Lifestyle, Longevity and Liquidity

A snapshot of aging Canadians

Aging, we believe, is less about ‘lost youth’ and more about a new stage of life. Certainly, your state of health is a major contributing factor to your experience as an older individual. Assuming you remain relatively well and active, what can 65 and older look like in Canada? What are some of the key wealth-planning considerations for older Canadians? With individuals generally living longer, one of the most important issues is ensuring your funds last throughout the later part of your life.

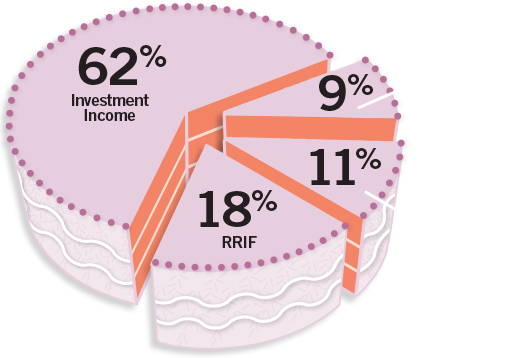

|  Retirement Income Sources Retirement Income Sources

Consider Mary’s example. A widowed 75- year-old, Mary inherited her late husband’s Registered Retirement Income Fund (RRIF). She now holds assets totalling $3 million, not counting the value of her home. Here is a breakdown of her income: • 62% investment income

• 18% RRIF

• 11% Canada Pension Plan

• 9% Defined benefit pension |

Ready to make sound decisions for your financial journey?

Contact us to help answer questions like these.

Call us at 403.355.6042