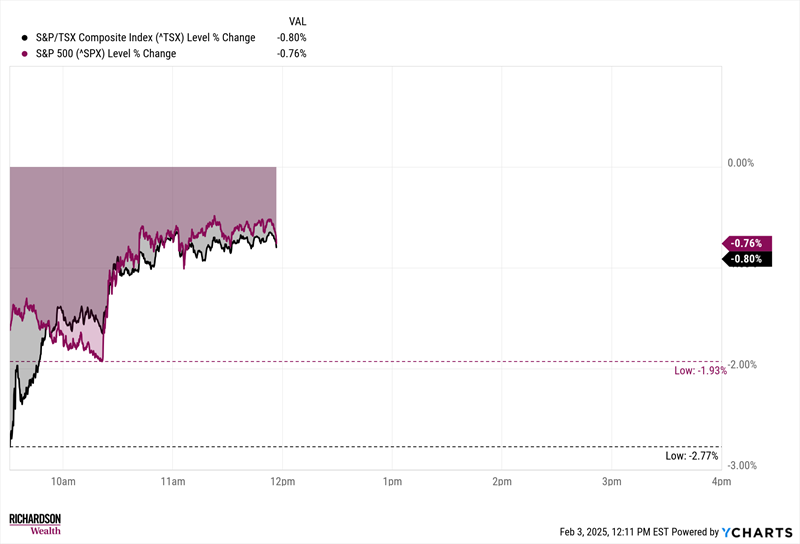

This morning, markets reacted sharply to the newly announced tariffs and Canada’s swift retaliation—an escalation that could mark a historic shift in Canada-U.S. relations. While trade friction was expected, the severity of these measures was higher than anticipated and resulted in an initial sell-off.

As of 12:00 pm, markets have already regained a significant portion of their losses, amid news of ongoing discussions between Canada, the US, and Mexico. Policy is likely to remain fluid in the coming weeks and we expect increased market volatility.

Moments like these test investors' nerves and tempt our instincts to make changes. While headlines may feel urgent, our approach remains grounded in discipline, diversification, and strategic decision-making.

We are focused on:

- Avoiding reactionary moves – Short-term volatility rarely dictates long-term outcomes. Speculative trading is typically counterproductive.

- Maintaining disciplined diversification – Our global equity, bond, and currency strategy is designed to absorb shocks and navigate uncertainty. It has been excelling in the current environment.

- Controlling risk – We continuously assess market dislocations for opportunities to optimize positioning while keeping risk targets aligned with your goals.

- Tax-loss harvesting – When appropriate, we can realize capital losses by selling certain taxable holdings and replacing them with equivalent investments to maintain market exposure while preserving tax benefits.

In case these tariffs persist, we recommend reviewing the list of affected goods to assess any personal impact.

Your financial well-being remains our priority. Please reach out if you have any questions or concerns.

Justin Caldwell

Senior Investment Advisor, Portfolio Manager

Caldwell Group