WHERE’S THE GROWTH?

The Bank of Canada recently dropped interest rates and some economists are predicting that they will fall further. The guaranteed side of portfolios just isn’t delivering the returns that are needed to fund most Canadian’s retirement expectations.

To further complicate the matter, the stock markets have been volatile – especially in Canada. As of late February, the S&P/TSX Composite Index is still below its September 2014 high. Meanwhile, the S&P 500 index is pushing into new all-time highs. Do you make the jump into U.S. stocks at this time? What about other parts of the world?

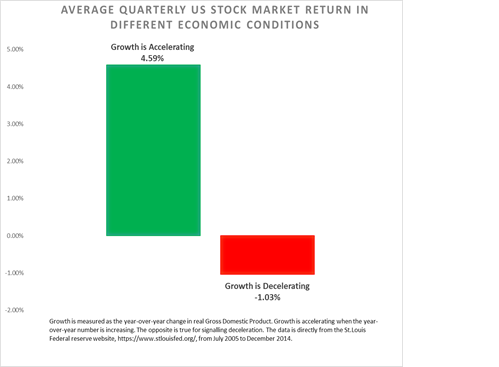

In addition to using traditional valuations of companies, we have found that measuring economic activity can be used like traffic lights to point the way forward in the equity markets. Consider three different economic phases: growth accelerating (green light), growth moderating (amber light) and growth declining (red light).

When growth is accelerating, we use our trading systems to select the best companies across all sectors of the economy. When growth is moderating, we find it is better to limit the sector exposure and when growth is declining, holding bonds or cash can traditionally be more rewarding.

As we measure it, economic growth has been fairly flat in North America for the past four months. The amber light has been urging some caution. Holding bonds or defensive sectors has been surprisingly rewarding in this time period.

So where are we now in terms of economic activity? As of late February, the U.S. has just shown us an uptick in economic activity. What could be a surprise to many people is that parts of Europe have also been moving into our “green light” environment.

To find out how we are positioning our client portfolios for the current economic conditions or to continue receiving our newsletter, check out www.phillipsfortress.com