How We Help

We help families achieve their financial goals by providing careful ongoing advice through our high-net worth capabilities.

True wealth management is much more than simply investing money - it encompasses all parts of a family's financial situation including portfolio management, financial planning, retirement planning, insurance planning, estate planning and tax planning.

In order for your family to comfortably meet its financial goals you must address your overall financial health and not just your investment management needs. Achieving true wealth is much more than simply buying a basket of Exchange Traded Funds - it takes careful and astute long-term planning. Achieving long-term financial stability is challenging, takes hard work and careful planning. This is where we come in.

Our Process

All of our client relationships begin the same way - a relaxed meeting consisting of a straightforward exchange of ideas.

We believe that listening is critical to the process as it allows you to clearly express your objectives and challenges, ensuring we clearly understand your financial situation and unique goals. During our initial complimentary face-to-face meeting, expect us to listen carefully to your needs, and to have a frank and open discussion about your goals and expectations.

Wealth Influences Every Aspect of Your Life

Instead of offering a generic solution, our team is committed to personalizing financial strategies for every client. Through every phase of your financial cycle, we will make certain that you have a clear vision of your progress. On your request, we will conduct reviews so we can adjust and update your wealth plan according to the changes in your life.

Wealth management is a lifetime process composed of many small steps. What we strive to provide is not simply a service, but an opportunity for you to truly understand your own wealth, so you can tap into its potentials to enrich your life experience.

Gauging The Financial Risks You Face

We will help you to examine your current situation to derive realistic goals with a measurable timeline. We will also help you to gauge the financial risks you face and find solutions that protect your wealth. When you retire, you will enter a different financial phase. Prior to this we will help you to draw a blueprint on how to create sustainable income, how to maintain your lifestyle and how to support your loved ones in the coming years. We will help you to discover a strategy that works for you and your family.

A Second Opinion Is Only the First Choice

Committing to a financial strategy is a hard decision. Without sufficient experience, every financial plan could seem like the right one.

However, to have a real choice, you must have a basis of comparison. The financial industry is riddled with one-size-fits-all packages. While these offer a partial solution, they also leave many opportunities unexplored. Worse yet, a financial strategy is a long-term plan with slow effects. How do you know you have a strategy that is perfect for you?

We care more about the happiness of our clients than the quantity of the people we advise. We tend to ask questions other wealth management professionals neglect. We believe that much can be revealed in the way advisors connect with their clients, so we try to engage our clients on a profound level that results in a truly customized solution. Perhaps the plan you have is a perfect fit, but perhaps it addresses only some of your needs. When a second opinion is readily available, why take a chance when you don't have to?

I. Financial Planning Steps

My mother-in-law has often said that it isn’t about how much you make but rather about how much you keep. A sound financial plan will ensure that your family achieves their financial goals and grows their wealth steadily over time.

It is important to keep in mind that a true financial plan is a long and extensive process and not something that can be done overnight. There are a lot of steps that need to be taken in order to provide you with the best solutions to achieve your family’s goals.

These steps include:

I. Define the Client Relationship

This is where we get to know you and your family, establish your financial goals and objectives and get a strong sense of what we can do to bring you piece of mind.

II. Data Gathering

This is where you provide us with all of the financial information that we require to properly analyze your overall financial health and develop your financial plan.

III. Financial Analysis

During this step our team, with the help of out Tax & Estate Planning Group will evaluate your overall financial health. Often, we may require additional information from you during this stage.

IV. Developing the Wealth Plan

This is where our team prepares the strategies that will help you achieve your goals and compiles the information in an easy-to-read summary. Once this has been completed we will meet in person and present our recommended strategies to you.

V. Implementation of the Wealth Plan

If you like what we are proposing we will discuss how we are going to put everything in place and start the implementation process.

VI. Review

Life is full of surprises. And now that your family has a Wealth Plan in place we will be ready to tackle whatever financial surprises are thrown at you. If something changes that make affect you reaching your goals we will let you know. If something unforeseen happens on your end we are here to help at a moments notice.

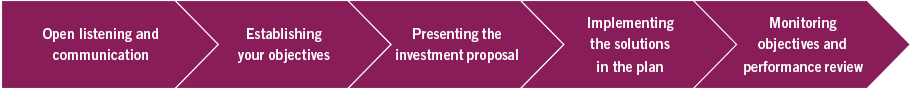

II. The Portfolio Management Steps

I. Open Listening and Communication

During your initial complimentary, face-to-face meeting, expect us to listen carefully to your needs, and to have a frank and open discussion about your goals and expectations. No paperwork; just a straight forward exchange of ideas and an opportunity to get to know each other.

II. Establishing Your Objectives

If you like what you hear, the next step is completing a thorough Investor Profile Questionnaire to clearly determine your objectives, and assist in understanding exactly where you are today, and where you want to be in the future.

III. Presenting the Investment Proposal

Mounir will sit down with you in person and take you through the investment proposal at a pace that you are comfortable with. This will ensure that you have an excellent understanding of the strategies we are recommending.

IV. Implementing the Solutions in the Plan

Mounir and his team will then implement the various facets of the plan. This process gradually takes place over the course of several months. During this time, Mounir will provide you with regular status updates so you know exactly where you are in the process at any given time until the plan is fully implemented.

V. Monitoring Objectives and Performance Review

Mounir maintains a continual watch over your investments and your investment strategy, and makes changes to your portfolio as needed. He also meets with you on a regular schedule as outlined in your proposal to ensure your financial plan continues to successfully perform up to expectations.