As Canadians, we’ve all felt the impact of recent trade policy upheavals. Long-held norms in international trade are being rewritten, and markets are whipsawing in response to shifting policies. Businesses thrive on certainty, and right now, uncertainty is at record levels.

Naturally, this raises questions about your portfolio. What happens next? No one can predict short-term movements—especially in an environment where policy direction seems to turn on a single individual’s decisions. However, dealing with uncertainty is fundamental to successful investing. That’s why we construct our portfolios to weather these unpredictable periods.

Why Diversification Matters

Despite the volatility, our portfolios remain modestly positive this year. Here’s why:

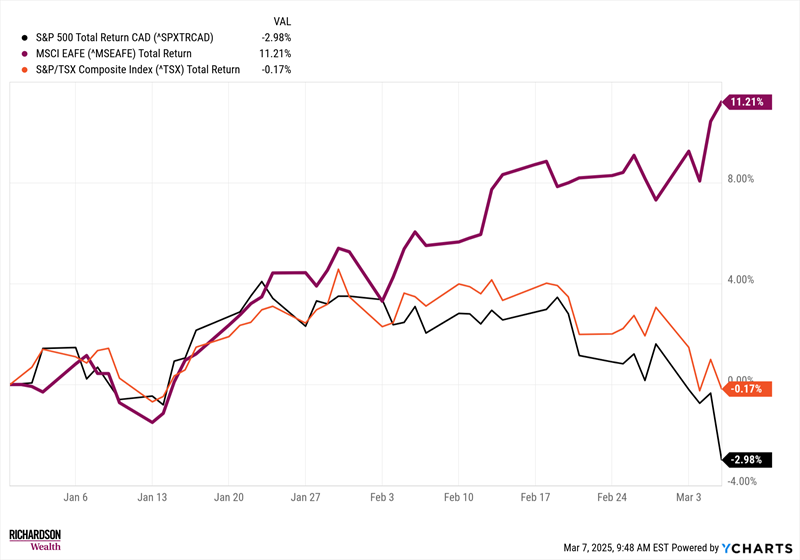

Geographic Diversification: While U.S. and Canadian equities have faced headwinds, international markets—particularly Europe —have gained over 11% this year, helping offset domestic declines.

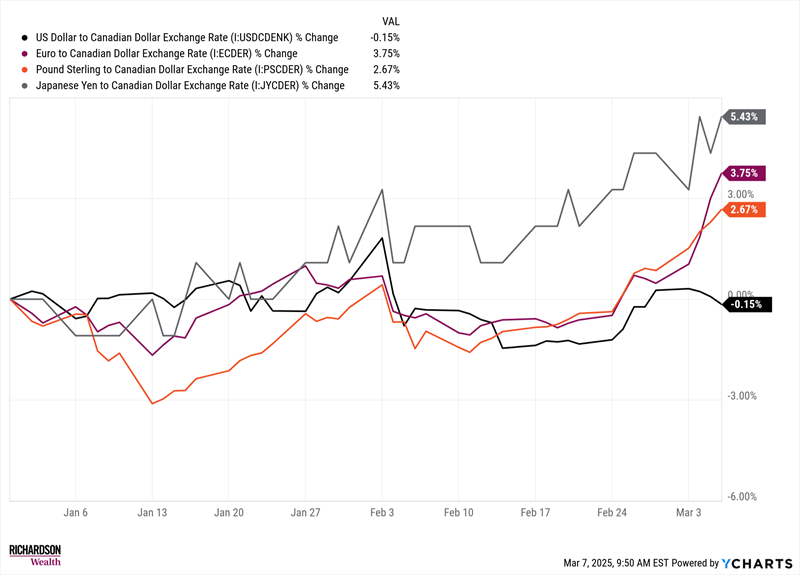

Currency Diversification: The Canadian dollar has weakened against a basket of global currencies. While this impacts purchasing power, it has been a tailwind for your portfolio, as we hold global assets in various currencies.

Sector Diversification: Not all industries are equally affected by trade tensions. While manufacturing and transportation have seen the most significant impact, other sectors have remained resilient. A well-diversified portfolio ensures we are not overexposed to any single risk.

TSX Composite year-to-date sector returns. Source: FactSet

Staying the Course

No strategy is immune to market declines—volatility is part of investing. In fact, the ability to earn returns above inflation exists precisely because of this uncertainty. A diversified approach, however, gives us the best possible preparation to manage these fluctuations and keep portfolios positioned for long-term success.

If you have any questions or want to discuss your portfolio, please don’t hesitate to reach out.

Justin Caldwell

Senior Investment Advisor, Portfolio Manager

Caldwell Group