2017 Market Review and Year Ahead

All around, 2017 was a stellar year for nearly all investment classes, with almost no setbacks or volatility to speak of. From technology stocks to global real estate to certain commodities like cobalt and lithium (for electric cars) to speculation on cryptocurrencies and marijuana stocks, this was a strong year for risk assets.

Natural Gas would be the big exception to the playbook, with the price of gas down 18% this year, and many producing companies down far more than that, like blue-chip Arc Resources, down 36% in 2017. XEG, the index fund that tracks the Canadian Energy sector was down 13% in 2017.

The Canadian dollar had a wild ride against the USD this year, with a low point struck in May of 72.5 (the Home Capital crisis and concerns there would be bad-mortgage contagion within the banking sector). It then swung upwards of 14%, peaking at 82.5 cents reached in September. The run up in the loonie was attributable to improving oil prices, forest products, and base metal prices, two quarters of GDP growth, and most importantly, two interest rate hikes from the Bank of Canada, making our government bonds more attractive to local and foreign investors. The loonie was up 7% to the USD over the course of the year, ending 2017 at 79.7 cents. Note that the move in the loonie negatively impacts the value of unhedged USD investments for investors measuring their returns in Canadian dollars. By example, the S&P 500 rose 19.4% in local terms and 13.5% in Canadian dollars. We still feel that the diversification benefits of holding US dollars will outweigh the short term performance drag on US holdings over the long run.

The November 2016 US presidential election is what really got the rally started, as the market embraced Donald Trump’s promises of tax reform, relaxation of government regulations, a push for more business friendly policies, and increased defense spending, most of which have come to pass. Further fueling the rally was another year of global easy monetary policy. The Federal Reserve raised rates 3 times in 2017, but kept interest rates benign, with overnight rates at 1.25%- 1.5% and 10 year Treasuries yielding 2.4% at year end. Europe left its stimulus policies in place, as did Japan, and China’s economy continued to grow at 6% or better. China’s economy is important to watch with regards to global growth, as it contributes about 1/3 of overall global growth now, and if it continues to grow at the government set rate of 6.5%, then will eclipse the size of the US economy in 10 years (Bloomberg).

Further fueling the rally, the US dollar fell 8% against its trading partners this past year, which is a boon for US multinationals and for emerging markets, who buy commodities in US dollars, US manufactured goods, and borrow in US dollars. Looking ahead, growth is widespread and the forecast for global GDP in the year to come is positive at 3.7% in 2018, higher than both 2017 at 3.7% and 2016 at 3.2% (IMF forecasts).

December 22, 2017, Richardson GMP

September 2017 marked the 10th year anniversary of the collapse of Lehman Brothers, which is generally viewed as the

starting point of the financial crisis. The long recovery that started after the market troughed in April 2009 hasn’t been

completely benign, with the TSX dropping 11% in each of 2011 and 2015. The TSX was up a comparatively modest 6% in

2017, when the S&P 500 was up 19.4% (11.2% in Canadian dollars), Japan up 19%, Hong Kong up 36%, Australia up

7%, Germany up 12.5%. Outside of Canada, equity markets like this haven’t been seen since the 1990's. Bond markets

also continue to perform, surprising most analysts who expected a negative year in 2017 with the start of the Federal

Reserve’s interest rate hiking program coming into play.

Risk assets have broadly benefited from globally coordinated Quantitative Easing. What Quantitative Easing has meant,

primarily, is that central banks, in particular the US, Japan and the European Central Bank, have been the substantially

the biggest buyer of bonds since 2009. Wells Fargo estimates that central banks have bought more than all the bonds

issued by G10 governments over the last two years (they are buying new issues and in the secondary markets), Financial Times, January 2, 2018. This explains why German 10 year bonds have a 0.4% yield (and have traded with negative yields in recent years). These central bank buyers are not investing for economic reasons, but to create interest in investing in other asset classes, to keep borrowing costs low for corporations and consumers, and to encourage

borrowing by companies to invest and grow businesses, and forestall the risk the economy would have crashed

completely following the crisis as fearful investors were inclined to hoard cash. Globally, central banks now own 20% of

their countries’ outstanding bonds.

Undoubtedly, the stimulus has worked. This is the 4th year in a row that global M&A has peaked over $3 trillion in

transaction value, a record fueled by the access to cheap debt. Global real estate has boomed in cities like New York,

London (up five fold since 1995), Vancouver, Auckland and Sydney. Global equities have trebled in value from the market

trough in 2009. Corporate debt is trading at 2007 era yield spreads – meaning that investors are accepting little

compensation for the higher default risk.

The US markets have outperformed other markets over the last 10 years in particular because many of the world’s

biggest technology disruptors are domiciled there. Facebook, Amazon, Microsoft, Netflix, Apple, alone account for 65% of the run of the NASDAQ 100 this year. Money has also been drawn to the US equities market as large global institutional investors, from Exchange Traded Funds, to Japanese pension plans, and Middle East sovereign wealth funds, have needed yield. Most of the world’s largest, most liquid, best credit rated, and with the most trustworthy accounting, tend to trade in the US. Yields on the equity in companies like Pepsi, Johnson & Johnson, Boeing, are far more attractive than similar corporate and sovereign debt issues. While corporate and government debt yields remain negligible or negative after inflation and taxes, we still expect demand for these US blue chips to stay steady.

Source: FT.com

A question being posed by many of our clients: are we due for a big correction given how much markets have moved?

It is a well-worn adage that bull markets don’t die of old age – the fact that the bull has run largely uninterrupted for many years now is not a reason in itself to expect a reversal. However, since we have had such a long uninterrupted period of extremely low volatility, we keep asset allocation in portfolios geared to protect us from some blips we could expect in 2018. When investors have made money quickly, and there were substantial gains made broadly in the US in 2017, short term investors can move for the exits very quickly to crystallize those gains should an unexpected trigger spook markets. From a broad perspective, the backdrop to the market remains benign. Central banks are very cautious in their approach to raising interest rates so as to not overly disrupt markets. Furthermore, the global growth picture has momentum, and US policy changes have the potential to drive economic upside over the next year. The weaker US dollar is also a benefit to global markets.

Valuations do make it more difficult to find bargains in the market: The median P/E multiple on the US market sits at 20

today, while the TSX may be closer to 23 times earnings (Motley Fool.com).

We do need to be cautious in stock selection as many companies are trading at P/E valuations that are historically much higher than the market would give them for the rate of growth that they have – US consumer staples is one sector where we see 25x earnings on many companies with very moderate rates of growth. However, some companies trading at these valuations are arguably not expensive: Facebook is a good example of one. Facebook trades at 29x earnings, but is forecasting revenue growth of 27% and earnings per share growth of 22% over the next year, and it has no long term debt (Value line estimates). Its only foreseeable risk to its dominance in advertising is regulatory. It is a building concern that regulators could start looking at the monopolistic tech giants and start to break up some of their market share.

Other risks to the markets in 2018:

-

If central banks become too aggressive on tightening their balance sheets, this could cause volatility in bond markets that might spill over into equity markets

-

If regulators start to inflict anti-trust measures on dominant tech companies (Google and Facebook, by example), this would impact valuations in the space broadly and negatively. However, the current US administration does not seem focused on this issue.

-

President Trump’s administration starts a global trade war.

-

If interest rates were to rise too quickly, it could tip the economy into a downturn. This is a risk in the UK, Europe,US and Canada in particular.

We feel that investors should have a portion of their portfolio invested to provide insurance against a period of market

volatility. How do we do that?

Asset Allocation

-

Cash. Cash has undesirable rates of return for the long run, at 1.2% in Canada (before tax and inflation), but is good to have around in the event of a falling market. Investors with cash on hand have the appetite and ability to buy into volatility.

-

Bonds. We don’t advocate large portfolio weightings in bonds for the general moderate growth oriented investor, as returns at this juncture are not exciting. Furthermore, long term bonds have the added negative of being strongly vulnerable to interest rate moves, which would drive down their prices. However, the income generated from a bond portfolio is helpful when capital gains are difficult to obtain in equity markets. Stay with shorter duration portfolios.

-

Dividends. Equity investments that generate income can help a portfolio move forward when stock prices are not. Most of the outperformers this past year were pure growth oriented companies with no dividends: Google, Facebook, Amazon, NVIDIA, etc. The right balance between growth and income for an investor is based on her particular long term risk tolerance (ability to withstand portfolio fluctuations), offset by the desired rate of return to

target.

-

Hedged Alternative Investments. For certain accredited investors, alternative investments should also be a component of a portfolio as they can add to growth in more challenging equity markets. Non-correlated specialized funds that can short sell, employ arbitrage strategies, use options and other derivatives can provide big benefits to portfolios when markets are more uncertain.

Canadian based investments

Since Canada is our home country, it is worthwhile commenting in particular on where we are investing in Canada, and

why we expect to be underweight Canada in equity and bond investments for another year as compared to US, Europe

and other international exposures. The TSX has not participated in the post-crisis boom to the extent other markets have

and we feel that this is the likely scenario again this year and beyond, for reasons outlined below.

10 year comparable returns:

-

TSX 10 year annualized price-only return: 1.6%

-

TSX Total Return (with dividends and assumes reinvestment of all dividends): 4.7%

-

S&P 500 10 year annualized price-only return (in USD terms): 6%

-

S&P 500 10 year annualized total return (in USD): 8.3%

-

EURO STOXX 10 year annualized (local currencies): -2.1%

-

WORLD 10 year annualized (local currencies): 2.6%

TSX 10 year chart. Up 17% over 10 years as compared to S&P 500 up 83% over 10 years.

Source: tmxmoney.com

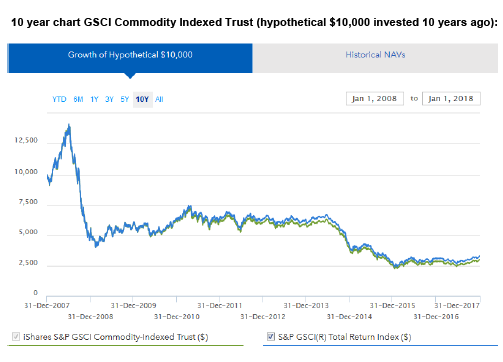

With the TSX’s weighting to commodity related companies, which still broadly haven’t recovered from the financial crisis, it is understandable why TSX returns have been relatively low.

Source: Ishares.com

Focus on dividend payers:

Investors in the TSX, more than most other developed markets, depend on dividends for their return over the long run

(see chart below). We do see some opportunity in Canadian equities, and in some cases valuations are more attractive

than in the US, but we are cautious in believing in the growth story for Canada. We see other jurisdictions that likely have

a better growth picture, and potential for upside growth. So our focus when investing in Canadian companies is on those

that either have exposure to the stronger US or stronger global economies, such as Manulife for their Asian growth focus,

TransCanada and CN Rail, and some of the banks for their US exposure. Most of our Canadian investments also pay a

meaningful dividend.

Fixed Income

In regards to debt markets here, we are underweight Canadian bonds as they are very overvalued and offer risk of price

depreciation, or capital losses, over the year ahead, and the income is so light from investment grade bonds under 5

years in maturity that it would not compensate an investor for even modest losses. Investors are also not being

compensated well for default risk on high-yield bonds.

-

10 year Canadian government bonds yield: 1.84%

-

5 year Canadian government bonds yield: 1.68%

-

Royal Bank High Interest Savings Account (money-market): 1.2%

-

Telus Corp 5 year bond (March 2022 maturity): 2.47%

-

Superior Plus 6.5% coupon 4 year bond (high yield): 3.95%

o Trading at 105, a 5% premium over issue price, guaranteeing price loss between now and maturity date of December 2021.

Bond markets could be volatile in the year or two ahead as we are entering the first real phase of bond buying reductions

from central banks, along with the potential for interest rate hikes. Given bond markets will require nimble trading, and

with interest rates higher outside Canada we prefer to have our fixed income allocation managed by institutional

managers with the best track records and experience in these markets. We can access nearly any manager in Canada,

and feel we have identified the best for experience, depth of team, track record and risk management. These managers

invest for some of the largest investors in Canada, such as the major Canadian pension plans. Our top managers include

Toronto based RP Investment Advisors, Manulife, and PIMCO, one of the world’s largest institutional managers.

Headwinds for Canada include:

-

Oil and gas industry: pipeline development is still verboten and access to international markets remains remote. Natural gas prices for Canadian producers could stay below the marginal cost of production as the US continues to rapidly grow its natural gas production.

-

Overleveraged Canadian consumer that is highly dependent on continued strong housing markets for household net worth. The housing bubbles in Canada’s biggest markets are at risk of a serious downturn, which would bury a large swath of Canadian borrowers under unsustainable debt loads.

-

The Bank of Canada could raise interest rates too quickly and damage the fragile economy or even tip it into recession.

-

NAFTA renegotiation. There is a risk that NAFTA could be killed by President Trump. This would be negative for our dollar, foreign investment in Canada, the economy, and our stock market.

o We believe the best protection against this scenario is to limit Canada’s equity exposure and avoid the most vulnerable sectors.

-

Tax and policy trends that are hurting businesses: rising labor costs and regulations are putting pressures on small businesses; carbon tax is a drag on industrial operations and consumers; increasing personal and corporate taxes while our closest and most important trading partner is reducing both; increasing risk that high earning individuals, entrepreneurs and corporations will redomicile to more friendly jurisdictions; increasing borrowing at all levels of government will all be impediments to growth.

I thank you for your continued trust and support, and welcome comments and questions.

Tricia Leadbeater

Mackie Wealth Group

Visit our website at www.MackieWealthGroup.com

All material has been prepared by The Mackie Wealth Group. The Mackie Wealth Group is an investment team at Richardson GMP Limited.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before

acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson GMP Limited, Member Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.