The stance of the Federal Reserve chair, Jerome Powell, as confirmed publicly this week, is for continued support for the economy, as 10 million jobs are still missing.

A year ago the Fed lit a fire under prices for assets like stocks with its expansion of credit and extremely low interest rates.

At some point the Fed will start to worry about inflation and try to put out that fire.

Will the Fed keep pouring gasoline on the fire?

James Grant, in a recent interview with Russell Napier, described the Federal Reserve as acting as both arsonist and firefighter; a very apt description, in my opinion.

The Fed is fueling the boom in asset prices and ignoring potential inflation outbreaks. At some point the Fed will have to turn to the job of fire containment.

Last March the Fed recognized that the recession was going to be unusually deep. Millions of people were laid off, or told to stay home or chose to quit their jobs due to the pandemic. The official unemployment rate in the U.S. soared to 20 percent for the broadest measure and 15 percent on a narrower definition. These numbers of unemployed have not been seen since the Great Depression of the 1930s.

Of course, the official numbers do not tell the whole story as the government chooses its definition of unemployment to exclude “discouraged workers”. If the caller doing the employment phone survey phone finds that a person is not working and is also not even looking for work, that person moves out of the unemployed and goes into another category, outside of the work force and not counted as unemployed.

John Williams, author of ShadowStats, calculates unemployment including some of these so-called “discouraged” workers and finds that the unemployment rate surged to 35 percent in 2020 and is still at 25 percent, a rate not seen since 1945 (blue).

The Fed is aware of the horrific numbers of unemployed and discouraged workers and has no intention of withdrawing its stimulus.

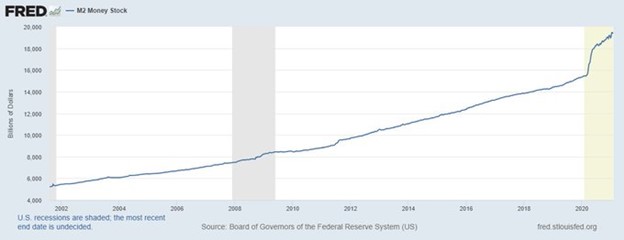

An unprecedented injection of money into the economy:

Source: FRED - St. Louis Fed.

The broad money supply – M2 – has grown by 25 percent in one year and has quadrupled since 2000. This massive injection of liquidity has resulted in only modest gains in employment but has pushed asset markets, especially stocks and recently housing, to a frothy level.

This odd combination of a stock market at record highs during the worst recession since 1945 has never happened before.

When will the Fed change from arsonist to firefighter? Of course, that timing depends on inflation.

Bill Dudley, former chair of the New York Fed, said recently that the Fed will continue on its course. Four things are important to the Fed:

- The economy is still below capacity by (at least) 10 million jobs.

- Inflation is low.

- People are convinced that inflation will stay low.

- The Fed has plenty of tools available to restrain inflation if needed.

The Fed might be too complacent about inflation as recent numbers show that market participants expect inflation to reach 2.21 percent, the highest level since 2014. But the Fed has signaled that it will be slow to react to inflation, at least initially.

As Grant’s Interest Rate Observer February 19, 2021 states:

“After years of dire inflation predictions … the people who run fiscal and monetary policy … have decided the risk of ‘overheating’ the economy is much lower than the risk of failing to heat it up enough.”

So more gasoline on the fire for now but keep those water hoses handy in case they are needed soon.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.