The Robot's Economy

Despite some intra-year volatility, equity markets are having a strong year with broad equities up nearly 10%.

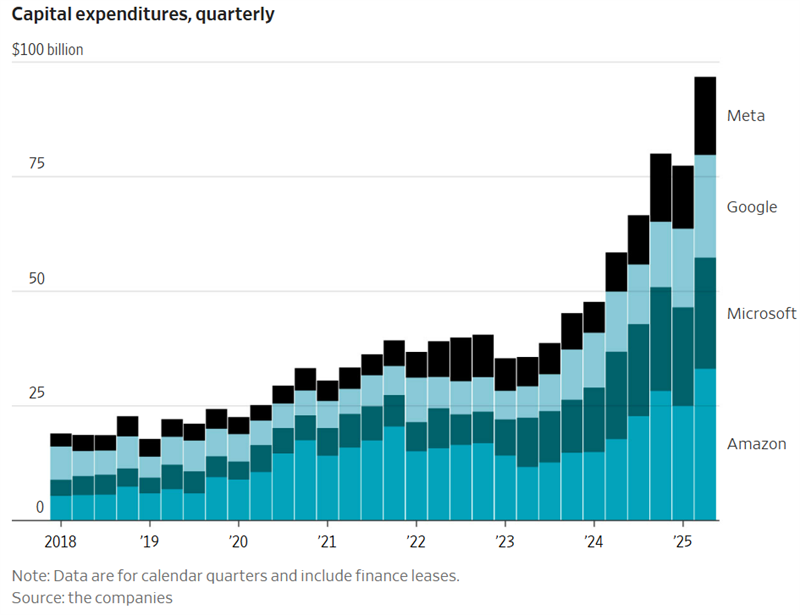

While geopolitics and tariffs have been significant, the dominant market theme has been the massive infrastructure spending related to artificial intelligence.

This investment is happening at a tremendous scale and it is accelerating.

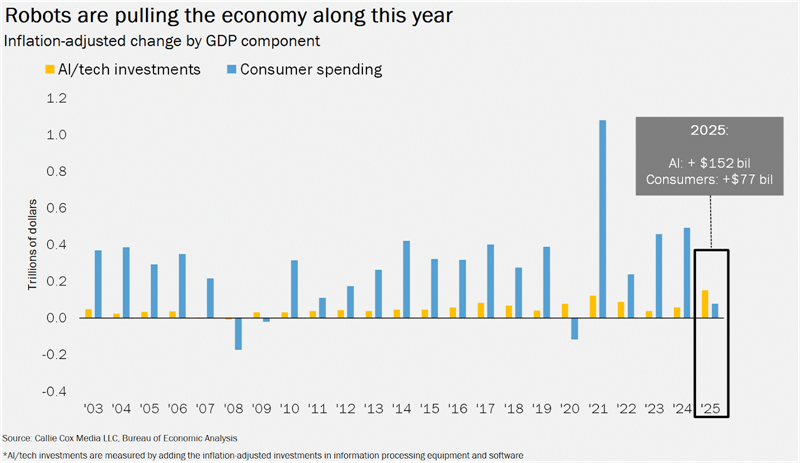

In fact, tech infrastructure spending in the US has even outpaced all consumer spending on goods so far this year.

The dominance of this theme is showing up in a major way in market capitalizations, with the three largest companies in the S&P 500 now accounting for over 20% of its total value.

Where does this all go? One path sees AI-driven productivity gains spreading to the rest of the economy, lifting all sectors. The other path is one of caution, where the pace of AI improvement plateaus and productivity gains stall.

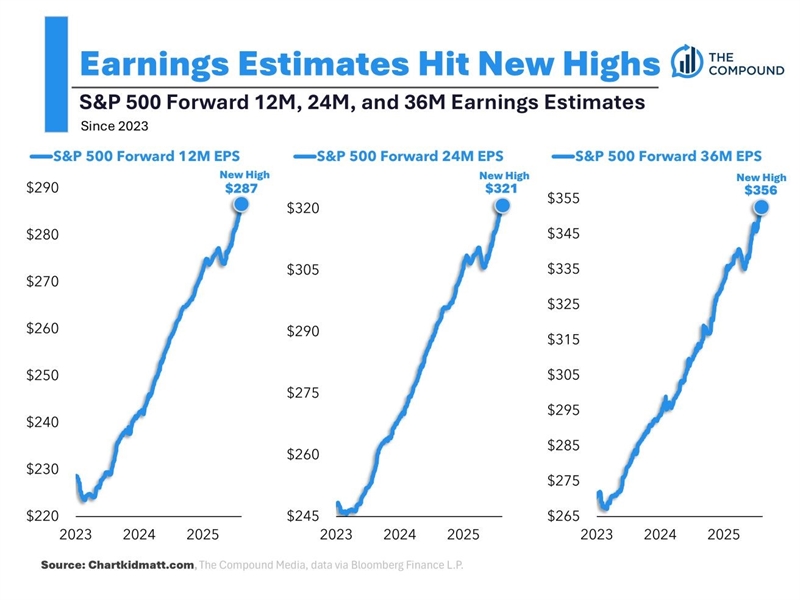

Unlike the dot-com bubble of 2000, this investment is supported by material and rapidly increasing corporate earnings.

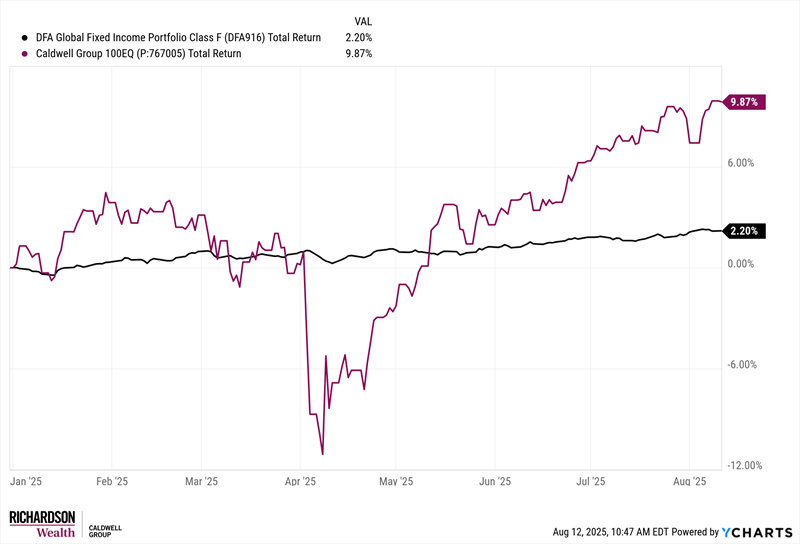

No one knows for certain which path will prevail. Our portfolios have benefited from the rise of AI, but they are also positioned to lean away from the market’s most aggressive tendencies. Bonds, which are a key dampener of volatility in our strategies, have also shown resilience.

In a world that is rapidly evolving, the principles of sound investing do not. Market themes come and go, it is foolish to assume they will fail, but it is dangerous to go all-in. A well-constructed portfolio is designed to endure any single outcome. As such, our guidance is unchanged: stay diversified and maintain the discipline of your long-term plan.

Justin Caldwell

Senior Investment Advisor, Portfolio Manager

Caldwell Group