June 2025

As summer arrives, markets are gradually moving past the stress that shaped sentiment in the spring:

.png)

While tariff and trade headlines haven’t disappeared, the constant cycle of threats, reversals, and pauses from the Trump administration has made markets increasingly wise to the game. Tariff headlines are now largely seen as negotiating tactics rather than concrete policy shifts - a dynamic aptly summed up by the so-called TACO trade (Trump Always Chickens Out), which feels fitting given how events have unfolded.

That hasn’t meant an end to the drama. In recent weeks, we’ve seen EU tariff threats doubled to 50%, then paused; all tariffs deemed illegal by U.S. courts, only to be reinstated; a blanket increase in steel tariffs; targeted Apple tariffs; an apparent trade deal with China (we’ll see); and soon-to-go-out “take it or leave it” tariff letters to various countries. The pattern continues: headline risk, market reaction, then walk-back or dilution. It’s become a bit of a "boy who cried wolf" scenario - with each new announcement having less impact as markets adapt to the playbook. So far, this aligns with our original view: outcomes are likely to prove less damaging than the headlines suggest.

Through it all, the market’s underlying tone has improved since the depths of April. Our view then - that fear was overdone and sentiment could reverse - has largely played out. Still, this remains a market navigating crosscurrents: noisy trade headlines, a fluid U.S. policy backdrop, and a bond market wrestling with fiscal realities.

Looking ahead to the summer months, one key area we’re watching is the evolving Big Beautiful Bill - the Trump administration’s sweeping tax package aimed at lowering corporate taxes and extending key provisions set to expire next year. While still early in the legislative process, its potential to drive corporate earnings and investment could help offset ongoing tariff noise. We’re also seeing encouraging signs that deregulation - particularly in the financial sector - is back on the table, which could further support growth if it gains momentum.

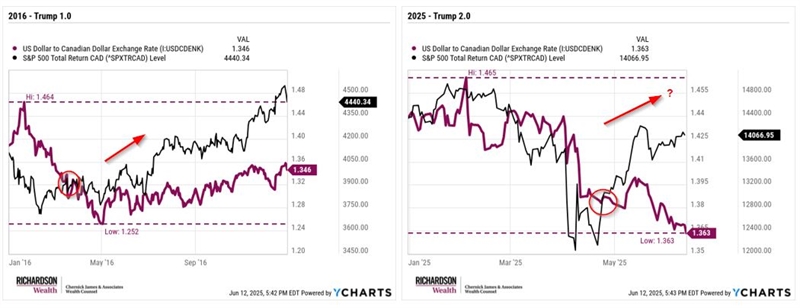

At the same time, U.S. fiscal concerns remain front and center. Moody’s recent downgrade of U.S. debt to AA+ underscored these worries, though market reaction has been muted so far. We continue to monitor the debate around deficits and its impact on bond markets and currencies. A weaker U.S. dollar - both globally and relative to the Canadian dollar - has been a key theme this year. While this has weighed on USD-based returns in the short term, we view it as a familiar setup, reminiscent of 2016 when Trump similarly talked down the dollar in his first term. In time, this too could well become a tailwind for equities as it was back then:

For now, corporate earnings remain strong, and U.S. economic data continues to be mixed - not without challenges, but far from recessionary. We continue to expect volatility, as anticipated at the start of the year, given the unpredictable nature of the U.S. administration and the broader policy backdrop. Amid this environment, we continue to see AI as the most important structural narrative in markets today - one that remains underappreciated amid the ongoing political noise. Because of this, it is encouraging to see AI leaders regaining momentum in recent weeks, reinforcing our longer-term view of the theme’s transformative potential. We remain focused on this key structural theme, which we believe will continue to reshape markets well beyond the current cycle.

With that, we’ll welcome the steadier footing markets have found and remain committed to keeping a watchful eye on the ever-evolving investment landscape. And as summer arrives in full, here’s to making the most of the longer days and better weather ahead.

- Jack

Helping the Next Generation: Making the Most of the First Home Savings Account (FHSA)

With housing affordability still a major challenge in Canada, many families are looking for ways to help the next generation get into the real estate market. One of the most effective tools is the First Home Savings Account (FHSA), introduced in 2023.

The FHSA allows eligible Canadians aged 18 to 71 to contribute up to $40,000 toward a first home. Contributions are tax-deductible, and qualifying withdrawals are tax-free. Annual contribution room is $8,000, and investments grow tax-free. If the funds aren’t used to buy a home, they can be rolled into an RRSP without affecting contribution limits.

Importantly, contribution room only starts accumulating once the account is opened - so even if you’re not ready to contribute, opening an account early can help maximize your room later. Parents and grandparents can support by gifting funds, which the account holder can use to contribute, combining intergenerational support with tax efficiency.

I recently hosted a client seminar where I provided an overview of the FHSA and how it fits into broader family planning discussions. If you’d like to learn more, you can view the recorded presentation here. To access the recording, please use the following password: CJ#$21My

If you’d like to explore this strategy further or access additional resources, please don’t hesitate to reach out.

- Alysha

Over the past two years, I’ve written often about artificial intelligence (AI) and its growing impact on business, markets, and everyday life. But while AI is becoming more mainstream, I’m still surprised by how many people - clients, friends, and family - tell me they haven’t tried it themselves. That’s perfectly understandable; this is new territory for most. Knowing this, I wanted to provide some basic guidance to help you get started - because when it comes to using and benefiting from AI, getting started is really the only hurdle.

You’ll find plenty of AI tools available these days, but the one I recommend - and the one that first got me hooked - is ChatGPT, from OpenAI. It’s easy to use, widely available, and a great starting point if you’re curious about AI.

What is ChatGPT?

ChatGPT is an AI chatbot - think of it as an intelligent assistant you can interact with by typing messages to or speaking directly. You enter a question or request, and it responds in clear, natural language. Many people use it to write emails, summarize articles, brainstorm ideas, plan trips, draft speeches, explain complex topics, or explore new hobbies. The possibilities are surprisingly broad - and you don’t need any special technical knowledge to get started.

How do I access it?

The easiest way is to download the ChatGPT app from the Apple App Store or Google Play Store on your smartphone or tablet. You can also visit chat.openai.com on your computer. In both cases, you’ll create a free account using your email.

ChatGPT offers both a free version (based on an earlier model) and a paid version - ChatGPT Plus with access to the most advanced model. For most casual users, the free version is perfectly sufficient.

How do I use it?

Once signed in, you’ll see a box where you can type any question or request - this is called a prompt. The beauty of this technology is that you don’t need to know any special language; just type naturally, as if you were asking a person. Here are a few examples you might try:

- What are some good dinner ideas for a summer barbecue?

- Give me a 5-day itinerary for visiting Tuscany.

- Help me write a birthday toast for my friend turning 70.

- Act as a sounding board and provide balanced information on a health-related question I’ve encountered.

- Help me plan and troubleshoot a home improvement project.

- Explain this math homework problem to my child in simple terms.

- Summarize this long article so I can understand the key points quickly.

- Suggest thoughtful gift ideas for an upcoming anniversary.

ChatGPT will reply in seconds. You can continue the conversation, ask follow-ups, or start a new topic at any time. So, what are you waiting for? Give it a try!

- Jack

AI Is Hungry for Power: Why Electricity Is the New Bottleneck

The headline-grabbing AI systems we all read about - from ChatGPT to self-driving-car software - live inside enormous data centers run by many of our model portfolio holdings, including Microsoft, Google, Amazon, Meta, and Equinix. These facilities require a nonstop, rock-solid flow of electricity. As adoption soars, the biggest question is no longer “Do we have enough chips to build the data centers?” but also “Can the grid keep them powered 24/7?”

Nowhere is this pressure clearer than in Northern Virginia’s “Data Center Alley,” the world’s largest cluster of these specialized facilities. Local utilities and regulators are working urgently to expand generation and transmission capacity so that servers stay on and innovations keep coming. In many regions, the pace of new AI applications now depends as much on kilowatts as on code.

Recognizing this shift, we’ve recently added Dominion Energy to our investment models. Dominion plays a key role in powering Virginia’s grid - and the fast-growing AI infrastructure anchored there. For a closer look at why energy has become one of the biggest bottlenecks (and opportunities) in AI, the CNBC segment below provides an excellent overview.