2018 in review and the year ahead

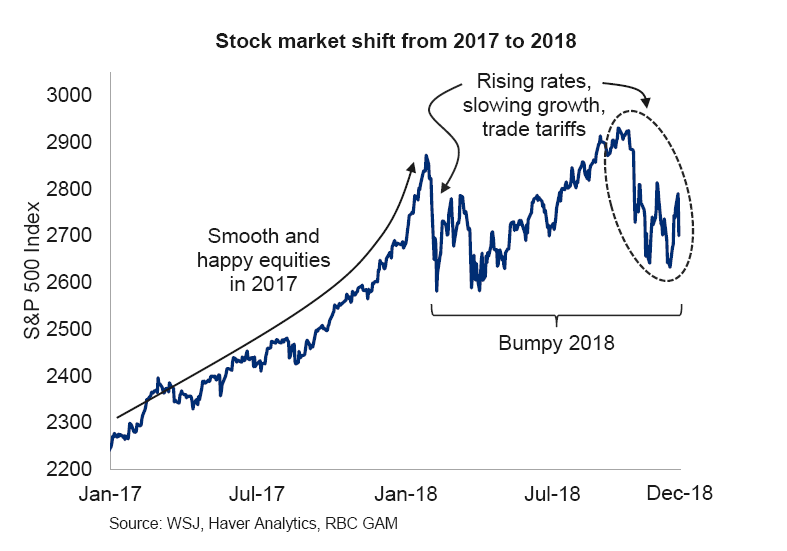

Compared with the smooth ride of 2017, 2018 was a difficult year in markets, with nearly all asset classes ending in negative territory. This was one of the rare years where cash investments outperformed nearly every other asset, including bonds. Cash hasn’t outperformed both stocks and bonds since 1994, and has only happened 10 times since 1926.

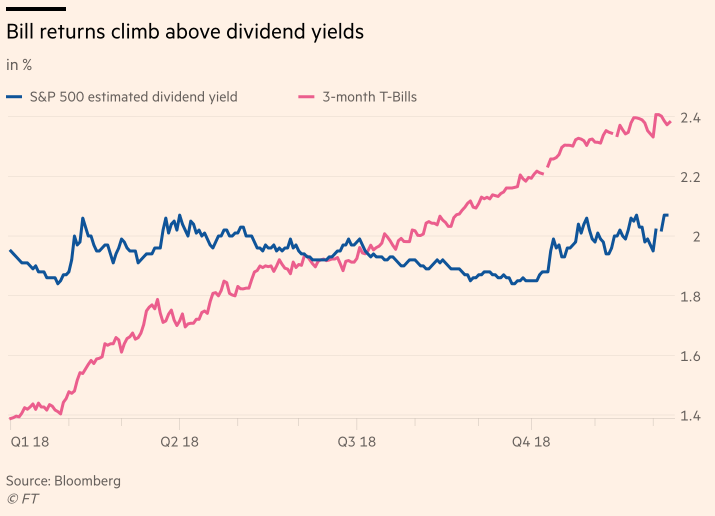

Three-month US treasuries today yield 2.4%, up from 1.4% a year ago. Additionally, the US dollar gained 5% over its major trading currencies in 2018 (as measured by the US dollar index, DXY), making US cash one of the best sources of return for global investors in 2018. Short term Treasuries are also yielding more than the average 2% yield of the S&P 500, making cash a viable alternative investment to stocks for investors that don’t want market volatility. This is the first time since the financial crisis of 10 years ago that Treasuries provide a yield that is higher than dividends. It is also the first time in 10 years that T-bills provide a return above the rate of inflation.

We witnessed asset class and sector rotation out of bond proxy stocks and into cash in the fourth quarter, as stresses on the markets continued to rise. For example, in the week of December 5th alone, $46 billion was redeemed from US stock mutual funds and ETFs, nearly twice as large as any other week on record. Correspondingly in that week, $81.2 billion went into US money market funds. This was the trend for most of Q4. In Canada, three-month government bills have increased in yield in the last two years from 0.5% in January 2017 to 1.65% by December 2018. However, the higher yield in the US as compared to other major economies has continued to draw investors to the US dollar and help preserve its status as the reserve currency of the world.

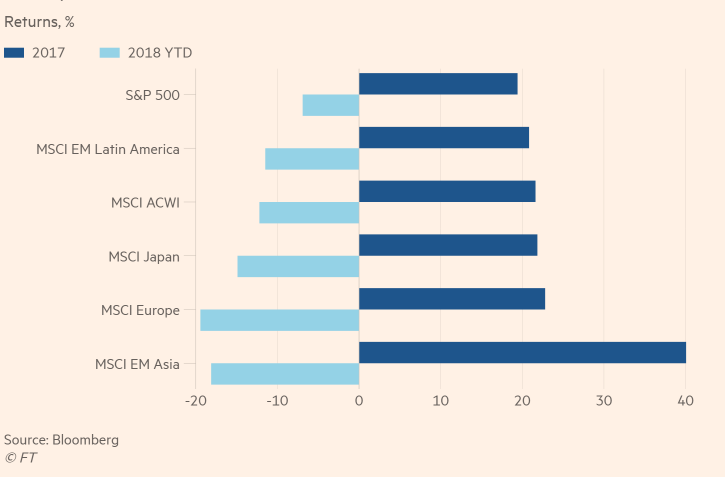

Major equity indices, 2018 versus 2017:

Definition: MSCI ACWI = Morgan Stanley Capital International All Country World Index

Performance of other markets of special interest to Canadians:

-

Gold up +7.5% in the fourth quarter, but still down -2% on the year

-

WTI Crude -25% in 2018

-

TMX Canadian Universe Bond index +1.4%

-

TSX -11.6%

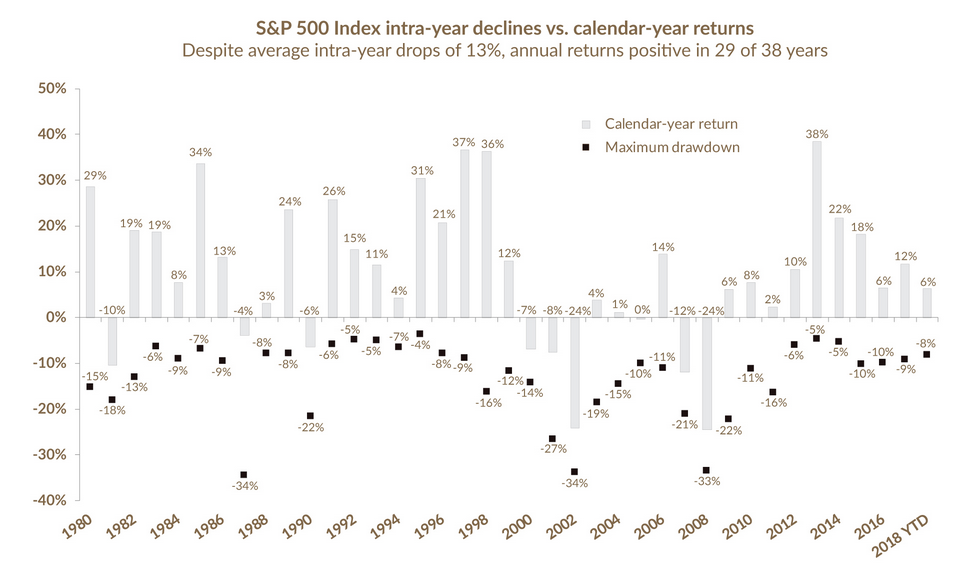

After a year like 2018, it is worth mentioning our principles behind successful portfolio management for the long run:

Source: Edgepoint, Bloomberg. As at September 30, 2018

-

Well-designed portfolios already incorporate the possibility of bear markets.

-

We expect that 2019 markets will continue to be volatile, but we have diversification across our asset classes to shelter portfolios and provide dividend and income when capital gains are more challenging to obtain. Our individual stock holdings have been selected because they are financially strong companies, with low debt to equity ratios, and debt to earnings ratios, and have proven through market cycles they can protect and grow capital over the long run.

-

We plan and invest for a long-term investment horizon that stretches over years.

-

Investments are generally selected with the belief that their business model will continue to perform over years. Only occasionally are stocks are picked for short term returns when the market provides us an opportunity through volatility.

-

Asset allocation is designed to balance the objective of growth in the upswing of the business cycle, and protection in downturns.

-

Active management is key to reducing risk.

-

Asset allocation, the mix in a portfolio between cash, bonds, equities and alternative investments (private loan funds, hedge funds, arbitrage funds, etc.) can be dynamically adjusted to be strategic in times where certain segments of the market have low expected returns.

-

Our client portfolios are balanced to be sheltered from the full brunt of the volatility of equity markets.

-

We use external fund managers when they specialize in a geography or strategy that we cannot replicate, and think is an important exposure for a portfolio. Active over passive index funds have the benefit of risk management within the fund and possibility of outperformance through concentrated portfolios. Like individual companies, investment managers are also picked for the long term, based on their experience, culture, and approach to security selection and portfolio construction.

-

When we invest using funds, we tend to use outside fund managers over passive index funds. Passive index ETFs don’t differentiate between the quality of one bond or stock over another – they replicate all positions that are represented in its parent index at all times. We select specialists who focus on their niche of the market, whether it be fixed income, global stocks, or hedge funds, that have a proven track of managing risk through several cycles. Active managers are proactive in terms of asset class and individual company selection. By example, our managers at RP Investment Advisors and Edgepoint went into the month of December prepared with over 10% cash balances, which would allow them to be opportunistic in December and in the months to come.

-

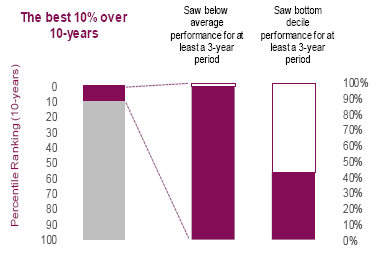

An interesting recent study by Morningstar showed that top performing funds usually experience short term underperformance to their peers. The study included all US equity funds with a 10-year track record and showed that the top 10% of fund managers saw below average performance for at least 3 of those 10 years, including 3 years in the bottom decile of their category. As such, we don’t necessarily fire a manager for a year of underperformance. We monitor our fund managers continuously to ensure their investment process remains intact and aligned with our client’s portfolio objectives.

Top investment managers have periods of underperformance:

Source: Richardson GMP, Morningstar

There is a high degree of uncertainty of what lies ahead for investors in 2019, so we are keeping portfolios positioned cautiously.

-

There is no shortage of concerns for the market to worry on, and they have been well broadcast: the Federal Reserve and now Europe are attempting to unwind the extraordinary Quantitative Easing programs of the last 10 years; how far will the Federal Reserve raise rates and will that kill the US expansion; the stress the rising US dollar is putting on emerging markets and global economic growth; US versus China trade tensions; China’s economy slowing down, which drives 25% of the world GDP; Brexit and political tensions across Europe; extreme uncertainty for oil prices.

-

To position ourselves for highly uncertain times we are doing the following:

-

Keeping bond durations short and underweight in portfolios while we expect returns to continue to be low. There is little added return to own 10 year over 2-year bonds, so we will stick with short maturities until that improves. Even though returns may be unexciting, our selections should be far less volatile than stocks and provide a portfolio ballast in uncertain times.

-

Using certain Alternative strategy funds and hedge funds which can make money in volatile markets, be uncorrelated and less volatile than stock markets.

-

Investing in equities that don’t have high degrees of leverage in a rising rate environment, who have moats around their business, and are resilient in their sales should consumer spending slow down. Equities which can raise their dividends sustainably over the rate of inflation are also appealing.

-

We continue to be cautious and underweight Canadian equities.

Much of what is moving markets right now is political and depending on how issues are resolved will create wild swings in the markets. Having cash, alternative strategies and bonds on board in portfolios will allow us to be both resilient and opportunistic.

We thank you for your support and trust and welcome your comments,

Tricia Leadbeater and the Mackie Wealth Group

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.