2020 midyear market update

A tale of two quarters

Source: Richardson Wealth

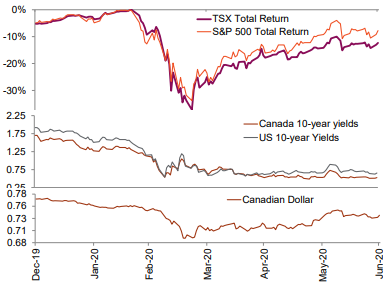

The stock market performance for the first half of 2020 has been a tale of extremes. The first two quarters could not be any more different from one another. 2020 started with record highs being set on indexes in February. The Dow Jones Industrial Average, by example, nearly hit 30,000 points, after reaching 25,000 for the first time ever just 2 years prior. But then, the mysterious flu that had swept through China in January, quickly circled the globe to Italy, then other parts of Europe and the Western Hemisphere. The unimaginable happened when governments around the world mandated a near total shut down of personal mobility and economic activity in March.

Source: Richardson Wealth

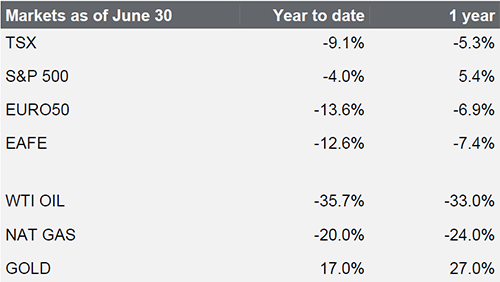

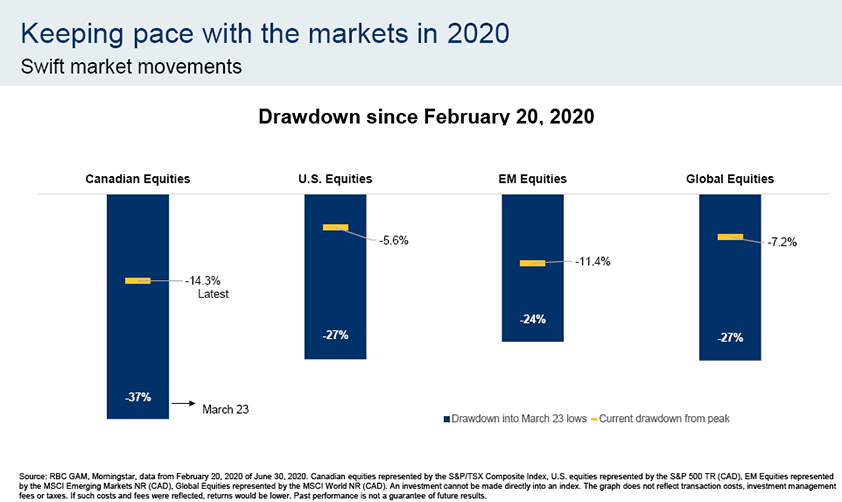

The ensuing panic in the markets that followed the widespread lockdown orders unleashed the fastest bear market in history. Infections were piling up at an alarming rate, and the mortality rate of the illness was unclear but understood to be serious. The bull market that was in place for a decade took less than 20 trading days to unwind. At its lowest point, the MSCI All Country stock index hit -32.9% for the year. The Dow suffered several 1,000 plus point day drops in that two-week period and volatility was more dramatic than during the Financial Crisis. Liquidity in bond and money markets seemed to be drying up, which was a shocking echo of what triggered banking and corporate crises in 2008. The first quarter was a total washout for bonds and stocks.

Then came the second quarter. In the last week of March, Central banks and governments quickly recognized that a mandated shut down of activity required government intervention and compensation. The sharpest recession in history was countered by the biggest synchronized monetary and fiscal stimulus programs ever seen. This decisive action certainly helped avert a global Depression. The US Federal Reserve in particular, positioned itself as a major buyer of US Government Treasuries, mortgage backed securities, corporate bonds, exchange traded bond funds, commercial paper and loans, and thus a floor was put under the bond market, which in turn halted the freefall in equity markets. This decisive action gave investors the confidence to step back into risk assets again, at least in certain sectors.

Source: PIMCO

Where do we go from here? The Market versus Main Street

We think the worst drama of market volatility is behind us, as worst-case economic scenarios have been avoided. However, avoiding the worst case does not entail a quick return to the economic levels and growth of early 2020. A recovery back to the same level of global activity is expected to be gradual and uneven. Many industries, such as hospitality and air travel, are not expected to return to 2019 levels of activity before 2022, and that is assuming a steady progression back to normal economic activity again. At this time, we don’t expect governments will have appetite for full shutdowns again, even in the event of second and third waves, but we may continue to see regional pull backs in economic movement and activity, as we are seeing today in certain counties in California, and regions of Australia.

From an investor’s perspective, we note that even with virus cases rising in parts of the world, economic activity is returning as countries continue on the path to reopen their economies from lockdown. Positive signals, such as improving payroll data and rising PMI manufacturing index orders are being reported. Oil prices are tentatively improving with a modest uptick in demand, coupled with an unprecedented shift of OPEC production and uneconomic production elsewhere.

Despite some green shoots emerging, the seeming exuberance in the market is puzzling, given unemployment levels are still at historical highs and job security is fragile for many. Corporate earnings are due to fall further in the second quarter, dividends are being cut in certain sectors (energy and global banks), personal and corporate debt is high, and banks are likely to record increasing levels of impaired loans.

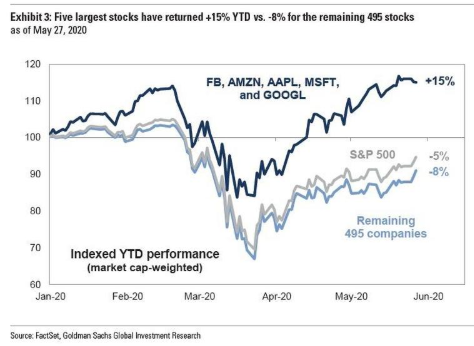

One explanation for the rise in risk assets is the unprecedented wave of liquidity that has rolled over the market, unleashed by Central bank buying of debt and issuance of government support cheques. Further, with interest rates near zero, many view stocks as their only haven for investment dollars. Gold bullion has also been a recipient, with gold prices up 27% so far this year. With regards to stocks, the US market has almost singularly been the beneficiary, with funds flowing into a few core areas: tech, pharma, consumer staples. European and Canadian indexes are still well in the red year to date.

Investor interest is centered on companies that can grow or be stable even in a tepid or recessionary economy: the Working From Home (“WFH”) stocks, such as Microsoft, Netflix, Zoom, Nvidia; pharmaceutical companies that may discover a treatment or vaccine; or defensive global consumer staples that pay a secure dividend (such as Pepsi, Kimberly-Clark, Johnson & Johnson). The US is home to the world’s largest most liquid and stable companies that have above average profitability and growth (such as Microsoft, Google, Visa). These are the companies that are growing through disruptive innovation, have strong global brands and competitive moats, and their cost of capital today is nearly zero. Amazon for example raised US$10 billion in bonds this quarter, with a portion of the issue paying creditors 0.4% for 3 years.

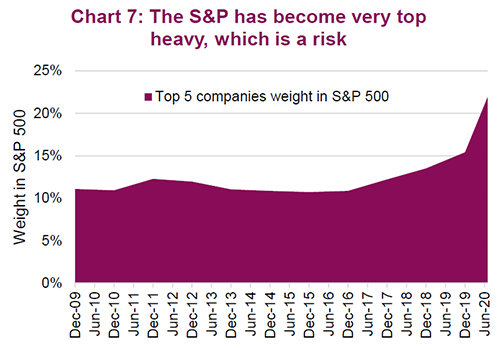

The outperformance of these largest companies has in fact led to concentration we have not seen since the Tech Bubble of 2000. The so-called FANMAG group (Facebook, Amazon, Netflix, Microsoft, Apple, and Google), valued at $6 Trillion today, now constitutes 10% of the global stock market as measured by the MSCI All Country World Index of stocks.

Source: Richardson Wealth

Investor interest in this sector is reasonable, as these Tech companies are extremely resilient, centered on utility like subscription models, and many have grown their business during lockdown. However, extreme concentration in a narrow group of names does not represent a healthy market. Cyclical companies, that depend on a growing economy to grow their earnings are still in deep negative territory for the year, which to us signals the uncertainty that remains in the minds of investors. To the end of the first quarter on the S&P 500 Sector performance was as follows: Energy -37%; Industrials -15.5%; Financials -24.6%; Real Estate -9.5%.

Looking Ahead:

For now, the unprecedented wave of liquidity unleashed by central banks and government borrowing helped to lift asset prices quickly. Looking ahead, we feel portfolios need to be positioned to be able to weather a wide range of possible outcomes over the next year. Even though economic growth is expected to be weak for the next 12 or 24 months, risk assets may still provide positive returns. Companies that can innovate in technology and pharmaceuticals could still deliver earnings growth (but valuations need to be watched carefully from here). Central banks have broadcast they will continue to support markets until the economy is healthy again. As consumers go back to work and school, economic activity will continue to rise, and discovery of a vaccine would dramatically change the market’s outlook.

However, significant risks loom large: the fall will bring a possible end or change to government paycheque support programs; a US election; and rising virus cases may impact consumer and corporate confidence to spend and invest. Consumers and many corporations are very leveraged, and thus are very fragile should a return towards normal not occur.

We have equity exposure to participate in growth should equities continue to perform based on an assumed return to a normal economy in 2021 and by the lift to valuations given by 0 interest rate policies, but we are balanced with meaningful allocations to corporate bonds, some hedged fund strategies, such as arbitrage, alternative credit, and long-short bond funds. We also have exposure to gold and/or gold equities and cash positions. We remain focused on owning quality companies that can deliver earnings despite an uncertain economic environment, while keeping principal protection in the forefront of portfolio construction.

We appreciate your ongoing trust in helping you to achieve your goals.

Sincerely,

Tricia Leadbeater and the Mackie Wealth Group