Assurance vie : temporaire ou permanente

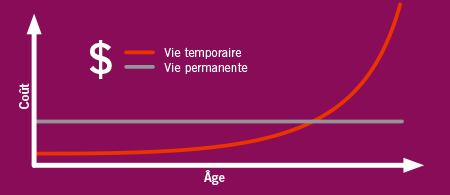

Ne tardez pas trop à planifier votre couverture d’assurance à long terme. Le coût des assurances augmente avec l’âge.

Assurance vie temporaire

Cette assurance est peu coûteuse les premières années. La prime augmente par la suite à certains intervalles, et de façon exponentielle dans les dernières années.

Assurance vie permanente

Même si son coût de souscription est plus élevé, cette assurance peut être structurée de façon à niveler le montant des primes tout au long de votre vie.

Dans une perspective de planification successorale, l’assurance vie permanente peut permettre de :

- Financer votre facture d’impôt au décès;

- Partager équitablement votre succession (p. ex., conserver le chalet familial pour la prochaine génération);

- Faire des dons à des organismes de bienfaisance.

La vie est complexe. Une bonne planification de l’assurance peut aplanir les difficultés en cours de route.

N’hésitez pas à nous contacter si vous avez des questions.