And just like that, it’s as if April never happened. After all the chaos, markets ended April nearly flat. That outcome might seem surprising given how dramatic the month felt - but for those of us who’ve lived through countless market cycles, it wasn’t entirely unexpected. We’ve seen periods like this before, where fear takes hold, only for markets to steady and recover just as swiftly.

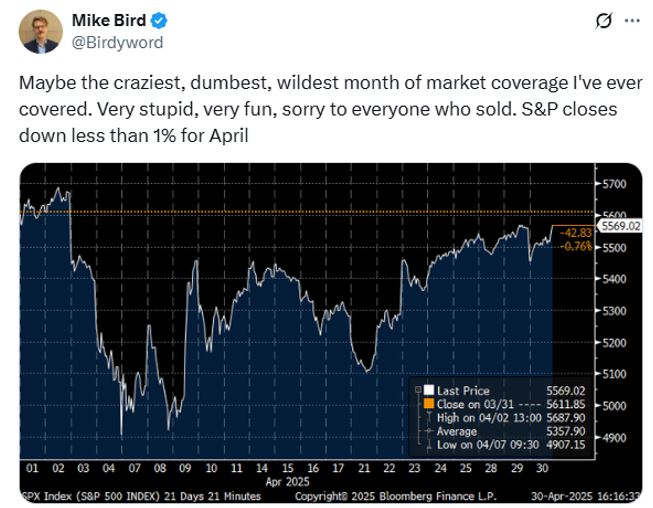

Earlier today, I came across a post from The Economist’s Wall Street Editor Mike Bird that captured the madness of it all. And while I wouldn’t go so far as to call it “fun,” it certainly reflected the emotional swings investors endured. The chart below says it all:

While the month’s final result may have seemed unlikely just a couple of weeks ago, it’s a scenario we had considered all along. In fact, mid-month I had drafted a market updated titled "Through the Lens of Past Corrections" that spoke directly to this possibility - drawing on market history and investor behavior during sharp pullbacks. This update never went out, thanks to the sheer pace of policy reversals and market swings, but the core of it remains as relevant as ever and I think it’s worth sharing parts of it here.

In that unsent update, I noted that “we’re now four days into one of the most pronounced short-term pullbacks in recent memory,” driven by Trump’s self-inflicted trade war and a surge in volatility that made it easy to believe “this time is different.” But as I wrote then - and still believe now - markets have a habit of pushing through fear and recovering, often when pessimism feels most overwhelming. I underscored that point by referencing Charlie Bilello’s table of returns, which documents how markets have historically behaved during similar bouts of volatility - and how those periods have often marked the beginning of strong forward returns:

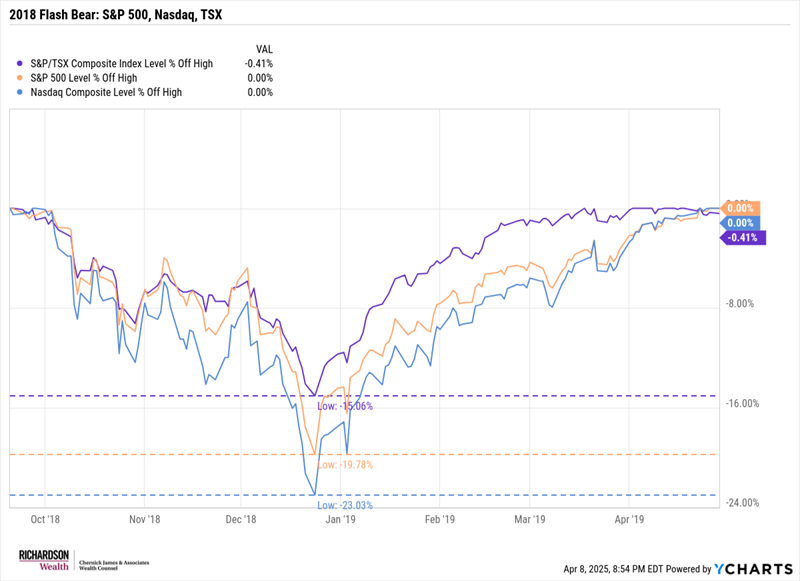

I also pointed to two recent examples - late 2018 and early 2020 - where sharp selloffs were followed by swift recoveries. In both cases, sentiment collapsed quickly but reversed just as fast once conditions stabilized:

.png)

That piece ended with three reminders I lean on during times of market stress:

- Fear has a shelf life.

- Emotion rules the short term.

- Recoveries often begin when sentiment is at its worst.

Those lessons still hold. They’re why we stayed disciplined through the noise of April - and they’re likely to remain true for the rest of this year

So, are we out of the woods? Hardly. I don’t expect the chaos policy emanating from the White House to vanish overnight. But for now - barring another sharp turn - we may have seen the worst of the tariff-driven market volatility.

And that brings us to the bigger point. As we’ve emphasized in previous newsletters, navigating markets through erratic, unclear policy decisions is challenging - but it’s also familiar territory. Our investment process was built for this. While we may make small adjustments around the edges, we stay anchored in our core beliefs: know what you own, understand why you own it, and stay the course. These beliefs matter most in times like this

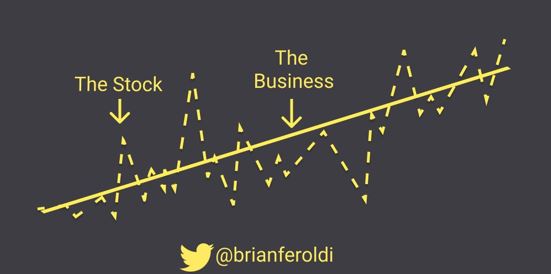

We’re now early into earnings season, and many of the companies we own are reporting results that meet or exceed pre-tariff expectations. That’s no accident. These are well-run businesses - built for the future and still delivering, even with the headwinds. It’s worth remembering: at extremes, stock prices can disconnect from business fundamentals. But beneath every stock is a real company solving real problems. Execution matters. Over time, quality rises:

So, what now? We head into May with trade negotiations ongoing and real economic disruptions emerging. Talk of recession is growing - and we get why. It’s hard to make business decisions amid daily policy reversals, and that uncertainty is beginning to ripple across the global economy.

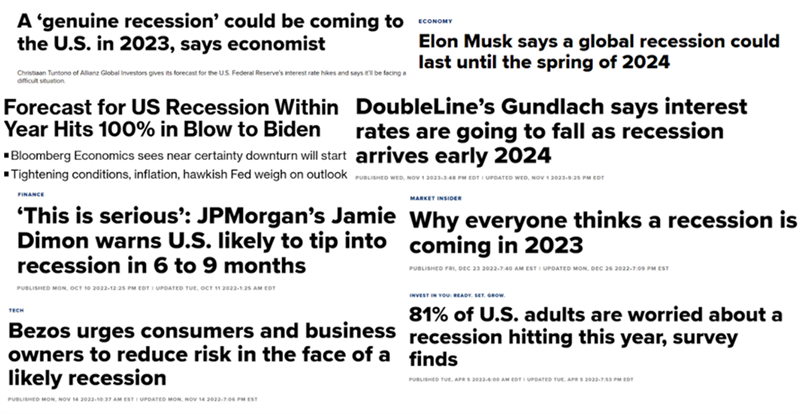

Will it lead to recession? Possibly. Yesterdays first-quarter U.S. GDP print was negative. Another negative quarter would meet the technical definition. But even if we get there, that declaration will come in hindsight - just like every past recession. That said, we must not lose sight of the fact that a recession is by no means guaranteed and expert consensus has been wrong before, even when it’s sounded most confident:

What matters more: stocks usually bottom well before recessions are officially declared. So paradoxically, we could be in a weakening economy with a strengthening market - as we’ve seen before.

Even more disorienting is the idea that April’s pullback may have already priced in the worst of the tariff-related risk. Supporting that view is a rare, powerful technical signal: the Zweig Breadth Thrust, which measures investor psychology as panic selling transitions to panic buying. Historically, when this signal fires, forward returns have been remarkably consistent: markets have been positive 100% of the time over the next 6 and 12 months, with average gains above 14% and 23%, respectively:

___X.jpg)

By no means is this a guarantee of what comes next, but it’s a data point worth noting - especially when investor sentiment remains fragile.

Time will tell how it all plays out. For now, the hard data hasn’t confirmed the recessionary headlines. The global economy is mixed - slower, but still growing. April’s volatility was frustrating, chaotic, and self-inflicted - but we view it as yet another correction that tested our patience without changing our direction.

As we look ahead, the landscape will remain noisy - shaped by negotiations, shifting policy, and evolving sentiment. But through it all, our focus remains the same: owning quality businesses, staying grounded in process, and letting time and discipline do their work.

Because while no two corrections unfold the same way, the principles that carry us through them don’t change.

As always, stay the course.

- Jack

New BC and Federal Tax Rules Could Impact Your Real Estate Plans

Thinking about flipping a property or selling a home you’ve owned for a short time? It’s important to be aware of new federal and provincial rules that could significantly affect your tax outcome. At the federal level, any gain from the sale of a residential property owned for less than 12 months is now considered business income and fully taxable—regardless of whether it was your principal residence or if you intended to live there long term. This means the usual capital gains exemptions no longer apply in most cases. While there are limited exceptions for major life events like death, divorce, or job relocation, the default treatment is a much higher tax rate than many sellers expect.

British Columbia has layered on its own Home Flipping Tax as of January 1, 2025. If you sell a property within two years of purchase, you could face an additional provincial tax—starting at 20% of the profit if sold within the first year, and gradually decreasing to zero by the end of year two. This applies not just to traditional home sales, but also to beneficial interests and assignment contracts. Together, these new measures make short-term property sales far less financially attractive and could significantly impact your after-tax return.

If you’re considering a property sale or new real estate investment, we recommend consulting your tax advisor to review the specific implications of these new rules. We also welcome the opportunity to support you in evaluating how these changes fit within your broader financial strategy. Whether it’s assessing timing, reviewing ownership structures, or aligning decisions with your long-term objectives, we’re here to ensure your decisions align with your overall goals in a thoughtful and tax-efficient manner.

Jurassic Bark? Dire Wolves Are Back—But This Isn’t Westeros

If Game of Thrones made you wish dire wolves were real, here’s a twist: they might be again. Thanks to advances in genetic engineering - and a Dallas-based biotech startup called Colossal Biosciences - scientists have created living pups with reconstructed DNA from the long-extinct Ice Age predator.

The project echoes the plot of Jurassic Park, but with fewer raptors (for now). Using DNA from 13,000- and 72,000-year-old fossils, researchers modified gray wolf cells to express traits believed to be unique to the dire wolf - larger size, white fur, and even distinct howls. The result? Three living “neo-dire wolves,” raised in a secure preserve, not a movie set.

It’s a fascinating mix of cutting-edge science and ethical debate, especially as Colossal turns its attention to resurrecting the woolly mammoth, Tasmanian tiger, and dodo. Whether this is a hopeful future for conservation - or nature meddling gone too far - is up for debate.

Curious to learn more? Click the link below to explore a video from TIME on the science - and the stakes - behind this bold experiment