Lower gas prices are going to boost the economy because everyone has more money left in their pockets after filling the tank, right? The reality may be a bit more complicated than that.

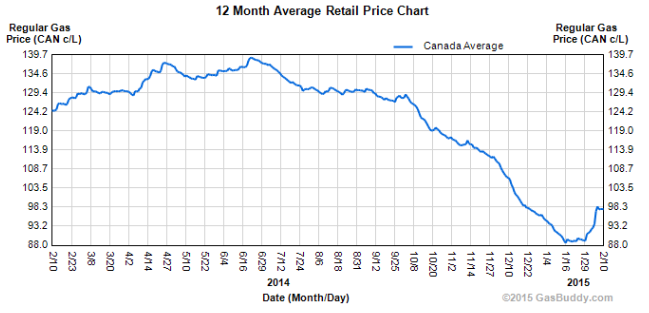

There is a growing concern that we might be entering a period of deflation. Deflation, in its simplest terms, is a decline in prices. Most consumers have noticed the drop in energy prices but many other commodity prices have been dropping as well. The fear is that this represents the end of the commodity cycle that started toward the beginning of the century.

While lower prices might initially boost the economy, an interesting consumer behaviour develops. Let’s look at an example. Do you remember as the prices started dropping at the pumps? If you are like me, you would top up the tank every time you saw a lower price; whether you needed much gas or not. After a while though, we get used to falling prices. We begin to question, "Why would I buy gas at this price if I could wait and get it at a lower price?" Falling prices initially provide an uptick in sales followed by a slowdown.

What happens to employment? During deflationary periods, we see corporate profits shrink and that can result in wage cuts or layoffs. We are already seeing this impact in the oil sands and the resulting slowdown in housing sales in places like Calgary.

Canadian stock portfolios can be especially impacted by the falling commodity prices because so much of the Canadian stock market is comprised of companies that produce raw commodities. If you own an investment that tracks the Canadian stock market, chances are you have experienced more downward movement in your portfolio than a portfolio of carefully selected stocks. Portfolios positioned heavily into Canadian stocks have done well in recent years. However, relative to the rest of the world, those same portfolios may have suddenly become under-performers as the prices of commodities drop.

So where do you invest as interest rates are cut and the stock market declines?

There are some investments that will potentially benefit from a deflationary cycle and others that will provide increasing purchasing power as prices drop.