We have faced a number of questions on tariffs and how those developments could impact the markets and investments. We would like to share a few thoughts on these matters. In general, markets dislike uncertainty and can be volatile in the short term but are biased to move higher over the long term as history has shown. Our current challenge is to stay the course to benefit from long-term market growth, while navigating turbulence in the near-term surrounding tariffs and economic uncertainty.

Our approach is to ask ourselves and recognize what we can’t control vs. what we can control. Knowing the difference will help us reduce stress and avoid emotional mistakes as investors.

What we can’t control

What we can’t control is when the next tariff headline will hit the news and whether it is negative or positive for the markets. Tariffs were announced in February (negative), then delayed (positive), then enacted in March (negative), and now there’s news of a potential compromise with Canada and Mexico to scale back the new 25% tariffs (positive). The headlines are changing almost daily, like the wind. Good luck to anyone trying to predict these moves.

As you may recall, Trump using tariffs as a negotiation tactic is something we have seen before in his first presidential term. The tariff and trade war headlines were similarly fear-inducing at the time, but markets eventually worked through the noise and marched on. This could be the case for the present situation because, on the other side of tariffs, there are many pro-growth U.S. policies (tax cuts and deregulation) and corporate earnings remain strong.

What we can control

What we can control is risk management and leveraging the power of diversification to protect capital and capture opportunities outside of North America. At a high level, our globally diversified, multi-asset portfolios are built to protect capital and weather the storm in turbulent times like today and then provide long-term growth once the storm passes.

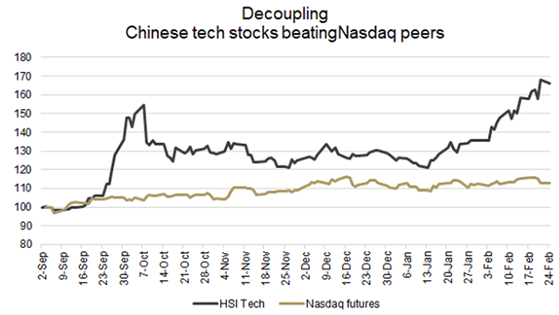

Within the equity component of our portfolios, we have added and will continue to increase exposure to international markets, such as Europe and China. Investors are shifting their focus away from the U.S. stock market to European and Asian equities as higher economic stability and relatively cheaper valuations in those regions offer better opportunities. In particular, we want to highlight our shift from U.S. technology to Chinese technology that has been fruitful thus far. The chart below shows the outperformance of Chinese technology stocks over U.S. technology stocks since the fall of 2024. Even with the U.S. announcement of tariffs on China, Chinese technology stocks have continued to march higher. The key takeaway is that there are still pockets of strength in the global stock market and that is good news for global investors.

HSI Tech = Hang Seng Index Technology

Nasdaq = U.S. Technology

Source: Richardson Wealth

In conclusion, like all past episodes of market turmoil, this too shall pass. If we embrace volatility as part of investing, we can reap the rewards of long-term growth. Future tariff headlines will no doubt cause more short-term uncertainty and volatility, but that volatility can translate into opportunities for active investors. We believe our portfolios are well-diversified and well-structured to handle such short-term market turbulence.

All material has been prepared by YD (Young Dang) Wealth Partners. YD (Young Dang) Wealth Partners is an investment advisor team at Richardson Wealth Limited. The opinions expressed in this material are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license. Richardson Wealth Limited, Member Canadian Investor Protection Fund.