Tricia Leadbeater’s Market Updates

Second quarter update (July 2017)

Summary of 1H 2017: the Trump trade fades, populism weakens, and currency markets get volatile.

| LONG TERM RETURNS* | YTD | 1YR | 2YR | 3YR | 5YR |

| S&P/TSX Comp (price) | -0.7 | 8.2 | 2.1 | 0.1 | 5.5 |

| S&P/TSX VENTURE COMP IDX | 0.6 | 6.3 | 6.9 | -9.3 | -8.4 |

| S&P 500 (price) | 8.2 | 17.0 | 8.4 | 7.3 | 12.2 |

| NASDAQ (price) | 14.1 | 28.5 | 11.0 | 11.7 | 15.9 |

| EUROPE | YTD | 1YR | 2YR | 3YR | 5YR |

| EURO STOXX 50 | 4.6 | 21.5 | 0.3 | 2.2 | 8.7 |

| England (FTSE) | 2.4 | 15.0 | 5.9 | 2.7 | 5.6 |

| MSCI | YTD | 1YR | 2YR | 3YR | 5YR |

| World | 9.4 | 17.3 | 5.1 | 3.2 | 9.2 |

| EAFE | 11.8 | 18.2 | 1.1 | -1.5 | 5.8 |

| Emerging Markets | 17.2 | 23.0 | 2.0 | -1.3 | 1.5 |

| BONDS | YTD | 1YR | 2YR | 3YR | 5YR |

| All Government Bonds | 1.0 | -2.1 | 1.1 | 2.5 | 1.9 |

| FTSE TMX Universe Bond | 2.4 | 0.0 | 2.6 | 3.8 | 3.3 |

| CURRENCY LEVELS | CURRENT | -1MO | -3MO | -6MO | 12MO |

| Canadian Spot | 1.2964 | 1.3500 | 1.3318 | 1.3441 | 1.2924 |

| Trade Weighted Dollar | 95.63 | 96.92 | 100.35 | 102.21 | 96.14 |

| ENERGY | LEVEL | 1MO | 3MO | 6MO | 12MO |

| Nat Gas (US/MMBtu) | $3.04 | -1.2 | -4.9 | -18.5 | 3.8 |

| WTI Crude (US/bbl) | $46.04 | -4.7 | -9.0 | -14.3 | -4.7 |

| PRECIOUS METALS | LEVEL | 1MO | 3MO | 6MO | 12MO |

| Gold (US/oz) | $1,242 | -2.3 | -0.4 | 7.9 | -5.9 |

| Silver (US/oz) | $16.57 | -4.8 | -9.2 | 3.6 | -10.8 |

Source: Richardson GMP

*shown in local currencies, annualized returns

Macroeconomic data remains strong globally, which is underpinning positive performance by all developed country market indices so far this year, with the exception of Canada, which is down -0.7%. Weakening commodity prices, and nervousness around the overheated housing markets and connected banking sector led to Canada’s negative returns.

Outside Canada, equity and bond markets generally performed quite nicely, as they are still benefitting from the “goldilocks” scenario of steady, albeit low GDP growth rates, accommodative monetary policy, and tame inflation expectations. The IMF is still calling for 3.5% global growth this year, and 3.6% in 2018. The Eurozone is expected to grow 2% this year; the US 2.3% (assuming Trump’s tax reforms are not put through in 2017). Canada, benefitting from the lower dollar in the first half is running well over 2% GDP growth so far this year (OECD Economic Outlook, June 2017).

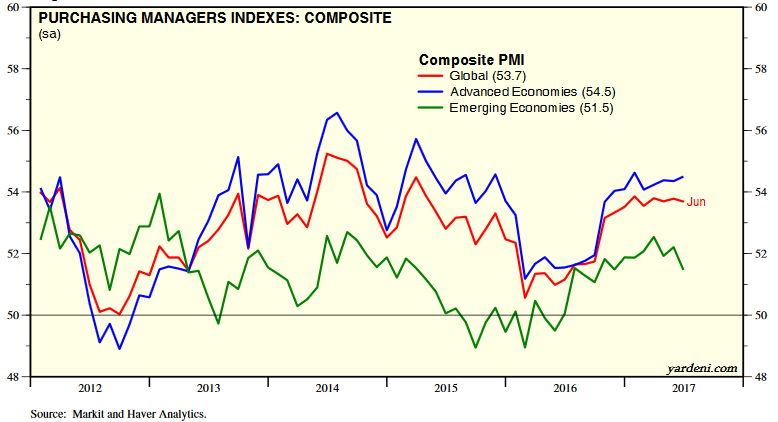

Looking ahead, Purchasing Managers Indexes also still indicate business managers are preparing for growth. The PMI polls business owners and tracks new orders, inventory levels, production, supplier deliveries and employment. Readings above 50 are positive indications on the health of the manufacturing sectors

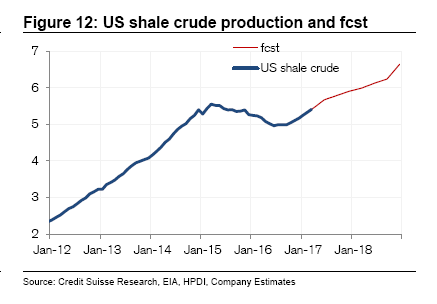

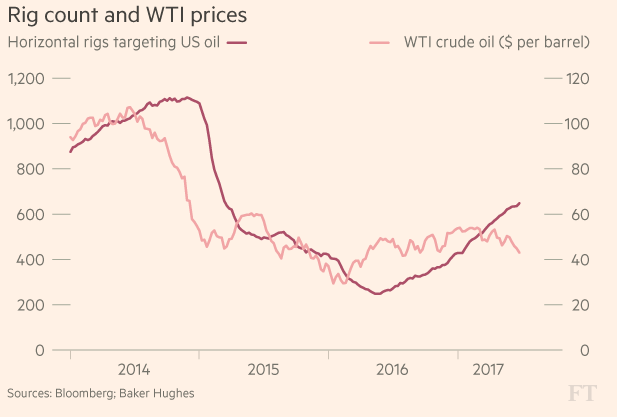

Commodity prices are the exception to the growth story in 2017, particularly oil which is down 14.3% year to date on the back of the rapid rebound in US shale oil production. US oil production is back to its peaks of 2014. US shale growth, along with higher production from Iraq, Iran, and Libya are largely offsetting the cuts to production self-imposed by OPEC earlier this year. Lower oil prices help many emerging market economies, but likely will have a dampening effect on Canada’s growth prospects with oil and gas remaining our largest exported product.

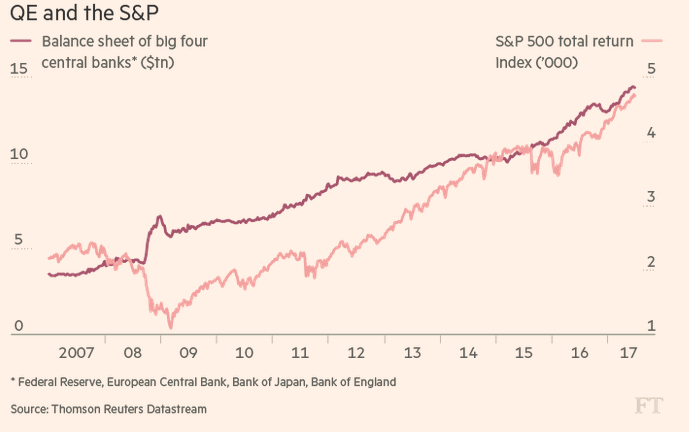

Source: ft.com

The last week of the quarter introduced the first real bout of “risk off” trading since the US presidential election, as the investigation around Trump’s circle and Russian involvement in the US election heated up, and the Republicans failed to put through any reforms on healthcare. These factors have the market concerned about the Trump administration’s ability to put through tax reform or other major fiscal stimulus policy.

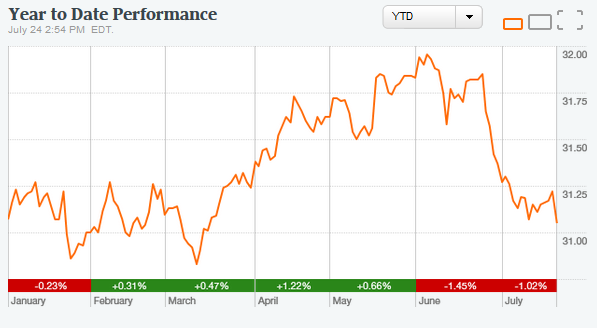

These past weeks also saw the first hawkish talk on interest rates in several years, which prompted a bond sell-off at the end of June. The now decade long era of ultra-low interest rates may be near its end. Central bankers of several developed countries broadcast on the same week that they would trend toward monetary tightening after 8 plus years of near zero rates and the aggressive bond purchase programs referred to as “quantitative easing”. Europe, the UK and Canada all expressed intentions to raise interest rates in the foreseeable future. Canada followed through on its first rate hike since 2010 in July, reversing one of the two 0.25% cuts made in reaction to the oil price plunge in early 2015. The Federal Reserve has already raised interest rates twice this year, with indications they may look to taper their asset buying (market supporting) program over the next year.

Bonds and bond proxies are especially sensitive to upward moves in interest rates. A chart of the Ishares Core Canadian Universe Bond Index ETF is below:

Source: Globeandmail.com

Aggressive central banks would be a risk to equity valuations.

Stock market valuations have been closely tied to the support of central banks. Central bankers are very cognizant that they must tread carefully in withdrawing support and avoid widespread damage to equity markets:

It is likely that central banks will be cautious on raising interest rates and withdrawing asset purchases as inflation expectations remain muted across developed markets. Interest rates are raised in part to keep inflation in check.

Ft.com June 26, 2017

Notes on the Canadian dollar:

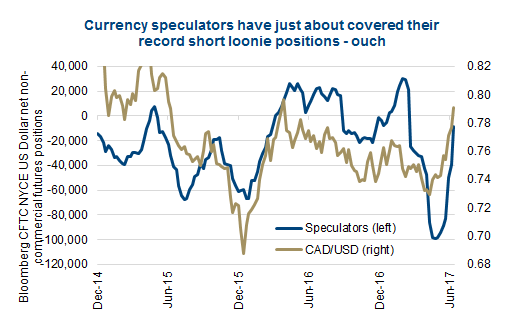

As of July 23, consensus among bond and currency forecasters is that the Canadian dollar has run too far and is overvalued against all its currency pairs. Some of the run up in the CAD was a result of short-covering – short positions on the Canadian dollar hit a multi-year high in spring. This speculation was largely based on worries around contagion from the Home Capital investigation into the housing and banking sector broadly:

Source: Richardson GMP, July 2017

Consensus among currency traders that the US dollar will appreciate 4.5% against the CAD from here, or inversely, the CAD will fall back towards 76 cents from the current 80 cent vs the USD on July 24, reverting back to its mean value of the last year.

Outside of short sellers, the other main factor in the run up of the last two months is owing to the corresponding pullback in the US dollar. The US dollar has dropped over 9% from its peak last December. This is an extraordinary move on the world’s reserve currency, and the impacts will be felt over the next few quarters to come. A weak USD helps countries that import goods from the US and borrow in USD; but is harmful to countries like China that send most of their exports to the US. A weaker USD will help much of the major S&P 500 companies on their earnings, such as McDonald’s, GE, J&J, who have well over 50% of their sales outside America.

Strategy

Our positioning in portfolios remains the same as our last several reports. Fixed income is kept with a shorter duration and investments are weighted to global and US exposure where better opportunities remain. Bonds can be useful to lower portfolio volatility and remain a key component of asset diversification. But with low future returns expectations, investors still cannot rely on fixed income to meet investment return objectives without taking undue risk. By example, a 9 year Bank of Nova Scotia bond maturing December 2026 has a 2.73% yield to maturity, and a high degree of price volatility expected on the bond between now and 2026. In a taxable account that pays 50% tax on income, and if we assume a 2% annual rate of inflation, the investor is barely preserving the purchasing power of their money over 9 years if they hold to maturity and risk capital loss if they need to sell before the term is up.

As such, we still believe that equity exposure is the primary means to realize investment goals. Even with equity valuations having moved up steadily over the last several years, stocks remain best opportunity to achieve real rates of return after taxes and inflation. But we expect more volatility from here – it has been a year of unusually low volatility and the longest stretch of time in 20 years without a 5% dip in the market. The last 5% pullback was around the Brexit vote in June 2016. And dividends remain more attractive then investment grade corporate bond yields. In a rising interest rate environment, companies with the strongest balance sheets will be an important factor for future valuations.

We continue to look to invest in companies in Canada with exposure to the steadily growing US economy as opposed to reliance on the overleveraged Canadian consumer, exposure to overheated Canadian housing markets, or commodity prices. And we remain especially interested in US and global equities as well. Global developed markets trade at lower valuations then US stocks – especially Europe- and we will delegate some portfolio management to specialists in this space.

Still, with equity valuations not cheap, and volatility measures showing great complacency in equity markets, we advocate some exposure to Alternative investment strategies. For accredited investors, we buy hedge funds and alternatives that have low correlation with stock market returns and often are less volatile than stock markets. These fund managers use pairs trades, short selling, and arbitrage strategies to create growth in volatility.

We thank you for your ongoing trust and support. It is a privilege to work with you in achieving your goals.

Please feel free to contact me with your comments.

Sincerely,

Tricia Leadbeater and the Mackie Wealth Group

Director, Wealth Management

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson GMP Limited, Member Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.