Pay Yourself First

While an entry-level salary might seem insufficient to support savings, reframing your perspective can help. Treat monthly savings as non-negotiable, akin to fixed expenses like rent or phone payments. Automatic transfers to a savings or investment account, even with a modest initial amount, instill a positive savings habit and curb the urge to spend on non-essential items.

Understanding Compound Returns

Compound returns refer to earnings (interest or gains) on previous years' returns. When $1000 earns 5%, it yields $50 in the first year, with subsequent years' returns increasing due to reinvestment. $1050 earning 5% in the second-year, results in $52.50 gain. The rate of return you earn and the length of time the funds are invested significantly impact compound returns. A single deposit of $1000 at 5% grows to $8144 after 10 years, while $5000 invested annually at the same rate accumulates $74,178 after a decade.

Starting Early

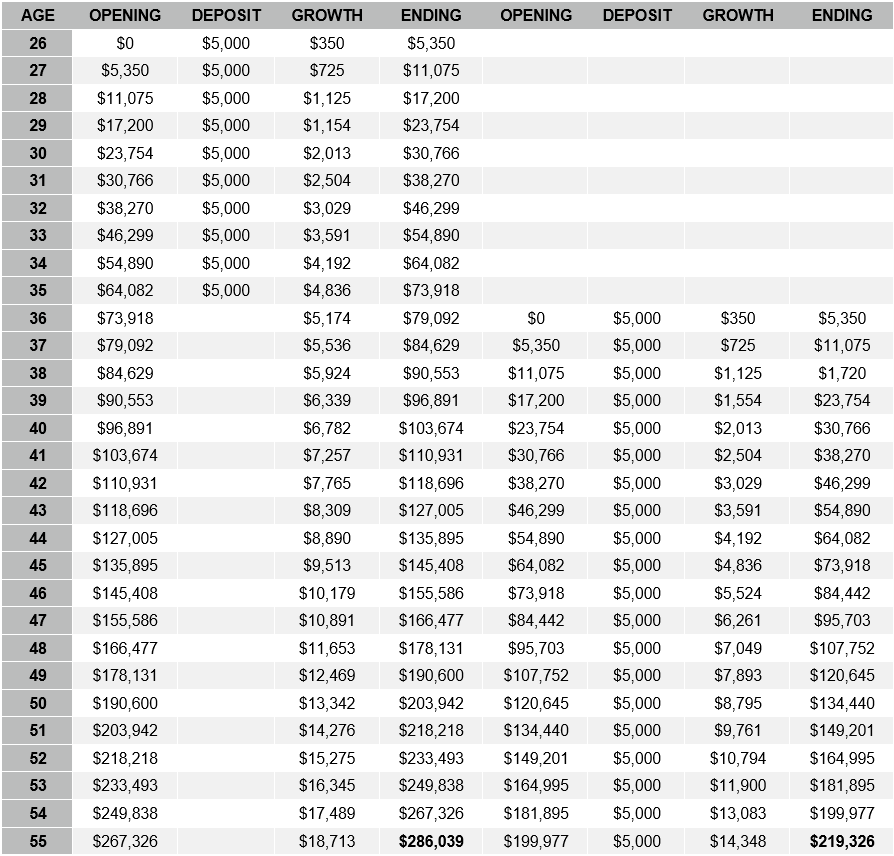

The overlooked advantage of compound returns lies in its increasing significance as savings grow. For instance, saving $5000 annually from age 26 to 36 accumulates more wealth by age 55 than starting at 36 and saving $5000 annually until 55 ($50,000 total deposits). Starting early proves remarkably advantageous in wealth accumulation.

The chart below illustrates the power of starting early. Because the portfolio is compounding on a much greater sum after 10 years, the investor who starts early would need to invest less and still achieve a higher value at the end of 30 years than the investor who defers investment for 10 years and makes 20-year contributions.