As we move deeper into summer, markets have largely held onto - and steadily built on - the gains since bottoming in late April. Since then, we’ve had the usual drip of on-again/off-again trade threats, walk backs, re-announcements, and delays - summed up perfectly by a favourite Mad Men meme, featuring Don Draper coolly pitching his latest idea:

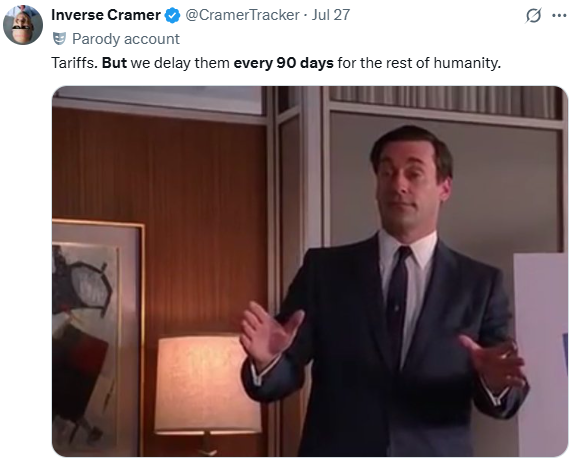

Year-to-date, the S&P/TSX is up 12.49%, while the S&P 500 in Canadian dollars has gained 3.15%. Not bad for a year that began with concerns over tariffs, U.S. fiscal strains, and a softer U.S. dollar. The weaker greenback has weighed on U.S. returns for Canadian investors, but as we noted last month, this mirrors Trump’s first term - a stretch that ultimately turned into a tailwind for stocks as a weaker dollar supported global liquidity, U.S. corporate earnings, and demand for cheaper U.S. equities. Global bonds, as measured by the Bloomberg Global Aggregate in Canadian dollars, the defensive ballast within our portfolios, have returned 2.36% year-to-date.

.png)

The real engine behind the rally has been earnings strength. While many feared tariffs would dent profits, Q2 instead delivered the highest S&P 500 earnings beat rate since 2021, alongside a notable pickup in positive forward guidance. Canadian companies have also posted broadly solid results, benefiting from stable domestic demand and firm commodity prices. Corporate America’s resilience - a theme for much of the past five years - remains intact. Paired with steady economic data (still no sign of a recession) and the current AI-driven capex boom - which has now outpaced U.S. consumer spending growth - it’s led many to draw parallels to the last major bull cycle of 2009-2020. In that comparison, the COVID shock of 2020 and the inflation spike of 2022 now look more like a reset, much like the Global Financial Crisis reset before the last long bull run.

On top of this sits today’s most important structural market driver: artificial intelligence. AI is cutting costs, expanding margins, accelerating innovation, and embedding itself deeper into our daily lives - all while improving at breakneck speed. Record investment is pouring into AI infrastructure and the energy systems to power it, with sovereign funds and corporations alike driving the build-out. Wall Street has embraced the “AI gold rush,” and the payoff is already showing up in earnings for the major players. OpenAI, for instance, is reportedly in talks at a $500 billion valuation, with models outperforming intelligence benchmarks across the board. Like any transformative shift, AI is sparking debate, but the investment momentum is undeniable.

None of this means volatility has vanished. August has historically been a bumpier month for markets, often as activity slows into late summer, with September not far behind. Policy remains fluid, headlines will keep coming, and speculation - even about the Fed Chair’s job security - will continue to stir the pot. But the combination of resilient earnings, steady economic data, and powerful structural tailwinds has given markets a far steadier footing than most expected just a few months ago.

As we move toward summer’s final stretch, here’s to making the most of the warm weather and long days while they last.

- Jack

A Smarter Way to Give: How Donor Advised Funds Simplify Generosity

Over the past year, we've seen a steady rise in clients asking how to incorporate generosity into their wealth plans without adding unnecessary complexity. One of the most effective solutions we recommend is a donor-advised fund (DAF).

A DAF is a charitable giving account held within a registered public foundation. You can contribute cash, publicly traded securities, or other eligible assets, receive an immediate donation receipt, and then recommend grants to any CRA-registered charity on your own timeline. Since the donation is made up front, you lock in the tax credit right away. The assets in the DAF benefit from tax-sheltered growth, and you can recommend grants to charity whenever you choose.

The benefits extend well beyond tax savings. A DAF brings all your charitable giving into one account, so you receive a consolidated tax slip instead of tracking multiple receipts. You can also name family members as joint or successor advisors to create a multi-generational legacy. Donating securities in-kind eliminates capital gains tax on the donation, increasing the value of your gift. The sponsoring foundation handles administration – including vetting charities, issuing receipts, and maintaining CRA compliance – so you can focus on the causes that matter most to you.

To make giving seamless, our team partners with Charitable Impact, Canada’s largest independent DAF platform. Through their Impact Account, we can manage your charitable capital under the Chernick James Tse & Associates mandate, investing it with the same discipline and care as the rest of your portfolio. You have real-time visibility through Charitable Impact’s dashboard while we work together to build a giving plan aligned with your values and financial goals.

If you’re planning year-end tax strategies or simply looking for a more efficient way to give, let’s discuss whether a donor advised fund is right for you. To learn more about DAFs and how they might fit into your overall wealth plan, read our full guide here.

- Alysha

Ever since Ray Kurzweil’s The Singularity Is Near landed on my desk in 2005, his use of the “event horizon” metaphor has shaped how I think about technology - and the companies behind it. In astrophysics, the event horizon is the boundary around a black hole beyond which we can no longer observe or predict outcomes; it’s where the known rules of physics begin to break down. Kurzweil borrowed that idea to describe the moment when technological progress becomes so fast and profound that the future is fundamentally unknowable. Sam Altman’s recent essay, The Gentle Singularity, picks up that metaphor and suggests we’ve already crossed that boundary: today’s AI models outperform humans in many cognitive tasks and are beginning to accelerate their own development - even as life still feels familiar, for now.

If that trajectory holds, the 2030s could deliver an abundance of intelligence and energy, sparking a productivity boom on par with - or greater than - the Industrial Revolution, and perhaps laying the foundation for something approaching a post-scarcity economy. That’s why we continue to hold the foundational layers of AI - compute, energy, and infrastructure - while keeping portfolios nimble as this landscape rapidly evolves.

Altman’s full post is a quick, provocative read. You can find it here: The Gentle Singularity.

- Jack

AI Gets a Lab Coat: Why Novartis Is Our Next-Wave Beneficiary

In recent years, we’ve built positions around AI’s core enablers - semiconductors, cloud infrastructure, and hyperscale platforms. That groundwork has now expanded to include the resources these systems demand to function at scale. Dominion Energy - which we highlighted last month - fits squarely in that camp, supplying the massive power backbone AI models require. More recently, we’ve turned to identifying second-order beneficiaries: companies poised to win not by building the models, but by harnessing what those models make possible. Novartis (NVS) is our latest addition in that category.

We first spotlighted AlphaFold in a past newsletter - developed by DeepMind, an Alphabet company and one of our long-standing core holdings - for its potential to transform drug discovery by solving one of biology’s most complex problems. That promise is now being realized through Alphabet’s Isomorphic Labs, which has partnered exclusively with Novartis to simulate drug development in silico. The result: a step-change in speed and cost-efficiency, with the potential to redefine how - and how quickly - new medicines reach the market.

As Nvidia’s Jensen Huang put it, “For the very first time in human history, biology has the opportunity to be engineering, not science.” For Novartis, that future is already unfolding. The company’s deep scientific expertise and global reach give it the ability to turn AI-driven breakthroughs into real-world therapies.

This is what’s next: AI not just writing code or generating images but working with biology at a scale and pace previously unimaginable. For a deeper dive, watch Max Jaderberg’s TED Talk from Isomorphic Labs, where he explains how AI can compress years of lab work into seconds - and open entirely new frontiers in science and medicine.