Fourth quarter 2021 market update

2021 was a year of investing records; can we expect more in 2022?

Two years on from the emergence of Covid-19, the disconnect between the human toll from disrupted businesses, schools, and families, versus the meteoric rise in value of stock markets and other risk assets continues to increase. Even with coronavirus driven market turbulence at the end of the year, the TSX was up 21% (its best year since 2009, the year following the Financial Crisis). The S&P 500 struck a record 70 new all-time highs throughout 2021, with an overall advance of 27%.

A few of 2021’s notable records, echoes of 1999

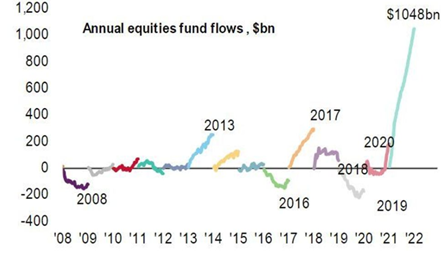

Record fund inflows into stocks. More money went into stocks in 2021 than in the last 20 years combined. Volume on options trading also made new records. The value of the Exchange Traded Fund market has doubled in value since the end of 2018, crossing $1 Trillion in value for the first time in 2021. Unprecedented printing of money by central banks, low interest rates, easy access to markets via day trading apps, plus the “free” money granted to people impacted by lockdowns, led investors to participate in stock markets like never before.

Record annualized inflow to global stocks in 2021

Source: BofA Global Investment Strategy, MarketWatch

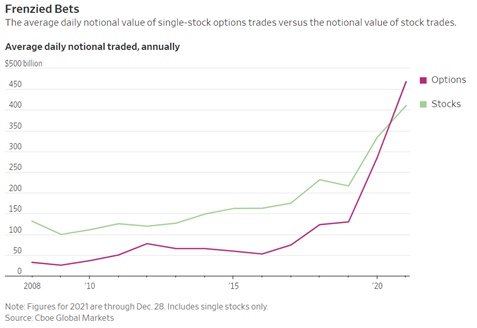

Trading levels in options hit the highest since the class was invented in 1973. The notional value of options traded daily surpassed the value of stocks traded for the first time. As retail investors gained access to this space, which is cheaper but can be riskier than owning stocks, they piled in. This growth in options can make the underlying stocks more volatile in periods of pullbacks.

Source: Cboe Global Markets, Wall Street Journal

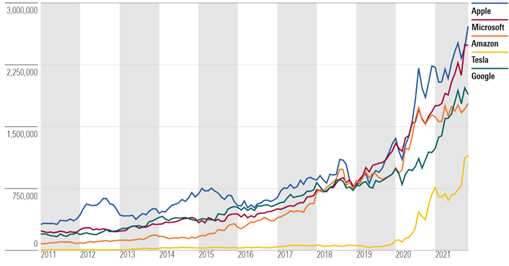

Mega-cap tech stocks make all-time new highs (again). The S&P 500 is dominated by the world’s biggest growth companies, making the US markets a standout globally for performance. Six of these companies constitute 24% of the value of the S&P 500, meaning that performance of the index is largely driven by the “FAANMG” names. Apple is up 125% from January 1, 2020 and closed the year at nearly a $3 Trillion market value. Today, it represents 7% of the index’s value. Of note, Apple’s worth is now larger than the entire US real estate, energy, utilities, and basic materials sectors combined. Its market cap is equal to 13.7% of the total 2020 US GDP. To compare, all publicly traded companies in Canada totaled a market cap of $2.64 trillion at the end of 2020. So, as Apple (and the FAANG group) goes, so does the S&P 500 (Morningstar data).

Market cap of largest U.S. companies

Source: Morningstar Direct Data as of December 9, 2021

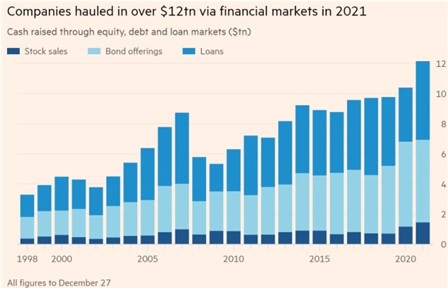

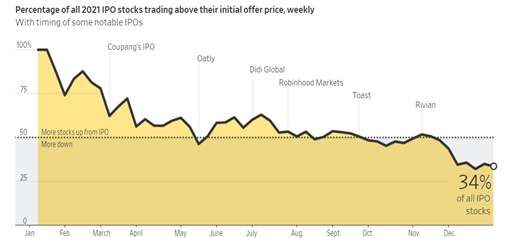

Record amounts raised for IPOs, M&A, loans, and new stock issuance. With interest rates at record lows, companies took advantage to raise capital. Startup founders and early private equity investors also took advantage of high valuations to cash out. Initial Public Offerings (“IPOs”) in the US raised a record of $594 billion, about double 2020’s bumper year. However, many of these IPOs were unprofitable and overpriced to the public. The Renaissance IPO Index ETF was down 10% on the year, and nearly 2/3 of 2021’s IPOs are now trading below their initial list price.

Source: Refinitiv, Financial Times

Source: Dow Jones Market Data analysis of FactSet data, Wall Street Journal

It was the worst year for bonds since 1999. Not all asset classes boomed in 2021. As inflation surged over the summer, and 10-year yields rose to 1.49% from 0.93% (as represented by US Treasures), bond prices fell. In an inflationary environment, the fixed coupon from bonds becomes less valuable to investors. We expect to see an even more challenging year for bond investors in 2022.

Source: Bloomberg, Financial Times

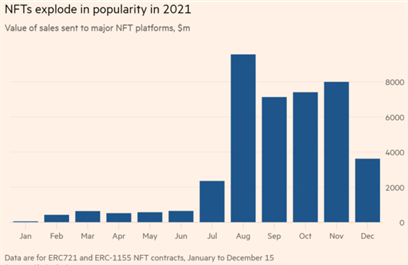

Crypto mania was revived and became mainstream. A year ago, only a niche group of Crypto followers knew what Non-Fungible Tokens (“NFT”) were, but after an NFT collage by artist Beeple sold for $69.3 MM at auction this spring, NFTs exploded in popularity. $40 billion of NFT art and collectibles transactions took place in 2021; by comparison the traditional global art market was valued at $50 billion last year according to figures by Art Basel and UBS: The Global Art Market - The Art Market – A Mid-Year Review 2021 (foleon.com).

Source: Chainalysis, Financial Times

After a year of extraordinary returns, some themes to consider that could drive return and volatility in 2022.

The year ahead will be characterized by a return to “normal” economic activity and the stay-at-home investment themes (like Peloton bikes and Zoom calls) will continue to abate. Money printing and covid-related government support programs will start to decline, which will dry up one of the sources of stock market “play” money. Higher interest rates and somewhat higher inflation could be a drag on some sectors, like parts of the bond market, or bond proxy stocks such as low growth utilities. What worked best in 2021 (mega-cap tech stocks and theme stocks) may not likely be the winners of 2022.

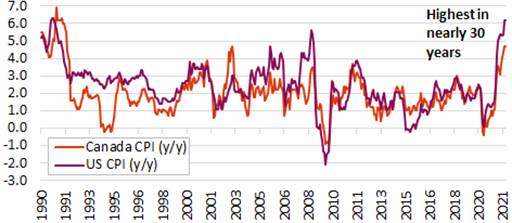

Higher inflation may persist through 2022:

Remember when the price of bread was….

Source: Bloomberg, Richardson Wealth

As we emerged from lockdowns in 2021, economic demand for goods grew faster than supply. Supply was disrupted by covid-related labour force restrictions at different points in time across the global supply chain. The mismatch between demand for goods and available supply is driving some inflation. Covid-related disruptions continue to impact supplies of goods from paper to sporting goods, to fresh produce and meat, to semiconductors for car manufacturing. However, supply should balance demand as the year progresses and manufacturing and shipping normalize again. Wage pressures may be more persistent, as the shortage of labour supply continues. But resuming pre-covid rates of immigration will help this inflation factor in time, as will the drop-off of pay cheque support grants as the economy continues to normalize. A longer lasting impact to prices will likely be the unprecedented money printing by central banks. This has inflated the value of houses, luxury goods, art prices, and stock markets as cash looks for a home in assets that could have a positive rate of return. Protection from inflation in a portfolio is important for the coming years ahead, as we expect inflation to run somewhat higher than it has the last 10 years.

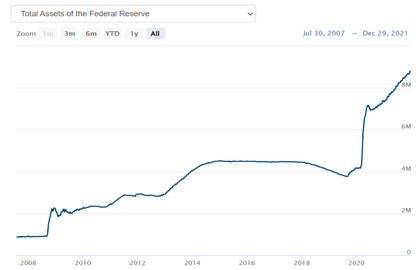

Total assets of the federal reserve

Source: Federal Reserve

Rising interest rates and the slowing of quantitative easing. There is an old trader’s expression: “Bull markets don’t die of old age; they are murdered by the Fed.” Money printing is slowing globally, meaning lower amounts of money will be hitting financial markets this upcoming year. The easy flow of money has lifted nearly all risk-asset classes, so as this slows, so may also the rate of funds going into investments. If interest rates rise too quickly, this could be a drag on the economy as borrowing and debt-repayment costs increase for consumers and businesses. However, we think a significant increase in interest rates over 2022 is unlikely, given the fragility of financial markets today to a pullback of support.

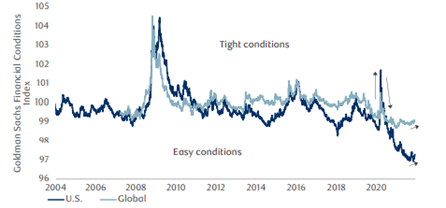

Financial conditions still extremely stimulative but starting to tighten

Source: Goldman Sachs, Bloomberg, RBC GAM

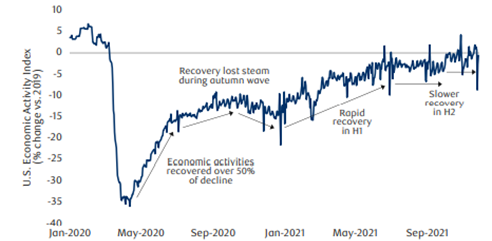

Economic growth will broaden. Covid bumps notwithstanding, we are moving towards more normalized life. Much of the savings that consumers accrued during the pandemic is available for spending. Jobs are plentiful. Rising house prices increase consumer confidence. We anticipate consumer spending to move away from stay-at-home services to back-to-work activities. Less spending on Peloton, more on consumer discretionary experiences like resorts, cruises, restaurants, and hotels.

As business confidence increases, companies are investing to rebuild inventories that were depleted or disrupted during the pandemic. Both are supportive of growing corporate earnings into 2022.

Source: Bloomberg, Richardson Wealth

Commodities are a sector with value. Oil and gas company valuations are still below historic norms, even after 2021’s run up in prices. This is also a sector that maintains value in an inflationary environment. Demand for oil will continue to rise as we increasingly commute to work, travel, and as supply chains repair. After years of low investment, inventories of projects necessary to maintain and grow supply are low. Also, with the strong focus on ESG investing and pressure to divest of commodity producers in institutional portfolios, the cost of capital to expand is very high for companies focusing on fossil fuel development.

The materials sector will be supported by renewed post-covid manufacturing and through government sponsored green infrastructure programs. Somewhat ironic, “build back green” spending will support demand for materials such as copper, iron ore, nickle, lithium and other base metals that are core components of renewable energy infrastructure and electric vehicles.

Investment conclusions

We assume the global economy will continue to improve, but at a slower rate than 2021 as we get into later stages of the pandemic recovery. Inflation and increasing interest rates may cool some demand, but we don’t see recession on the horizon. But with assets valued at premium valuations at the start of 2022, expect more volatility and likely lower returns than the past two years.

Source: Bank of America, Goldman Sachs, OpenTable, Macrobond, RBC Gam

Certain sectors are arguably at premium valuations, such as the top mega-cap tech stocks of the S&P 500. Continued profit growth will be key to maintaining the bull market in these stocks. Over-valued meme and tech stocks that and have little or no earnings could have a greater reckoning this year. Examples: Peloton, Rivian, Beyond Meat, Doordash. With the economy getting back to normal, fundamentals could come back into focus for investors in sectors that have established businesses with real earnings, so called “value” stocks. Technology companies that have real earnings in spaces like cyber security, cloud computing, 5G transformation, automation, will continue to grow and command ongoing corporate investment.

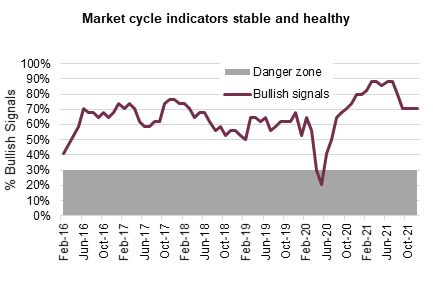

Today, the market cycle indicators the Richardson Wealth Investment team follows are bullish on the year ahead.

Source: Bloomberg, Richardson Wealth

Canadian markets may show well in 2022 with the TSX’s high weighting to value and cyclical companies like banks, insurers, energy producers, and low weight to negative-earnings tech companies. On this basis, over the last half of 2021 we trimmed our exposure to growth stocks and re-invested proceeds into value for diversification and to participate in the sectors that will benefit in the pandemic recovery economy.

We believe equities will provide better return potential than bonds for the year ahead. As interest rates rise, bond prices will move lower. There is a likelihood of negative return in longer maturity bonds this year. We are keeping higher than usual allocations to cash for balanced portfolios in lieu of a large bond allocation, as we feel increasing bond allocations will be more advantageous later this year or next year. Alternative investments are also a diversifier in our portfolios.

The demand for yield will continue to grow, from both retirees and pension style investors. In the continued low interest rate environment, equities that grow dividends at a rate that beats inflation will be in continued demand. We see opportunities in certain telecom, health care, financial services and oil and gas stocks.

Finally, to maximize your savings, be sure to undertake a personalized wealth tax and estate planning session. Ensure you are capitalizing on all vehicles and strategies for minimizing tax and preserving your wealth. If you would like to update your financial planning road map, please get in touch.

We appreciate your trust and ongoing partnership. We welcome your comments and questions. All the best for a healthy and happy 2022.

Best regards,

Tricia Leadbeater CFA

Portfolio Manager, Investment Advisor

Mackie Wealth Group