First quarter 2021 market update

Wondering when the party will end?

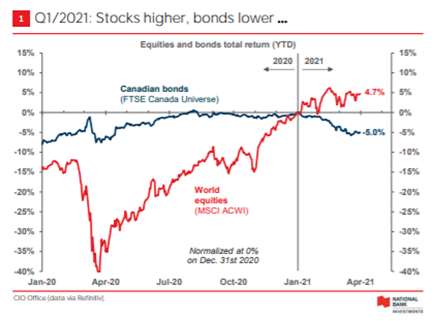

The end of March marked the one-year anniversary of the biggest stock market shock since the financial crisis. The dramatic 35% peak to trough drop was prompted by the unprecedented global economic lockdown of March 2020, enacted to slow the spread of COVID-19.

While many countries are today battling a variant-driven third wave of infection, the market recovery from the pandemic is now well underway. Equity markets decisively recovered their March 2020 losses by November. The new stage up in the bull market was coincident with the US election results and simultaneous announcements of successful vaccine trials.

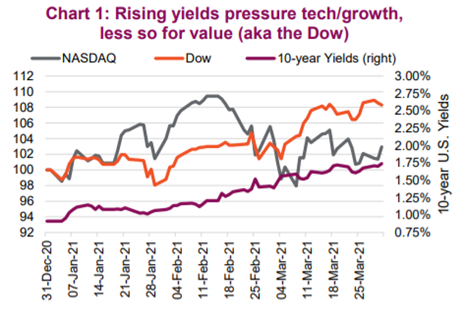

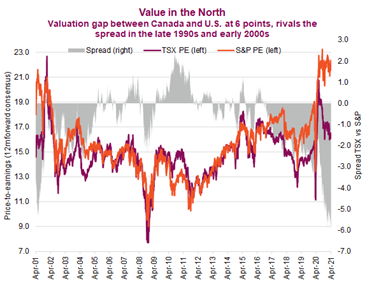

Despite the main street economy still facing severe restrictions and uncertainty, the US and Canadian markets touched new all-time highs several times in this quarter. In contrast to 2020, the mega-cap technology stocks have been the laggards in portfolios. Last year, the focus was on businesses that could thrive in lockdown. This year, investors are focused on cyclical and value stocks that do well when the economy is growing. In a complete reversal of 2020 winners versus losers, Energy and Financials were among the best performers in Q1, which also strengthened the Canadian dollar to its highest level in 3 years.

For the first time years, the TSX’s quarterly performance of +7.3%, far outstripped the NASDAQ, which up +2.8%.

Besides the tentative re-opening of the service industry, another factor that changed in Q1 was that interest rates started moving up quickly. Short term (under 2 years) interest rates remain near-zero, but 10-year rates have moved meaningfully. Rising long term rates are a signal from the bond markets that it expects both inflation and economic growth to improve in future years. The stronger yield curve is generally a positive signal about the future for the economy (growth versus recession is ahead), but higher yields benefit and hurt different sectors. Bonds are negatively impacted in the near term, as better alternatives for yield are available, and investors sell off low yielding bonds.

Source: National Bank

Financials benefit, as they profit from the spread between short- and long-term interest rates. Higher rates have been a drag on technology companies share prices, as it means they will have higher borrowing costs. The expectations of broad economic growth also means certain tech companies will now be competing for investor dollars against other cheaper sectors that will show higher rates of earnings growth moving forward. For example, streaming entertainment services, video conferencing, home office computer equipment, and online meal delivery and other companies benefitting from lockdown are not likely to have the same growth rates of in 2021-22 as compared to last year.

Source: Richardson Wealth

The skies still look blue:

After such stellar stock market performance, the last quarter, it is natural to wonder: Can the party continue forward from here?

For now, we think the fundamentals for the stock market are still very supportive. There was some small volatility and repricing downward of speculative names in Q1 that was healthy. There continues to be opportunity for investment outside the very expensive mega-cap US technology names. We have exposure to industrials and financials in Canada, such as rails, select oil and gas producers, banks, pipelines. We also have exposure to industrial US, Europe, and Japan to benefit from growing economic activity and better valuations in many cases. Many of our holdings in pharmaceuticals, credit cards, consumer discretionary companies give us exposure to the emerging market consumer.

Source: Richardson Wealth

- Corporate profits in the US declined 12% in 2020, far less than the 23% drop that analysts were originally predicting. Earnings continue to beat expectations and are expected to rise 23% in 2021 surpassing pre-pandemic 2019 levels.

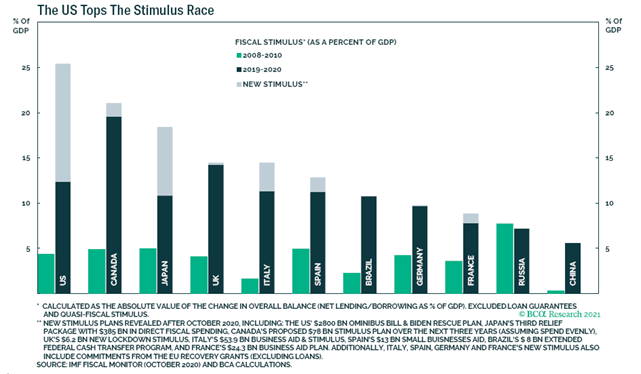

Source: Financial Times

- Monetary policy is still very stimulative, especially in the US with Biden’s $1.9 Trillion COVID-19 support package and potentially another $2-3 Trillion infrastructure spending package later this year. We note that a growing US economy and a build of infrastructure is a positive for Canada, as we will help supply the demand for lumber, agricultural goods, oil and gas, autos, base metals, etc.

Source: BCA Research

- Global central bankers have committed to maintain ultra-low interest rates for an extended period, possibly as far as 2023. The cost to borrow for mortgages, consumer credit, and investing is still historically cheap.

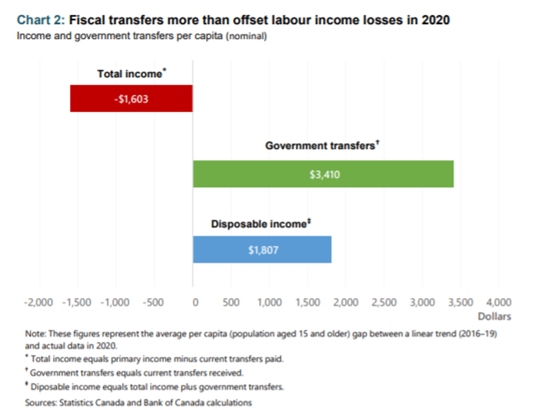

- Government cash transfers are keeping consumer balance sheets intact. Overall, paycheque subsidies and employment insurance more than offset employment income losses in 2020. And, as lockdowns also curbed spending opportunities, many consumers have accumulated savings that they are now ready to spend. Some excess cash was invested, contributing to the upward path in share prices.

Source: Bank of Canada

- Labour markets are improving as stay at home orders are relaxed. Entertainment and leisure sectors are expected to dramatically improve into year-end, albeit a return to pre-covid levels for some businesses may not be fully achieved until 2023. The big re-opening is still to come for restaurants & bars, airline travel, sports and concert events, hotels, theme parks, casinos, theatres, cruises…

Source: Financial Times

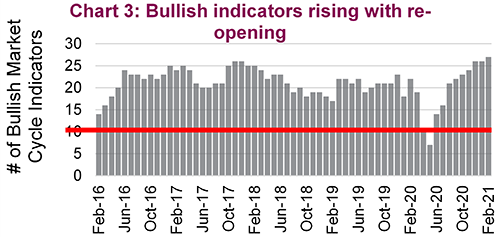

- Leading indicators are at their highest levels since 2018. This chart below represents the Richardson Wealth designed matrix of 33 economic, commodity, interest rate and valuation factors as leading indicators for the market:

Source: Richardson Wealth

RISKS: Mutation, Inflation and Taxes

- The market is pricing in a smooth and joyous return to life and increased consumption later in 2021. However, we have already seen delays in vaccination owing to disrupted manufacturing sites and potential contamination. Mutations may become a concern for managing case counts. Repeated lock-down and re-openings may break more small businesses and lower consumer confidence.

- Interest rates remain at historic lows, but are rising, so returns in government bonds and investment grade bonds could be challenged. Some bond managers are predicting an earlier return to rate increases than originally expected, perhaps in early 2022. While bonds are still worthwhile as a volatility-absorber in portfolios, we are keeping duration short, and investing in alternative income strategies like government agency-backed debt in the US (PIMCO); private lending (Bridging); long-short corporate bond funds (RP), Interest rate hedgers (East Coast), and high-yield (Purpose Credit). We believe these managers have an opportunity and skill set to provide solid returns.

- If central banks raise rates too quickly (a low risk today) we could see some repeats of the “taper tantrums” that shook stock markets in 2013 and 2018. When the Federal Reserve started to walk back bond buying and raise interest rates in the past, stock markets dropped sharply. Fears rose that the tightening could trigger a recession. We had a taste this year when over a period of about 6 weeks, when 10-year bonds went from a 1.07% yield to 1.74%. That small move up in interest rates caused the 7–10-year treasury bond index to drop 5.2% this year, and the 30-year to drop 11.5%. It also caused a wobble in the high growth NASDAQ this quarter, and a big jump up in banks and insurance companies.

- If 10-year yields go up enough, then certain investors will be happy to switch out of stocks and into guaranteed income streams. For the past several years, dividend yields from blue-chip US stocks were offering a far better rate of return than government bond yields. Higher bond yields mean investors do not have to take capital risk in stocks. An asset class switch could cause volatility at some point in the future.

- Elevated stock market prices are a risk to future returns from here. Investors need to be mindful picking stocks of where future growth is not already baked into the current price of the stock.

- Taxes. The past year of global government borrowing could be a future drag on growth in the form of increased tax burden. Some debt could be settled if the economy has a strong enough surge coming out of Covid to increase tax revenue naturally. But higher personal and corporate taxes are almost a certainty in coming years. The Biden administration is starting to present proposals to increase taxes to re-distribute wealth from the largest corporations in the world and the largest income earners, to those who were hardest hit in the pandemic.

Source: Financial Times

For now, increasing consumer and business spending and confidence, low interest rates, and continued government support are underpinnings to equity markets. We plan to navigate the uncertain times with portfolios designed to tactically benefit from changes in the economy this year and next. They also have to have an asset allocation that has some buffers for volatility and keep portfolios structured to strategically support long term plans.

We look forward to connecting in the coming weeks to discuss how we are positioning your portfolio for your investment goals, and to gain more knowledge on any changes to your plans.

We thank you for your continued support and trust. We look forward to connecting in the new year.

Tricia Leadbeater

Director, Wealth Management, Portfolio Manager, Investment Advisor

Mackie Wealth Group

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson Wealth Limited, Member Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.