Tricia Leadbeater’s Market Updates

The Trump trade and beyond (April 2017)

1st quarter re-cap:

-

Overall a decent quarter, but very mixed when you drill down sector by sector. Mega cap technology stocks stand out as the biggest winners, outperforming every asset class: Apple +24%, AMZN +17%; Facebook +22%.

-

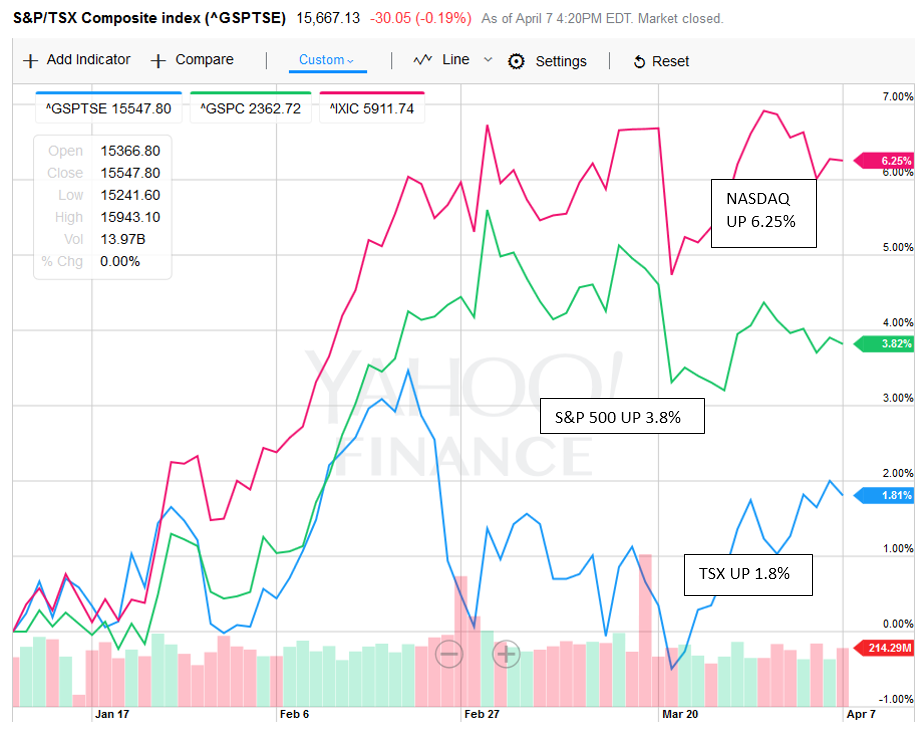

TSX +1.7%; Canadian bond universe +1.24%; S&P 500 +5.5%; NASDAQ +9.8%.

-

Canadian financials were negative in March and flat or down ytd; US financials weak or down ytd.

-

The Energy index, as measured by XEG (ishares Capped Energy) was down 10% in Q1; Canadian Natural Resources is the exception- most major companies like Cenovus, Crescent Point, Whitecap and Vermilion are down 15% or more.

-

The S&P 500 was flat in March, with only 3 of 11 sectors rising; the TSX up 1%. Markets are cautious following president Trump’s failure to change the Affordable Care Act, in case this is a signal that other economic policies will take longer to pass. Plus, savings from health care was envisioned to be used towards infrastructure spending.

-

Investors are also waiting to further direction from the Fed on “Quantitative Tightening,” regarding how fast rates will rise, and perhaps more importantly, how they plan to reduce the size of asset purchases they have been making in the bond market. By example, The Fed owns $1.77 trillion of agency mortgage-backed securities, or 30% of that market. Reductions to their buying program will impact mortgage and lending rates.

-

Britain formally began the Brexit process at the end of March. So far, markets are sanguine. The dramatic pullback in the pound since June 2016 has largely helped the UK economy. The UK FTSE is up 2.5% ytd, and up 18% over the last twelve months.

-

There are high expectations for first quarter earnings reports, which could impact markets in coming weeks either positively or negatively.

The market has moved dramatically since election night, November 8, 2016:

-

S&P 500 +12%; TSX +8%; 10 year US treasury bond yields moved from 1.7 to 2.5%, and their price dropped by 6%.

-

Oil prices benefitted from a commitment by OPEC to reduce production in December, which helped boost the TSX and components of the S&P 500. After WTI dropping to $44 in November, prices rallied to $54 and have been range bound around $50 since then.

-

Investors globally have continued to favour US equities into 2017, but there was some profit taking from US markets into quarter end.

-

The Federal Reserve raised rates 1/4% in December and then again on March 15, and signaled two more rate hikes could come this year. The Fed is also trying to work out how to reduce its balance sheet – when to slow down or stop buying treasury bonds. Either of these paths could be future sources of volatility.

-

P/E ratios above historical averages: The TSX is now trading at a forward P/E ratio of 17x versus 10 year average of 15.7x; and the S&P 500 at a forward P/E of 18.3 versus 10 year average of 15.3x.

Source: Financial Times

Year to date comparable performance chart of TSX, S&P 500, NASDAQ:

Source: Yahoo.com

The outlook:

Outside of commodity producers, equities are in the late years of the post-financial crisis bull market. Even given the run they have had, stocks could still move up from here. We still like a significant exposure to US and US based international equities despite above somewhat average P/E valuations. Volatility can be expected however, after a year of almost no volatility at all.

-

Trump driven policies could have significant positive impacts:

-

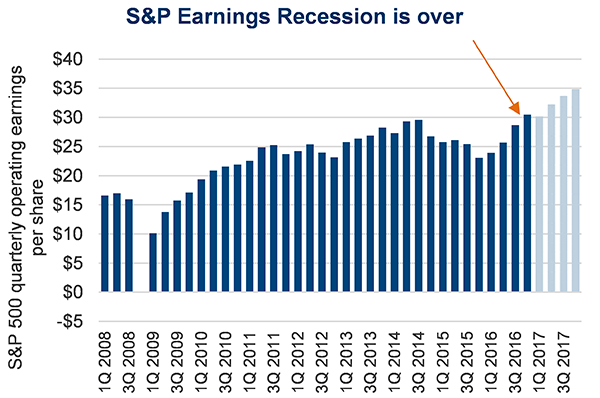

Tax reform could boost S&P 500 earnings by $10 – a material boost – and would bring the P/E ratio down to a not so elevated level, even without other earnings growth. The current expectation is for $130 per share for 2017 (which is 18x earnings). Source: Yardeni Research Inc.

-

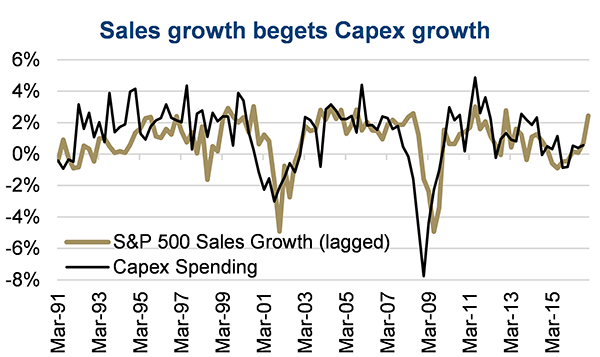

Repatriation of overseas held profits could lead to a boost in dividends and corporate investment in growth projects.

-

Lowering regulation to make certain industries more competitive globally increases activity and earnings.

-

The Fed is raising rates but very cautiously because of concern about causing volatility in markets. Monetary policy is still generally very accommodative.

-

The US economy is already strong – and Q1 is expected to be a quarter of strong earnings growth year over year on the S&P 500. Analysts are expecting a 10% boost to earnings year over year. Commodity oriented companies will show the biggest jump in earnings improvements.

-

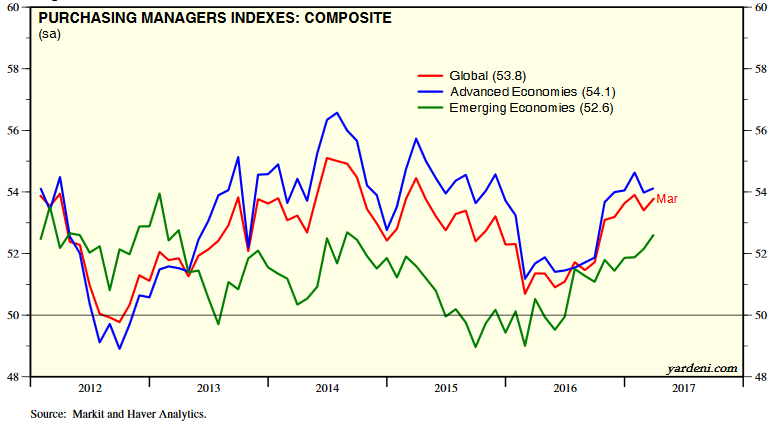

The fear of global deflation is over, a positive for corporations to make investments in inventory and hiring.

-

US Corporate price growth forecast to accelerate even without Trump policy changes – positive support for equity valuations:

Source: Richardson GMP Connected Wealth

-

The US is not the only economy in growth mode: the global purchasing manager’s index indicates syncrhonized global growth is to be expected this year. A PMI moving above 50 indicates strength in the manufacturing sector by measuring new orders, inventory levels, production, supplier deliveries and the employment environment. We seemed to have decisively turned the corner to growth mid 2016.

Source: Richardson GMP Connected Wealth.

International trends are stable or improving:

-

Europe’s economy is improving.

-

UK economy has been resilient despite Brexit negotiations to come – lower currency has helped.

-

Concerns around China’s rate of growth have abated for now.

-

Worries about trade war initiated by the US are moderating somewhat.

-

Monetary policy is still very accommodative in Europe and Japan.

There are of course risks to the global growth forecast, which include:

-

Political instability, from President Trump’s potential for impulsive and unexpected global policy maneuvers.

-

The Republicans fail to get key parts of tax and regulatory reform through in a timely manner.

-

Geopolitical risks from Brexit, to upcoming European elections, to middle east tensions.

-

The Federal Reserve acts too aggressively in reducing the size of their balance sheet and causes market uncertainty and instability.

-

Corporate debt in the US is now very high (outside of the financial sector), albeit financed at very low interest rates for longer than average maturities. Corporate debt is back to levels last seen in 2007.

-

Equity valuations being above average and gains made very quickly since the election could lead to bursts of profit taking should earnings disappoint.

Portfolio positioning from here:

Canadian bonds are more vulnerable and expensive than other alternatives. Our bond exposure is focused on corporates outside Canada, some high yield exposure, and shorter duration in a dynamic interest rate environment. Bonds are present in portfolios for income but at a reduced allocation for this market.

Canadian equities, from banks to pipelines, have benefitted from the improvement in commodity prices over the last year. However, going forward, our thesis remains to be focused on Canadian companies that have sales and growth opportunities outside Canada. This can include insurance companies like Manulife, and pipelines like Enbridge with its Spectra acquisition, CN Rail with its North American network, and Winnipeg based North American bus manufacturer, New Flyer. The weaker Canadian dollar helps exporters, as does a strong US economy, so this is where our focus for opportunity remains. Domestically, Canada is positioned to move in the opposite direction from the US. Canada is increasing regulation, especially in oil and gas and pipeline construction, one of our key economic drivers. We have a highly-indebted consumer that is vulnerable to future rate hikes. Housing construction has been a major factor in jobs growth, and rising house values are key to maintaining household wealth and stability; housing is vulnerable and bubble-like in some markets (Vancouver and Toronto in particular). Increasing corporate and personal tax rates plus an introduction of carbon taxes depresses economic activity and investment; we have a lack of leadership in technology and intellectual property development compared to US.

For now, we will maintain meaningful allocations to the US dollar and US equities for exposure to global cyclical growth and dividends.

Global equity valuations are generally lower than the US, and may provide better investment appreciation from here. Exposure to global equities is mainly via funds that have track records of sold risk-adjusted returns. We also own companies with large global components to their sales, such as: GE, Pepsi, Boeing, New Flyer, Manulife, and CCL Industries.

For accredited investors, hedge funds at this time may provide portfolio growth and insurance should volatility hit markets this year. Strategies that include M&A focused arbitrage should still find opportunity in the low-interest environment that has been supportive of corporate takeovers.

Please feel free to contact me with your comments.

Sincerely,

Tricia Leadbeater

Director, Wealth Management

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances..Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.