FEAR OF MISSING OUT? TENSION IN THE LATE INNINGS OF THE BULL MARKET:

In September, the Canadian equity markets finally played a little bit of catch-up to other developed markets, after being in negative return territory for most of 2017. The 2.8% move in September was mostly due to the boost from oils (up 8% in September), mining and banking stocks. The TSX index is now up 2.3% year to date, but still lagging well behind the US, Europe and major emerging markets.

Fixed income markets in Canada were negatively impacted by the Bank of Canada’s sudden two interest rate hikes this quarter. Interest rate hikes, especially off a base of near zero short term rates, negatively impacts the price of bonds as yields go up. The Canadian bond universe index lost 4% over the interest rate hike window, and total return is now only 0.48% year to date.

Year to date the TSX has been among the poorest performing developed markets this year, owing to the weighting on poorly performing commodity stocks and weak bank stocks for the first two quarters. Financials, Energy and materials stocks compose 60% of the total index. The energy sector remains down 10% year to date as of September 30 (natural gas producers generally down over 20% and making multi-year lows with AECO prices persistently weak). Banks are back in positive territory just as of the last two weeks of September – interest rate hikes help financials, especially life insurers. The financial sector now up 4.5% year to date.

Diversification outside Canada continues, a benefit for the equity and fixed income allocations in portfolios this year. US technology oriented stocks that we own still continue to outperform other sectors. However, the 9% move up the Canadian dollar since the start of the year has, for now, been a drag on total portfolio returns. By example, the S&P 500 is up 12.5% in USD local terms, but up only 4.4% in Canadian dollars.

A question facing investors at this time, given somewhat higher than average equity valuations, and with bond markets elevated: where do markets go from here? Where should investors go for returns from here? Cash like investments still provide negative returns after inflation and taxes. 1.2% is around the best rate to expect on cash right now in Canada (before tax).

Against the continued low returns on low risk investments, there is a building anxiety in the media that a crash in equities must be coming, given markets have been making new highs in the US seemingly almost every day since August, and with record low volatility for the last two months. Crossing the 10 year anniversary of the start of the financial crisis seems to be adding to the sense that it is near time to ring the bell on the bull market.

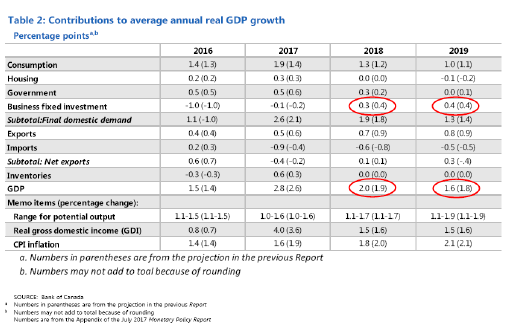

We also are starting to feel cautious on markets, but still remain focused on equity investments. Positioning to defensive balance sheet, large moat, resilient equities remains the course to take for now. We are focused on companies that can withstand higher interest rates, and still grow earnings and dividends. Yet we are taking some profits off the top of winning positions to be defensive, should an unexpected shock hit the markets in the coming quarters. Fundamentally, tailwinds still blow for equities. Corporate earnings are still growing in the US, and Canada is expected to be one of the highest growth developed economies in 2017 but continue on to low growth in 2018. Corporate America is starting to invest in labour and other capital which could keep the virtuous corporate earnings cycle going for a time. Earnings are still resilient or growing in many sectors. Housing and technology in particular remain interesting sectors in the US. In fact, we are seeing global growth and stability broadly. The IMF just raised its global growth expectations for 2017 and 2017: global real GDP growth this year is expected to be 3.6% and 3.7% in 2018, driven by emerging markets, in particular driven by continued stability and growth in China. Europe and the US continue to be growth regions as well.

For now, we conclude that investors will remain sanguine on their investments given there are no immediate breakdowns in fundamentals, and cash and short term government bond investments cannot meet basic return requirements. Global investors will continue to reach for required returns and yield. Large capitalization US and global equities still remain among the best positioned for those objectives. Demand for equities remains intact, for now. Given elevated valuations however, we could expect that overall returns from here could be moderate for investors.

We’ve had double digit growth in earnings the last two quarters on the S&P 500. The question facing equity investors today is whether earnings can continue to grow and support valuations as they have the last few quarters. If yes, then current valuations are reasonable and equity prices could continue to rise.

-

We continue to advocate US and international equities for better return opportunities over Canadian markets in the medium to long run. Note that the price-only annualized return on the TSX over 10 years is 1.1%, so international exposure can provide excess returns over our small and sector concentrated market.

-

The Canadian equities that we own tend to be businesses that have US and international exposure, such as New Flyer, CCL Industries, CN Rail, and Manulife. We have very little exposure to oil and gas production at this time, at around 2% or less in most portfolios. Oil and gas related exposure is focused on pipeline and related infrastructure and mainly with exposure to the very active US markets, like Enbridge and TransCanada.

-

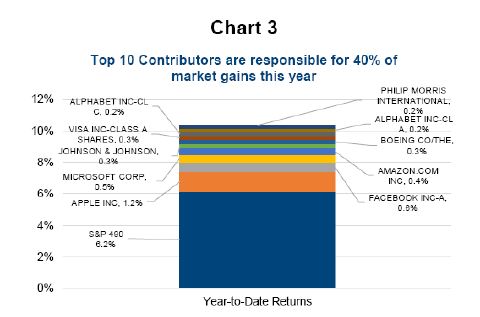

While the S&P 500 is one of the strongest markets, up this year 12.5%, it is interesting to note that 40% of the returns year to date on the S&P 500 are concentrated and attributable to 10 individual high growth technology stocks:

-

Equity valuations are not cheap 8+ years into the US bull market run, but we still find selective equities to be a more compelling source of return as compared to cash or fixed income alternatives. Forward P/E ratios on the S&P 500 are 18x, which is above average but not at extreme valuations. In the context of current inflation and interest rate expectations, this may be reasonable.

Notes on the Canadian dollar:

-

The move in the Canadian dollar has been one of the biggest factors on returns this year, with our portfolios weighted to US and global stocks and fixed income. The 14% spike up in the loonie’s value from its low of 72.5 cents in May to to 82.5 cents by mid-September, has meant that the appreciation in non-hedged investments has been muted this year.

-

The Bank of Canada raised rates twice this past quarter, removing the “insurance” cuts made in 2015 to stimulate the economy following the oil price crash. The sudden upward move in short term interest rates this summer made our 2- and 5- year government debt more appealing than most developed markets, and yields sit close to US government issues. As a consequence, demand for the Canadian dollar and Canadian securities has surged over the past quarter, after being shorted widely in the first quarter of 2017.

-

We believe that a continued strong Canadian dollar is not in the forecast for the long term and continue to hold our unhedged positions. We like the currency diversification to economies that we think will show better growth in 2018 and 2019.

-

We think that the Bank of Canada will need to be cautious in further interest rate hikes:

– Canadian CPI is well below the Bank of Canada’s target, running around 1.5% versus the 2% target (Bank of Canada).

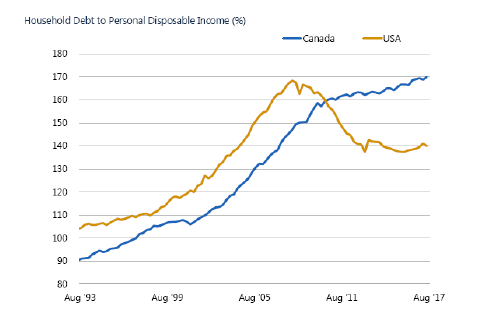

– It is well known that that Canadian consumer is over-indebted, with household debt sitting at 170% to personal income (from 90% in 1993). Further hikes on flexible interest rate debt would be untenable for many consumers.

– Residential investment is a headwind from here given higher borrowing rates and overheated markets in Vancouver and Toronto – and housing related activity was a major driver for growing GDP since the Great Financial Crisis, and especially the recent year. House prices are correcting dramatically in the GTA and somewhat in Vancouver following the introduction of the foreign buyer tax, lowering confidence and consumption power among families in these regions.

– The Federal government would like to support a variety of export markets for manufactured goods – a weak Canadian dollar is important for keeping labour and capital costs low relative to the buyer’s markets.

– Business exports will need to offset declining consumption and benefits from housing. GDP received big boosts from government spending housing and consumption in 2017, which is expected to taper off in 2018 (see chart).

– Trade is at risk at the moment with uncertainty on NAFTA negotiations. The US President can exercise authority in directing trade agreements so this is a big risk factor for Canada.

– The Federal Reserve in the US is likely to be cautious in raising rates from here and focus on decreasing the rate of monthly asset purchases instead. Canada is limited in that it can’t increase rates more rapidly than the US, which would cause the Canadian dollar to keep increasing relatively to that of our biggest trading partner.

Source:PIMCO/ Stats Can/ Fed Reserve board. 31 August 2017

Source: PIMCO presentation and Bank of Canada September 2017.

Fixed Income

-

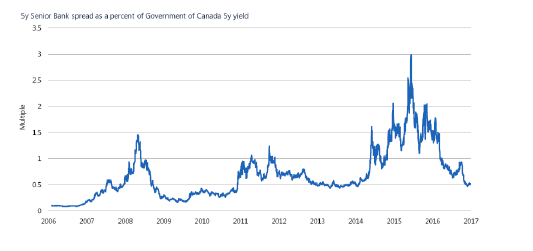

Canadian bond markets are especially overvalued, meaning we expect low yields and returns for now. Corporate bonds are priced to so as to have continued price drops should interest rates rise again. The chart below shows that the spread of corporate yields over government yields is very low – meaning that investors don’t pick up much more yield for taking on the much higher risk of investing in corporate debt over government debt:

Source: PIMCO, Bloomberg

-

With the Canadian bond markets overvalued, we have added managers over the last several years that provide active exposure to US and global markets, which have a more attractive opportunity set. We also have an element of exposure to high-yield issues to improve returns. Duration on the portfolios is kept short, generally under 5 years, as longer dated maturities could show violent price swings if interest rates start to rise. Active management (over passive Exchange Traded Funds) will be a major contributor to bond returns in a dynamic interest rate environment.

-

The chart below shows how bond markets can be very sensitive to changes in interest rates, since coming off near zero. The two 0.25% interest rate hikes of June and September drove the bond index price down 4% over four months, wiping out more than the yield received in a year. It is possible another hike could come early 2018, further capping returns on Canadian fixed income for now.

Source: Globeandmail.com

– Total return from the FTSE TMX Canadian bond universe over the last 12 months is negative at -1.43%.

– We expect modest or low returns from bond markets over the next 12 months.

– However, a moderate position in fixed income is warranted as a ballast against potentially increasing equity market volatility. Active managers can find trading opportunities when volatility appears and global markets still present the possibility for more interesting returns over local markets.

Finally, for accredited investors, we own alternative strategies that are non-correlated to equity markets. This is to add to the ballast and hedge portfolios when equities become volatile or low return. These strategies can achieve these returns via long-short or pair-trade strategies, arbitrage, and options strategies.

With thanks for your support and trust. Your comments and questions are welcome.

Tricia Leadbeater

Mackie Wealth Group

Visit our website at www.MackieWealthGroup.com

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson GMP Limited, Member Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.