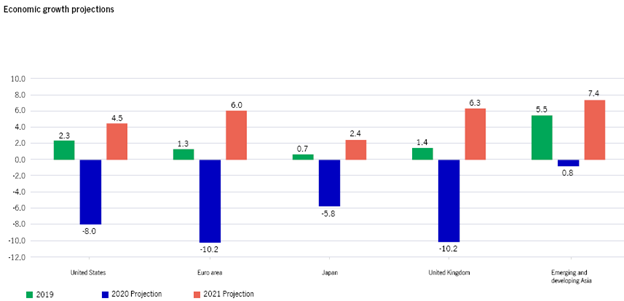

Asia did not slow as much as the West, as China, Taiwan and South Korea quickly contained the virus:

Source: Manulife investment Management, IMF

There is a risk the stock market is prematurely forecasting a return to normal. The markets are forecasting that a vaccine is a silver bullet that will solve all the havoc wreaked by COVID. However, continued lock-down cycles could structurally depress the economy. Daily cases and deaths are still generally rising globally, new variants are emerging. The rollout of vaccines could take longer than hoped. Corporate earnings growth must keep pace with built-up expectations in share prices to prevent a pull back in the market.

Geopolitical risk between US and China, trade tariffs, protectionism, and retraction of the global supply chain could lead to disruption. Tech companies are also at risk of political attacks for anti-competitive and anti-trust behaviour.

Inflation and higher interest rates: if either impact the fragile economy too soon, this could mean a step back for markets. Bonds are especially vulnerable.

Managing the risk:

Traditionally, investors hold cash and high-quality bonds to offset equity market risk. However, with the repression of interest rates, these instruments offer low to negative real rates of return after taxes and inflation. To manage risks, we continue to advocate reducing traditional bond exposure and instead allocate to alternative bond and equity strategies, and real assets like gold. These are assets that are generally not correlated with traditional equity and bond markets, and so can provide a source of return when traditional markets are weak or volatile. We have a meaningful portion of portfolios allocated to strategies that help investors cushion volatility and can continue to find income in a zero -interest rate world.

Income: we are adding alternative income sources to traditional bonds, relying on tested managers, for exposure to private lending to mid-sized Canadian corporations (Bridging Finance); mortgage, commercial and agency-backed debt (PIMCO), and specialists in high-yield and special situation credit.

For equities, we have added arbitrage strategies that specialize in merger and acquisition and IPO arbitrage. Our favoured managers in this space still see ample opportunity in the year ahead. We also continue to expand our exposure outside the US to capture developed markets that are trading at lower valuations and have exposure to cyclical industries that could benefit from government sponsored infrastructure and “green wave” spending.

We thank you for your continued support and trust. We look forward to connecting in the new year.

Tricia Leadbeater

Director, Wealth Management, Portfolio Manager, Investment Advisor

Mackie Wealth Group

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson Wealth Limited, Member Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.