The automobile industry is vulnerable to the advent of new technology.

Electric-drive technology will force a revolution in the manufacturing and sale of automobiles.

The incumbent car makers, auto dealers and those who finance the purchase of cars may not be ready.

Worm Capital, of La Jolla, California wrote a report titled “The Big (Auto) Short” which you can find here.

The premise of the Worm Capital paper is that the bubble in internal combustion engine autos is about to burst, like the subprime mortgage and housing bubble in 2006 in the United States. Of course, the automobile technology shift could be a bigger problem than the US housing crash because the internal combustion engine is used everywhere on this planet. This premise is not that far-fetched since electric autos are making a strong bid to replace cars powered by gasoline. The implications for the economy and, especially, the auto and energy segments are so large that the imagination struggles to visualize them.

One aspect of the auto industry that gets very little attention is automobile finance. Most people purchase automobiles on credit. The term of auto loans has been extended again and again, and now averages more than 60 months, with some loans up to 84 months. Many people trading in their vehicle after 3 years have negative equity, as the trade-in value is below the remaining debt on their original loan. These customers are paying more than 25 percent interest on the new loan to obtain a new vehicle, according to anecdotal reports. These loans were made for the purchase of autos powered by gasoline or diesel. If that technology becomes obsolete in just a few years, these loans cannot be repaid as the resale values for cars will plummet.

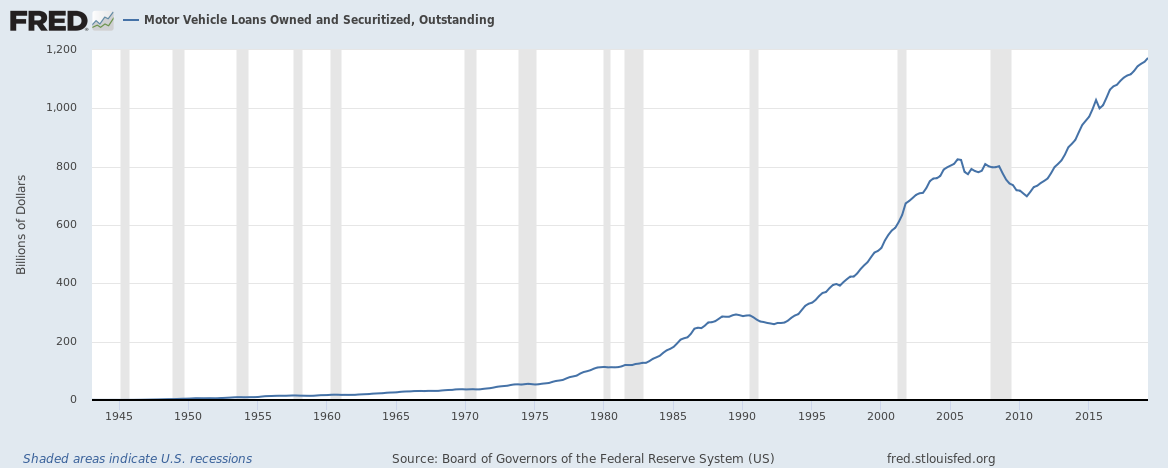

All outstanding car loans in the U.S. totaled more than $1.1 trillion recently. While this is much less than the mortgage industry, auto loans are about 33 percent larger than they were prior to the housing crash in 2006.

Source: St. Louis Fed, FRED

Auto dealers earn commissions for finance and insurance sales. The percent of profit that comes from the selling price of the car has declined from 4.5 percent to 2.1 percent over the last 8 years, putting additional pressure on selling higher margin items like insurance and credit.

The other major source of profit for dealers is maintenance, which is also under serious threat from electric autos that don’t require much. Electric owners cite tire rotation and windshield washer fluid as the only main items. That won’t be enough to allow auto dealers to survive.

The internal combustion engine is the main source of maintenance issues in cars these days, so the shift to electric eliminates that profit source. An automobile averages about $1,000 annually in maintenance costs, or about $300 billion total for the entire U.S.

This amount, as large as it is, is only about one-half of the annual US revenue from 17 million vehicles sold at an average cost of US$37,185, about $630 billion. Since new electric cars are at least that expensive, the total dollar amount for sales won’t decline, unlike maintenance revenue, but it won’t be going to GM, Ford and Chrysler, not to mention Volkswagen (the largest car seller in the world), BMW or Mercedes, unless they get an attractive electric vehicle offering soon. Tesla makes less than 1 million cars, so there’s room for many new entrants in an 80 million worldwide annual car market.

Watch for large automobile manufacturers to push out electric-drive offerings. And keep an eye on lenders who are over-exposed to car loans.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.