Second quarter 2022 market update

Outlook is still cautious

At mid-year 2022, markets continue to be tough for investors. The same factors that made the first quarter challenging persisted and even magnified through the end of June: the ongoing invasion of Ukraine and resultant strains on energy and food prices; inflation still rising and growing concerns that consumer spending will slow because of it; the lingering impacts of the pandemic, including China continuing to lock down parts of the country to contain the latest variant. Supply chain issues have persisted in part because of these lockdowns, secondly because of widespread labour shortages across many industries, such as manufacturing and construction.

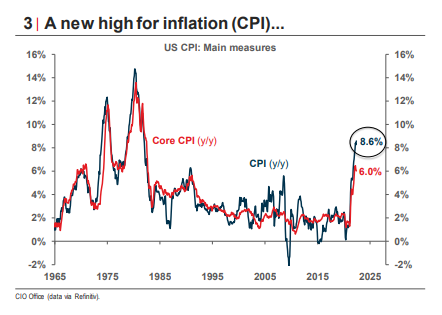

Inflation is back to 1980’s levels:

Source: National Bank Investments (data via Refinitiv)

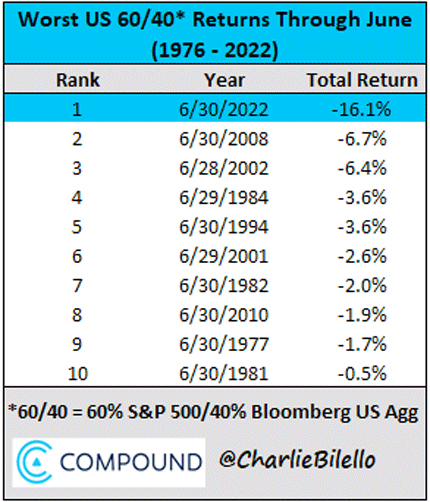

June capped off the worst first half of a year for stock markets since 1970. Growth and tech investments that were winners of Covid-19 lockdowns switched to be among the weakest this year (i.e., Netflix and Doordash), along with consumer discretionary stocks (Canada Goose and Peloton). There were few places to make or even protect money this quarter, outside of owning US dollars (the USD index is up 12% year to date against its major trading partners) and oil and gas investments. June was an especially tough month, the TSX down 9% as an example, as the first meaningful interest rate hikes took place across several major economies. Inflation numbers made highs not seen since the 1980’s.

Central banks have decisively pivoted from being the much-needed support for markets, cushioning the effects of the pandemic, to now aggressively restricting the economy and inflation. In addition to raising the cost to borrow money for home buyers and businesses, they will cease to be the “floor” buyer for government and mortgage bonds. Keeping interest rates low by buying billions of treasuries and mortgage bonds per month helped to encourage investors to take on more risk in other asset classes for the last three years (and to a large extent since the Financial Crisis). Today’s number one concern for markets is whether central banks can manage just a slowdown of inflation and not trigger recession later this year or 2023. However, even if they manage just a slowdown, there is a secondary worry that we enter a persistent “stagflation” period, wherein inflation on goods keeps creeping up while the economy slows down.

Market data year to date:

- S&P 500: -8.39% in June and -20.58% year-to-date

- TSX Composite: -9.01% in June and -11.13% year-to-date

- FTSE Canada Universe Bond Index: -2.18% in June and -12.24% year-to-date

- FTSE Canada Long Bond Index: -4.35% in June and -22.13% year-to-date

Balanced portfolio returns were the worst in 40 years:

Source: Compound Capital Advisors @CharlieBilello

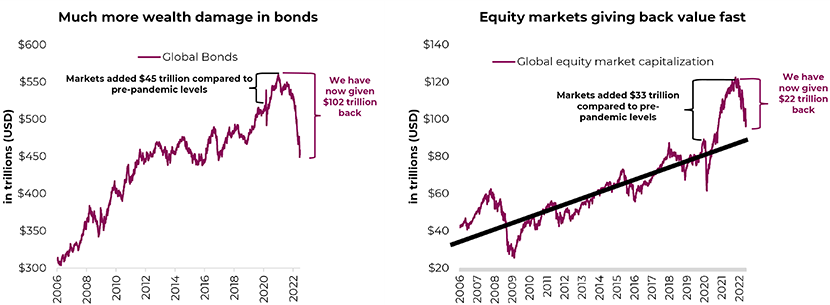

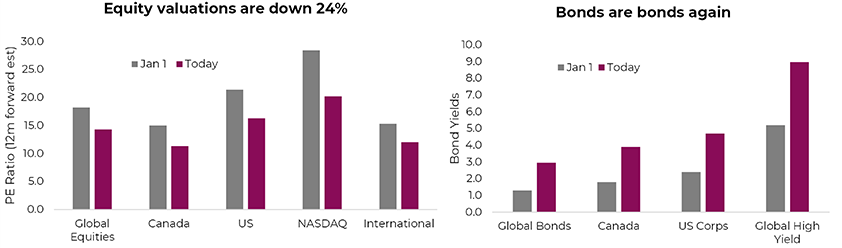

At the start of 2022, most asset prices, from housing, to used cars, to stocks were very elevated. Global equities were trading at around 20x P/E multiples, well above the long-term average of 15x. Global bonds carried a yield of 1.3%. Today, equities are down 18% from January 1, and global bonds have pulled back by 14%. Valuations are much closer to long-term averages today, with equities valued at 15.7x earnings and bond yields having climbed to yield 3.0%. We are closer to the bottoming of the market with valuations at these levels.

Source: Bloomberg, Purpose Investments

Since we are in bear market territory in stock and bond markets, it is worth reviewing how a bear market tends to progress from its beginning to the next upward cycle.

The progression and end of a bear market

Stage 1: Valuations are reset lower

Potentially, much of the reset of valuations has already happened. Many companies are now trading at attractive price to earnings multiples and have meaningful dividends, which are especially attractive if they are in sectors that are recession resilient, such as utilities, pharma, consumer staples. Bonds now are starting to provide attractive coupons, albeit still well below today’s rate of inflation of approximately 7%.

Equities and bond valuations are better than at the start of the year:

Source: Bloomberg, Purpose Investments

Stage 2: Economic growth and earnings are revised lower

If consumers spend less on services, goods, and real estate, this will lower earnings forecasts for companies and reduce corporate spending. We will get clarity on earnings forecasts for the rest of the year as companies start to report their Q2 earnings later this month. If earnings forecasts are lowered more than expected, then stock prices could weaken further yet.

Stage 3: Recovery

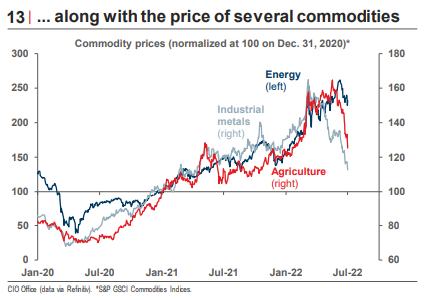

If inflation cools later this year, then this will allow central banks to cease tightening economic conditions. Lower inflation expectations will help consumer confidence and spending, and corporate investment in business and inventories will rise again. We are seeing early signs of inflation peaking, as oil and gas, agricultural and base metal commodities have had significant pullbacks in price over the last month.

Inflation may soon be tamed?

Source: National Bank Investments (data via Refinitiv)

Conclusion

We are in a bear market for stocks and bonds. How quickly recovery happens will be highly dependent on inflation data, especially over the coming quarter as central banks can measure the impact that higher costs of borrowing are having through the economy. We are paying close attention to employment numbers, wage inflation, housing activity, and commodity prices as factors that could indicate where we are at in the economic and inflation cycle. Lower commodity prices can hurt TSX companies more than US markets, but lower commodity prices will flow through into lower inflation, a net positive for the global economy. Other factors that will improve sentiment: China unlocking cities will help supply chain issues globally, and increase demand for many global companies like Apple and Starbucks. A resolution to the war in Ukraine could lower some commodity prices like gas, oil and wheat. Strong employment numbers continue to boost consumption, especially in the world’s biggest economy, the US. We note that in the last 10 years, a sustained recovery was initiated by a Federal Reserve pivot back to more relaxed stance. At the moment, a change of policy seems some time out as the Fed watches to see how measures are working through the economy. Portfolio stance: dividend paying companies whose businesses are resilient even in a slowdown; certain commodity producers that have medium to long term trends in their favour (low oil inventories and drilling globally; the conversion to EV driving demand for metals longer term); select growth companies whose values are becoming attractive after the broad sell-off. Corporate bonds, especially through some of our special situation managers provide attractive yields. The focus is on companies with strong competitive moats, global brands, and none that are not reliant on investor funding or bank borrowing to drive their growth.

Best regards,

Tricia Leadbeater CFA

Portfolio Manager, Investment Advisor