Markets are reacting sharply today to sweeping new U.S. tariffs and renewed fears of a global slowdown. The size and scope of the announced tariffs are unprecedented — surpassing even the most aggressive forecasts.

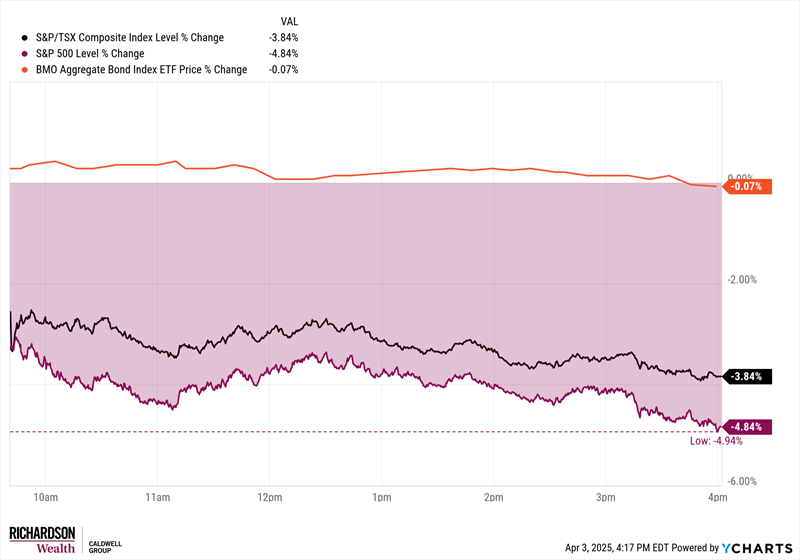

Global equities are broadly lower, with U.S. indexes hit hardest. If these levels hold, they bring markets back to where they stood last fall.

Bond markets are holding up well. Yields are falling, suggesting markets expect central banks to respond with rate cuts.

While these moves are fast and dramatic, they reflect a repricing of assets — not a collapse.

As Canada knows all too well, trade negotiations begin with aggressive positions used more as leverage than as final objectives. Negotiation and political posturing will likely dominate the months ahead, and these risks may moderate over time.

What to expect?

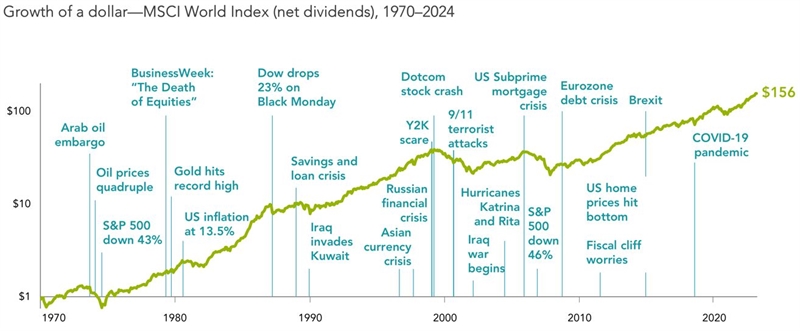

From Brexit to COVID, from trade wars in 2018 to inflation in 2022, market shocks reveal vulnerabilities — and prompt adaptation. Companies rework supply chains. Policymakers shift direction. Central banks recalibrate. Investors refocus.

The adjustment process is what matters — not the initial disruption.

Your portfolio has been built to weather moments like this. Volatility is not a flaw in the system; it’s the reason markets offer long-term returns. Strategic diversification, thoughtful rebalancing, and a focus on fundamentals are what allow investors to stay the course — and benefit from recovery.

We're watching developments closely. Where opportunities present themselves, we’re already looking to rebalance and harvest tax losses proactively.

If you have questions or want to talk through what this means for your portfolio, we’re here.

Justin Caldwell

Senior Investment Advisor, Portfolio Manager

Caldwell Group