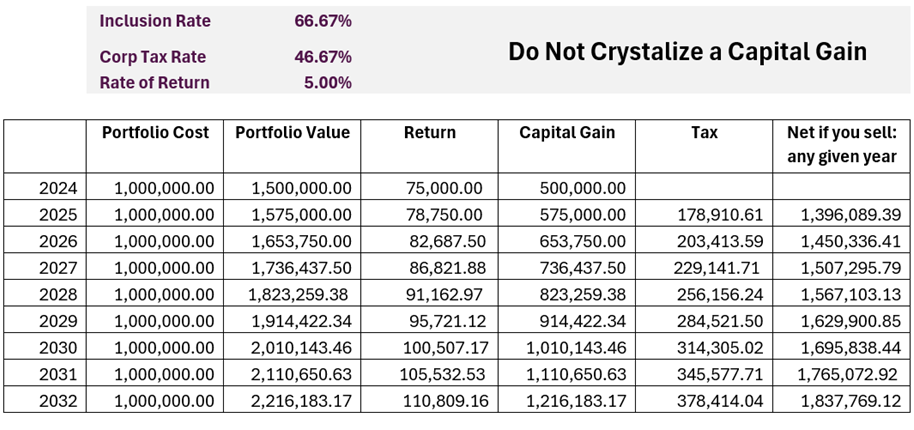

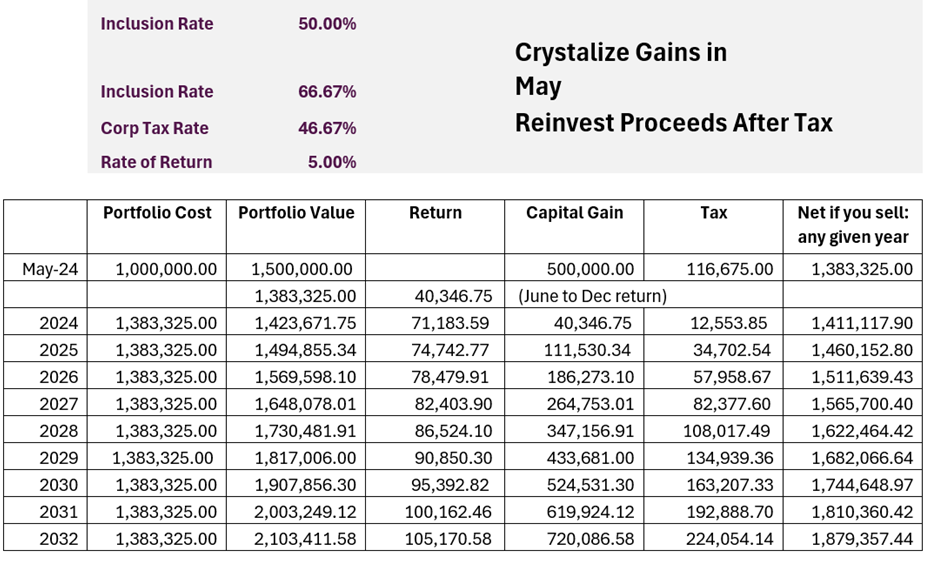

Below is a little chart that tries to quantify the impact of these changes.

This is a rather simple analysis. Other factors to consider when making this important decision are the spread between bid and ask and the ability to reinvest at good prices, your individual time horizon for the corporation and other mitigating strategies that could be put in place to offset tax.

For more detailed information, or an introduction to our Tax & Estate Planning team, please feel to contact us directly.