Challenges and Implications of Cognitive Decline

With age, individuals may experience a reduction in fluid skills, leading to diminished desire for extensive decision making and increased risk aversion. Notably, a decline in fluid skills can serve as a predictor of financial acumen among seniors, highlighting the importance of understanding and addressing cognitive changes. Despite potential declines in confidence in other areas, older adults often retain a high level of confidence in managing their finances. However, this confidence may not always align with optimal decision making, as cognitive changes may affect the ability to evaluate risk and identify investment opportunities accurately.

Leveraging Experience and Crystallized Intelligence

While declining fluid skills present challenges, crystallized intelligence, enriched by accumulated life experiences, can serve as an asset in financial decision making. Investors drawing from past market experiences exhibit greater caution and resilience in navigating market volatility. Moreover, older adults demonstrate a willingness to prioritize long-term financial goals over short-term gains, reflecting a forward-thinking approach rooted in personal experience.

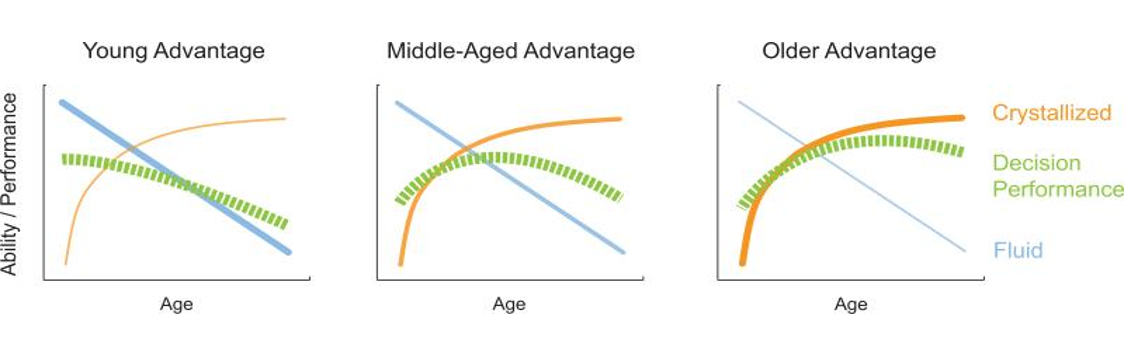

Fluid skills decline as we age and become a less dominant tool for decision making. Crystalized skills decline much later and become a more dominant tool as we age.

(Image from HHS Public Access, Financial Decisions & Aging Population)

Adjusting Investment Strategies for Changing Needs

In the context of a prolonged low-interest-rate environment, older investors may need to reassess their asset allocation strategies to align with changing financial needs and risk tolerance. Balancing the preservation of capital with the pursuit of investment returns becomes paramount, necessitating a careful review of investment portfolios and withdrawal rates. Strategic adjustments, such as increasing exposure to fixed-income securities or revising investment policies, can help mitigate risks and ensure financial stability in retirement.

Strategies for Mitigating Risks and Enhancing Financial Outcomes

Effective risk mitigation and financial planning require proactive measures, including open communication with trusted family members and financial advisors. These conversations provide opportunities to create contingency plans and enlist additional support during financial reviews. Collaborating with professionals can facilitate strategic adjustments to investment portfolios, ensuring alignment with long-term financial objectives and enhancing overall financial well-being in later stages of life.