Life insurance: Term vs permanent

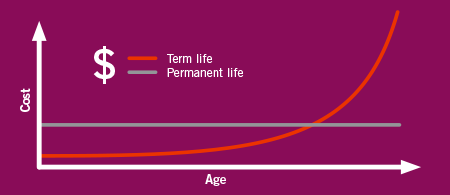

Don’t leave your long-term insurance planning too long. Insurance gets more expensive as you age.

Term life insurance

This is affordable in the early years. Premiums then rise at certain time intervals, increasing exponentially in the later years.

Permanent life insurance

While it is more expensive to purchase initially, it can be structured to keep premiums level for your lifetime.

Permanent life insurance for estate planning can provide:

- Funding for your tax liability at death

- Estate equalization needs (e.g. keeping the family cottage for the next generation)

- Gifts to charity

Life is complex. Proper insurance planning can help smooth the path ahead.

Please contact us should you have any questions.