Second quarter 2021 market update

The reopening economy

Over the first half of 2021, markets continued rolling along the upward momentum that began in mid-November 2020, when the results of the US election were decided, and the first COVID-19 vaccines were approved for use and immediate distribution.

For the first time in many years, the Canadian market has outperformed most other developed markets, including the unrelenting S&P 500. Year to date, the TSX was up 15.7% and the S&P 500 up 11.2% (in CAD).

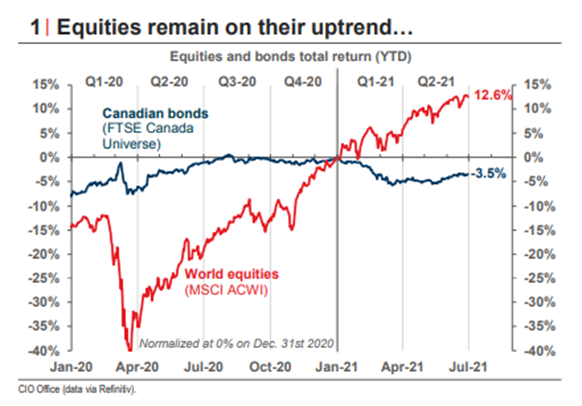

World Equities through the pandemic versus bonds:

Source: National Bank

Note the overall negative returns in bond market so far this year. Bonds were very helpful as a portfolio insurance tool during 2020 but are now challenged to provide positive returns. Coupons on investment grade bonds provide very low, or even negative rates of return after taxes and inflation.

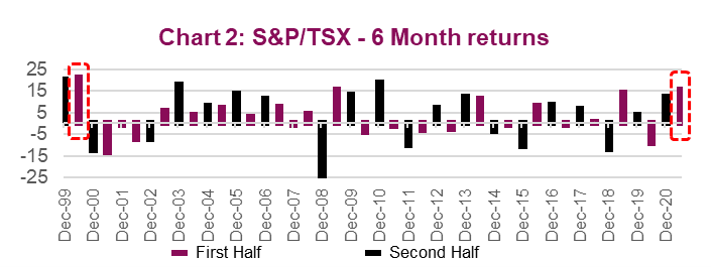

While most risk assets have performed extremely well so far, we note in particular these past six months have been strongest half year returns for the TSX since 1999. Investors have been looking to the re-opening economy to rotate some of the profits gained in US high tech mega-cap companies (“FAANG” stocks), and into cyclical companies that do well when the global economy is growing or inflation is coming back into the market: Energy, Metals, Financials, Transports, Industrials. Canada is outperforming the tech heavy S&P 500, because of our concentration in these cyclical sectors relative to the tech-concentrated US market.

Source: Richardson Wealth

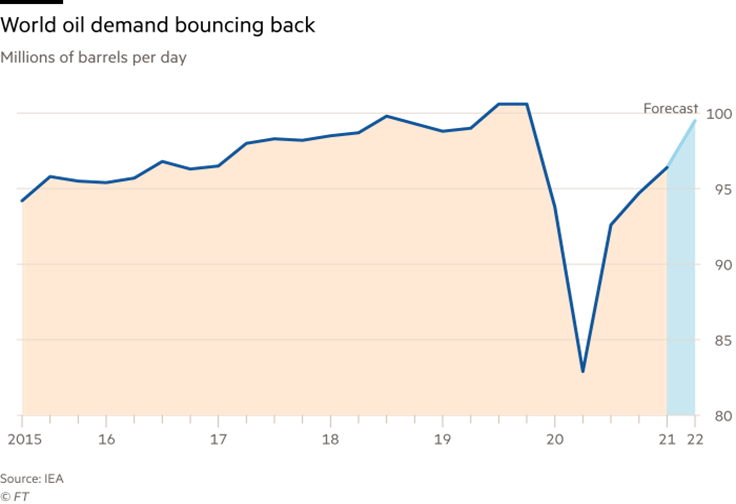

A chart below shows how quickly the demand for oil is coming back as economies are re-opening, another big benefit for the Canadian Dollar and Canadian companies:

Source: Financial Times

With the strong returns in stock markets year to date, the risk of a profit-taking correction seems to be increasing. For now, we view any pullbacks likely to be shallow and short and provide buying opportunities. This is because the fundamentals driving stock market returns over the last 6 months we expect to remain intact for the next few quarters. However, we are on watch for a catalyst that changes the narrative in the quarters ahead. And, while we view fundamentals to be very supportive, stock market returns are not likely to be as strong over the coming two quarters as they were the past two.

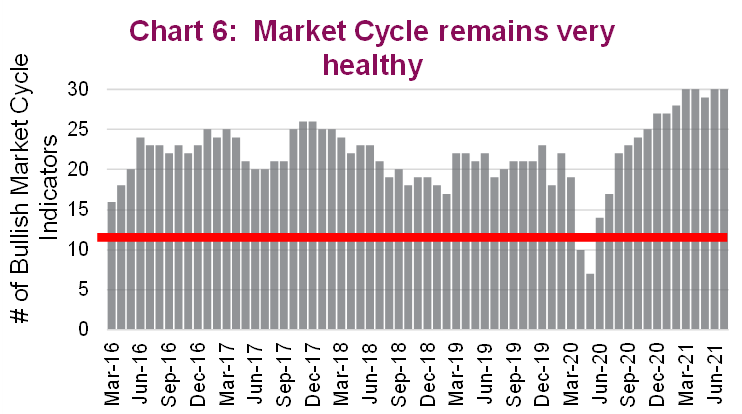

Market Cycle Indicators Chart: Below the red line is a danger signal. Markets are still well into bullish territory:

Source: Richardson Wealth

-

The economy is re-opening and growing: employers are hiring, manufacturers are building inventories worldwide, housing markets are strong, and consumers are starting to spend on re-opening activities: cruise travel, plane tickets, clothing, hotels and casinos, restaurant bookings, new cars. Savings accounts in banks increased dramatically over the last year and so long as consumer confidence stays intact, discretionary spending should grow this fall. Canadians saved an estimated $180 billion in bank accounts in 2020, compared to $18 Billion in 2019. (CBC, Bank of Canada). US consumers also saved similarly over the pandemic, with now $2.5 Trillion in excess saving. (Reuters)

-

Corporate earnings are growing substantially from 2020: corporate earnings are forecast to grow globally at 10% in each of the next two years. (Richardson Wealth)

-

Interest rates remain low: mortgage, business, consumer borrowing is cheap.

-

The Federal Reserve is keeping interest rates low and buying government debt: monetary and fiscal policy are still extremely stimulative.

-

Inflation for now seems contained: many of the sharp price increases in materials such as lumber have pulled back as supply chain constraints are easing.

-

Government COVID supports are still in place, including wage subsidies, unemployment benefits, rent assistance for businesses.

-

COVID restrictions continue to wind down globally: vaccine rollout is increasing, hospitalization and case counts are falling in developed countries.

Risks will rise in 2023. If we see slowing corporate earnings and economic growth, combined with reduced government supports and higher interest rates, this would be a recipe for choppy markets.

Opportunities: companies that benefit from in-person activities, from a contained rise in inflation and interest rates. Cyclical companies that benefit from a growing global economy, and the significant North American and European government infrastructure spending plans to stimulate economic growth. We believe increasing international markets (16x P/E) and Canadian markets (16x P/E) exposure is worthwhile, as they are relatively cheaper when compared to US equities (22x P/E). Cyclical and value companies could have higher growth from here, as the beneficiaries of the above re-opening trends. Bond returns we expect will continue to be challenging into next year in the current interest rate environment. We remain invested in short duration or special situation managers for fixed income. For the short term, cash may also be a hedge against stock market volatility.

We thank you for your ongoing trust and support. I look forward to catching up with you in the coming weeks.

Best regards,

Tricia Leadbeater CFA

Director, Wealth Management, Portfolio Manager, Investment Advisor

Mackie Wealth Group

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson Wealth Limited, Member Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.